The S&P 500 generated a return of 15% in the first half of this year, but it recently hit a patch of volatility and is trading 3% below its July peak. The next couple of months could be tricky to navigate with the Federal Reserve set to cut interest rates, and the U.S. presidential election in November.

But history suggests the S&P 500 always recovers to new highs over the long term, so any further sell-off is probably a buying opportunity. Cybersecurity stocks might be a great place for investors to look, because the threat landscape is growing more treacherous for businesses by the day, which is boosting sales for vendors that can provide the best protection.

Zscaler (NASDAQ: ZS) is one of them. Its stock is trading 57% below its all-time high, which was set during the tech frenzy in 2021, but here’s why it might be time to buy for the long term.

A leader in zero trust cybersecurity

Before the rise of cloud computing, a simple firewall would be enough to protect most businesses from malicious actors because most of their valuable data was often stored on local servers. But the cloud allows modern organizations to run all of their operations online, so they can seamlessly reach a global customer base and hire employees from practically anywhere in the world.

That comes with significant risks, because it means companies are vulnerable to attacks around the clock — and they could originate from anywhere. The attack surface has become so large that traditional cybersecurity tools like firewalls and virtual private networks (VPNs) aren’t enough on their own. Instead, Zscaler created the Zero Trust Exchange platform, which includes a suite of powerful tools for modern, cloud-based organizations.

It starts with identity security. Remote workers add a new layer of vulnerability because managers can’t physically see them in the office, so it’s impossible for the organization to know if it’s really them logging into the network, or if their credentials have been compromised. Zscaler’s zero trust identity security treats every login attempt as hostile, analyzing not only the employee’s username and password, but also their location and the device they are using to confirm it’s really them.

Plus, Zscaler only connects each employee to the digital applications required for their job, so even if an unauthorized user bypasses the identity security layer, they can’t access the rest of the network or compromise other assets.

Artificial intelligence (AI) is a key part of Zscaler’s platform, because it can perform tasks like identity verification in seconds. Plus, the company continues to roll out innovative new tools under its AI analytics umbrella, including Risk360, which proactively collects data from an organization’s digital environment to track risks. Then, it assigns a risk score to the business and recommends ways to mitigate potential vulnerabilities.

Zscaler says AI analytics is contributing to growth in upsells already, despite most products being less than a year old. The company’s portfolio of AI software will continue to expand over time, thanks especially to a new partnership with Nvidia. Zscaler will use the Nvidia AI Enterprise platform to deliver new solutions that will allow customers to deploy AI to achieve better security outcomes.

Fast revenue growth with improving profitability

Zscaler generated $2.167 billion in revenue during fiscal 2024, which was a 34% increase from fiscal 2023, and it was also well above the company’s forecast of $2.141 billion — a number it had raised three times throughout the year.

Zscaler expects to deliver about $2.6 billion in revenue during fiscal 2025, which would represent a slower growth rate of 20%. That deceleration has been a consistent theme over the last few years. First, the larger Zscaler becomes, the harder it is to generate the same rapid growth of its earlier years. Second, the company has carefully managed its costs lately to improve its bottom line, and that means it’s spending less aggressively on growth-oriented initiatives like marketing.

During fiscal 2024, Zscaler’s operating expenses grew by 21%. Since that was much slower than its revenue growth, the company managed to significantly narrow its generally accepted accounting principles (GAAP) net loss to just $57.7 million, from $202.3 million in fiscal 2023.

On a non-GAAP (adjusted) basis, which strips out one-off and noncash expenses like acquisitions and stock-based compensation, Zscaler generated a profit of $414.5 million, which was up by a whopping 81% compared to last year. Most analysts don’t consider this to be “true” profitability, but it’s a positive result when viewed in combination with Zscaler’s GAAP bottom line, which is clearly trending in the right direction.

Why Zscaler stock is a buy right now

Zscaler says there has been an 18% increase in ransomware attacks this year, and their success rate appears to be growing because there has also been an eye-watering 57% increase in the number of victims whose data has been leaked. As a result, businesses are likely to ramp up their cybersecurity spending as time goes on.

Zscaler values its addressable market at $96 billion, so it has barely scratched the surface of its opportunity (based on the company’s current revenue). That’s a key reason to own its stock for the long term, but another reason is because it’s relatively cheap.

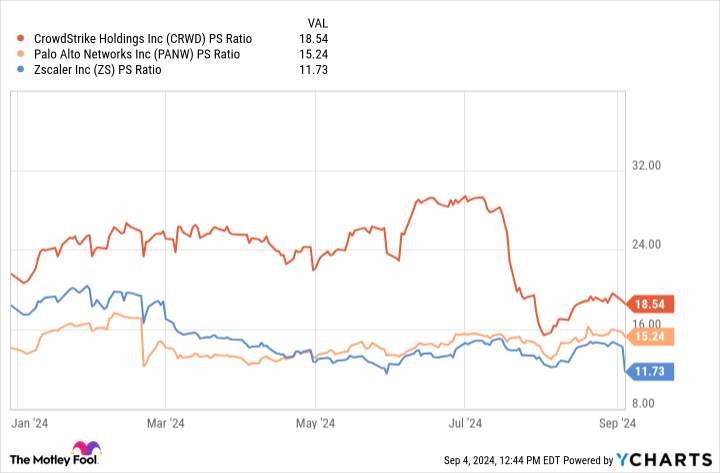

As I mentioned at the top, Zscaler stock is down 57% from its all-time high from 2021. It was unquestionably overvalued at the time, but since the company’s revenue has grown significantly since then, its price-to-sales (P/S) ratio has fallen to 11.7. That’s significantly below its peak of around 70, but it also makes Zscaler much cheaper than other cybersecurity leaders like CrowdStrike and Palo Alto Networks:

CrowdStrike grew its revenue by 32% in its recent quarter, and Palo Alto grew its revenue by just 12%. Remember, Zscaler is coming off 34% growth in fiscal 2024 (and 30% in the fourth quarter, specifically). CrowdStrike and Palo Alto are larger companies than Zscaler, which potentially means they will struggle to grow as quickly going forward (we’re already seeing that with Palo Alto). That makes it difficult to justify their premium valuations relative to Zscaler right now.

Therefore, based on Zscaler’s growth, its enormous addressable market, and its current valuation, now might be a great time to buy the stock.

Should you invest $1,000 in Zscaler right now?

Before you buy stock in Zscaler, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Zscaler wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $650,810!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike, Nvidia, Palo Alto Networks, and Zscaler. The Motley Fool has a disclosure policy.

1 Magnificent Stock Down 57% to Buy During the September S&P 500 Sell-Off was originally published by The Motley Fool