Technology stocks lost some of their luster on the market as heightened expectations about the proliferation of artificial intelligence (AI) technology put companies in this sector under pressure to deliver outsized growth each quarter.

Shares of Nvidia, for instance, retreated over the past couple of weeks despite the GPU leader delivering better-than-expected quarterly results and guidance that exceeded Wall Street’s estimates. However, a closer look at the prospects of the AI market indicates that the tech sector’s slide may not last for long. After all, Bloomberg expects the generative AI market to generate $1.3 trillion in annual revenue in 2032, with a compound annual growth rate of 42% through the end of that period.

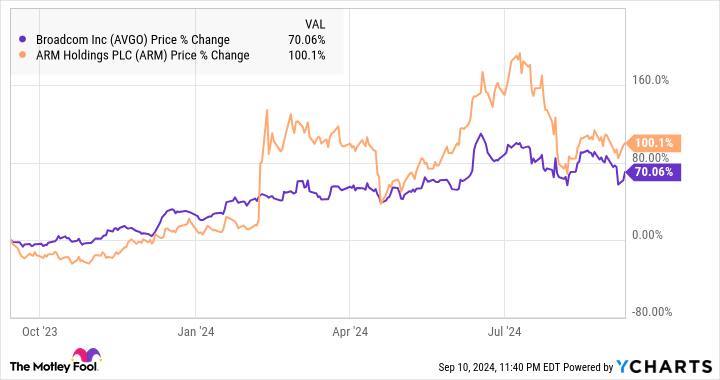

So, it won’t be surprising to see AI stocks get back into the good graces of investors soon, as they could continue to deliver healthy growth for a long time. That’s why it would be a good idea for investors to buy shares of Broadcom (NASDAQ: AVGO) and Arm Holdings (NASDAQ: ARM), both of which have pulled back significantly since the beginning of July.

Both companies are playing central roles in the proliferation of AI. More importantly, their results make it clear that AI is giving their businesses a nice boost. It won’t be surprising to see these stocks go parabolic on the back of their improving results. In the investing world, a parabolic move refers to a rapid rise in the stock price of a company in a short time — similar to the right side of a parabolic curve — and both Broadcom and Arm enjoyed such big surges in the past.

The case for Broadcom

Broadcom is a diversified tech company that designs various types of chips, such as smartphone connectivity chips, application-specific integrated circuits (ASICs), and ethernet switches, and now also provides enterprise cloud infrastructure solutions following its recent acquisition of VMware. But its semiconductor segment remains its largest source of revenue, producing 56% of its top line last quarter.

More specifically, Broadcom’s semiconductor business generated $7.3 billion in revenue in the third quarter of its fiscal 2024, translating into an annual revenue run rate of close to $30 billion. The company estimates that it will generate $12 billion in revenue this year from sales of AI chips, suggesting that the AI chip market could account for about 40% of its semiconductor revenue.

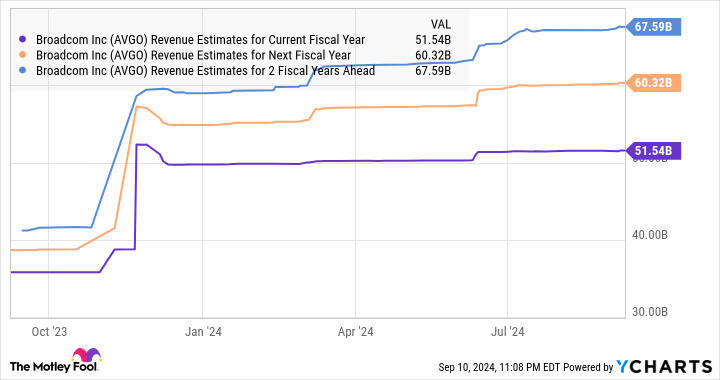

Based on Broadcom’s fiscal 2024 revenue forecast of $51.5 billion, AI is on track to account for 23% of its top line. But the good part is that Broadcom’s AI business could be at the beginning of a terrific growth curve. That’s because it could be sitting on a potential AI-related revenue opportunity worth $150 billion that it could convert into revenue over the next five years, according to JPMorgan.

The investment bank points out that the company’s AI revenue could record a compound annual growth rate of 30% to 40% during that period. This is probably one reason why analysts increased their revenue growth expectations for Broadcom for the next couple of fiscal years.

However, it wouldn’t be surprising to see those expectations head higher considering the huge AI-related opportunity that Broadcom is sitting on. Given that, investors could do well to take advantage of the 14% slide in Broadcom stock since the beginning of July. It is currently trading at 26 times forward earnings, and it may not be available at such a valuation for long.

2. Arm Holdings

Arm Holdings took a beating on the market of late, losing 23% of its value since mid-July. However, the critical role that Arm plays in the global semiconductor market puts it in a solid position to benefit from the proliferation of AI in multiple industries.

The British company licenses its chip architecture and designs to chipmakers, which pay it upfront licensing fees for the use of its intellectual property. Arm also gets royalties for every shipment of products that contain chips manufactured using its architecture and designs. With the market for AI chips expected to clock an annual growth rate of more than 40% through 2032, Arm is sitting on a golden growth opportunity.

The company’s AI-specific chip architecture is being used in applications ranging from smartphones to smart homes to cloud computing to autonomous driving. Arm estimates that more than 100 billion AI-ready chips made using its architecture could be shipped by the end of the next fiscal year, driven by the growth in shipments of AI devices such as smartphones and personal computers.

For comparison, 28.6 billion Arm-based chips were shipped in its fiscal 2024, which ended on March 31. So, Arm’s forecast of 100 billion-plus chip shipments in fiscal 2025 and 2026 suggests that its top-line growth is likely to accelerate significantly. Management’s revenue guidance range for its fiscal 2025 is $3.8 billion to $4.1 billion. If it hits the midpoint of that range, that would be a top-line jump of 22%.

However, Arm stock surged by 7% on Sept. 9 following Apple‘s launch of the iPhone 16. That’s because Apple reportedly used the British company’s AI-focused Armv9 architecture to design the processor powering the new smartphone model. Arm management claims that the Armv9 architecture commands twice the royalties of its previous Armv8 architecture, so iPhone 16 sales could drive some serious growth for it.

Apple’s iPhone shipments are expected to grow at a robust pace when the new models become available, as they are capable of supporting generative AI features on-device. As such, there is a good chance that Arm could deliver faster growth than it is currently forecasting this year, and stronger growth in the future as well.

Given all that, the possibility of Arm stock making a parabolic move cannot be ruled out. That’s why investors should consider acting quickly and taking advantage of the recent dip in the company’s share price.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, JPMorgan Chase, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic was originally published by The Motley Fool