The group of $1 trillion market cap stocks is tiny, and pharmaceutical giant Eli Lilly (NYSE: LLY) isn’t a member yet, though it is within striking distance at about $820 billion.

However, the drugmaker’s prospects look so strong that not only should it soon join the $1 trillion club, but it could even be a member of the more exclusive $2 trillion club by 2030. Here’s why.

The tirzepatide tailwind

What’s considered “solid” growth in revenue for a corporation? The answer depends on the industry. Top-line increases in the high single-digit and low double-digit percentages are pretty good for pharmaceutical companies, particularly large and well-established ones. Anything above that is, obviously, even better.

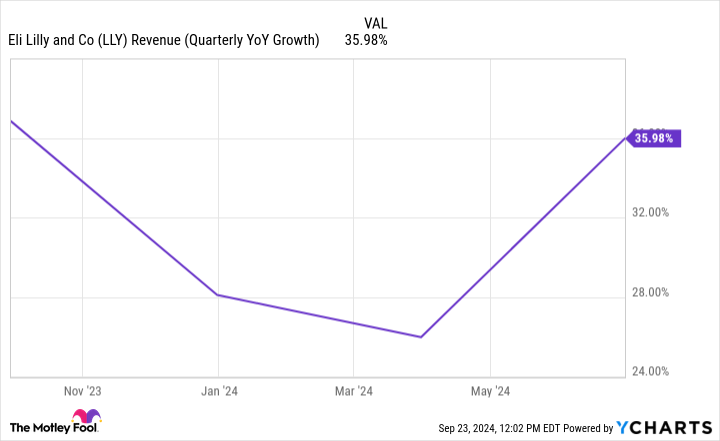

Let’s look at a chart of Eli Lilly’s quarterly revenue growth during the past year:

Notice that the growth rate never dropped below 24%.

Why is Eli Lilly performing so well? In a word: tirzepatide. That’s the active ingredient in Mounjaro, a diabetes medicine, and Zepbound, which treats obesity. It was first approved in 2022.

In the second quarter, Lilly’s tirzepatide-based medications generated a little more than $4 billion in sales. The overwhelming majority of drugs never generate $4 billion annually throughout their years of patent protection. Clearly, Eli Lilly has something special on its hands, and it’s still just getting started.

There are at least two indications for which tirzepatide has already passed phase 3 clinical trials but isn’t approved yet. The first is obstructive sleep apnea in obese patients. The second is decreasing the risk of developing type 2 diabetes in overweight or obese patients who are prediabetic. There are several more areas in which tirzepatide is being tested, including metabolic dysfunction-associated steatohepatitis, an area with a high unmet need.

So, Eli Lilly’s financial results will continue to be impressive through 2030 — largely thanks to tirzepatide, which will help send its stock price and market cap much higher. But that doesn’t tell the whole story.

There is more to Eli Lilly

While tirzepatide will be Eli Lilly’s biggest growth driver, a recent approval should also contribute. The U.S. Food and Drug Administration recently gave the green light to the company’s drug Kisunla, for treating Alzheimer’s disease (AD).

In the past 20 years, the pharmaceutical industry has mostly encountered failures when trying to develop novel AD medicines. Only two other products in this area have been approved since 2003. One of them, Biogen‘s Aduhelm, was granted the green light amid serious questions about its efficacy. Biogen has since discontinued Aduhelm, partly because it was a commercial flop: Doctors and hospital systems refused to prescribe it.

So Kisunla fills a significant need and should be at least reasonably successful. Expect the medicine to exceed the $1 billion-per-year mark. Its sales won’t compare to tirzepatide’s, but Kisunla should still contribute meaningfully to strong revenue growth through the end of the decade.

Eli Lilly’s stock price should also be boosted by clinical progress on new medications. Lilly’s pipeline is full of exciting products, particularly in the high-flying area of weight loss medications. By 2030, two of its anti-obesity candidates, orforglipron and retatrutide, could respectively generate $8.3 billion and $5 billion in revenue, according to drug industry research firm Evaluate. The drugmaker has an embarrassment of riches.

Don’t mind the valuation

Here’s one potential problem: The market may be getting ahead of itself and already factoring all of Eli Lilly’s success into its stock price. Lilly’s forward price-to-earnings ratio is about 41, more than double the healthcare industry average of 19. If the stock is overvalued, its upside potential will be limited. However, analysts expect Lilly’s earnings per share to grow at an average of almost 73% during the next five years; that makes the company’s shares reasonably valued at current levels.

To reach $2 trillion within six years, the company’s market cap would need a compound at an annual growth rate of at least 14.7%. That’s well within Eli Lilly’s reach.

Should you invest $1,000 in Eli Lilly right now?

Before you buy stock in Eli Lilly, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Eli Lilly wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool recommends Biogen. The Motley Fool has a disclosure policy.

1 Unstoppable Growth Stock Heading to $2 Trillion by 2030 was originally published by The Motley Fool