The U.S. economy has a stellar track record of producing the world’s most valuable companies. United States Steel became the first $1 billion company in 1901. General Motors then rode the automotive revolution to become the first $10 billion company in 1955. In 2018, Apple became the first to cross the $1 trillion milestone thanks to the success of its iPhone.

Apple remains the world’s largest company with a $3.3 trillion market capitalization, but it has since been joined in the trillion-dollar club by tech giants Nvidia, Microsoft, Amazon, Meta Platforms, and Alphabet.

Broadcom (NASDAQ: AVGO) might be set to join them. It’s currently valued at $761 billion, so its stock only needs to gain 31.4% from here to earn its membership. Here’s why I think it will happen.

Broadcom stock has soared recently, prompting a split

Broadcom was originally a semiconductor and electronics company, but since merging with Avago Technologies in 2016, it has been on an acquisition spree. It spent a total of nearly $100 billion buying semiconductor equipment company CA Technologies in 2018, cybersecurity giant Symantec in 2019, and cloud software developer VMware in 2023.

The acquisitions have propelled Broadcom stock to a 465% gain over the last five years and, earlier this year, it soared past $1,800, which made it somewhat inaccessible to investors with small portfolios. As a result, Broadcom’s management team decided to execute a 10-for-1 stock split, which increased the number of shares in circulation tenfold and reduced the price per share by a proportional amount.

The split went into effect on July 12, so investors can now buy one share of Broadcom for just $162 as of this writing. That spells an opportunity because the company’s growing presence in artificial intelligence (AI) could drive further upside from here.

A multifaceted artificial intelligence company

Broadcom has placed a heavy focus on AI across its organization over the past year to capture what could be one of the most valuable technological revolutions in history.

On the semiconductor side, Broadcom makes data center accelerators, which are specially designed chips for AI development. It also supplies networking equipment for data centers, including Ethernet switches that regulate how quickly data travels from one point to another. High-quality switches are critical to AI infrastructure, because data needs to rapidly flow through tens of thousands of graphics processors (GPUs) and accelerators.

During the recent third quarter of fiscal 2024 (ended Aug. 4), Broadcom said its custom AI accelerators segment grew by three-and-a-half times compared to the year-ago period thanks to surging demand from hyperscalers (which typically includes Microsoft, Amazon, and Alphabet). The company also said its Tomahawk 5 and Jericho3-AI switches delivered fourfold sales growth compared to the year-ago period.

Outside of the semiconductor business, Symantec is weaving AI into its cybersecurity products. For example, it launched SymantecAI earlier this year, which is a chatbot capable of answering users’ queries about their endpoint protection.

Then, there is VMware, which serves as the software layer of the data center to help organizations optimize their infrastructure. They can use VMware to create virtual machines, meaning multiple employees can plug into the same server to utilize all of its capacity. That ensures no computing capacity goes to waste, which is critical right now due to the short supply of high-powered GPUs and data center hardware.

Broadcom expects to deliver $51.5 billion in total revenue for the entirety of fiscal 2024, which will wrap up at the end of October. The company’s guidance initially suggested $11 billion of that would be attributable to AI across its businesses, but it just raised that estimate to $12 billion, which highlights the significant momentum in this emerging space.

Broadcom’s (mathematical) path to the $1 trillion club

As I touched on at the top, Broadcom has a market cap of $761 billion right now, so its stock only needs to gain 31.4% from here to place the company in the $1 trillion club.

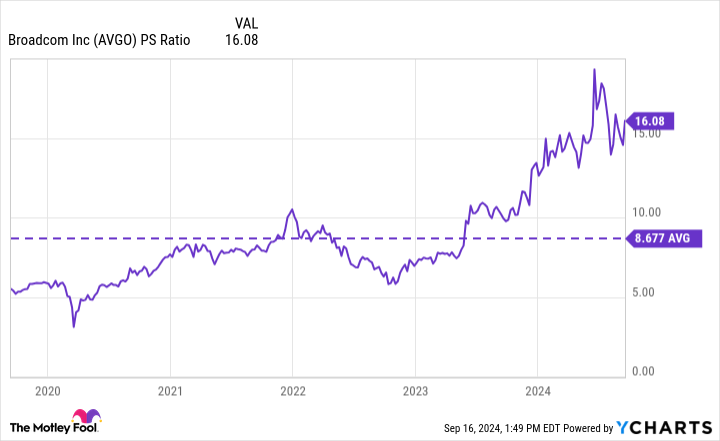

The company isn’t consistently profitable on a GAAP basis, so it can’t be valued using the traditional price-to-earnings (P/E) ratio. However, we can value it using the price-to-sales (P/S) ratio, which divides its market cap by its annual revenue.

Broadcom currently trades at a P/S ratio of 16. If that number remains constant, the company simply has to grow its annual revenue by 31.4% to justify its entry into the $1 trillion club. Wall Street expects Broadcom’s revenue to grow by 17.2% in fiscal 2025, which won’t be enough, but it could get there in fiscal 2026 if it can grow by that amount again.

There is a caveat. Although Broadcom’s P/S ratio is down from its peak of around 19, it’s still very expensive compared to its average of 8.7 over the last five years:

It’s clear why investors are willing to pay a premium for the stock right now — Broadcom’s AI semiconductor products are delivering explosive growth, and its acquisitions are adding a tremendous amount of value. However, there is no guarantee investors will be receptive to such a high P/S ratio over the long term, and a reduction back to its five-year average could add years to Broadcom’s quest to join the $1 trillion club.

Therefore, while Broadcom will be a spectacular stock to own during the AI revolution, investors should maintain a very long-term outlook (perhaps of a decade or more) if they buy it today. That will give the company plenty of time to grow into its current valuation.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Stock-Split Stock Set to Join Nvidia, Apple, Microsoft, Amazon, Alphabet, and Meta In the $1 Trillion Club was originally published by The Motley Fool