Smart investing means staying patient. Indeed, numerous studies agree: The longer someone stays invested in the stock market, the greater their returns.

With that in mind, let’s take a closer look at two fantastic buy-and-hold candidates and explore why long-term investors should seriously consider them.

Amazon

The first no-brainer stock I want to highlight is Amazon (NASDAQ: AMZN). There are dozens of reasons to own this iconic company, but let’s focus a bit on a few key financial metrics that explain why Amazon is a great stock to own for the long term.

First, Amazon is enormous. Its annual revenue is over $600 billion, trailing only Walmart in terms of revenue generated by an American company.

Second, despite its massive size, Amazon is growing impressively. Its revenue is growing at around 10% year over year, meaning that, at its current size, Amazon is adding about $60 billion per year in new sales.

Third, Amazon is on the cutting edge of some of the world’s most exciting new technologies. The company’s cloud unit, Amazon Web Services (AWS), is generating much of that new annual revenue, as it is growing at a faster clip than the rest of the company — roughly 19% year over year. In addition, Amazon is a pioneer in the robotics industry — with over 750,000 robots working day and night in its fulfillment centers. Finally, the company has many artificial intelligence (AI) initiatives, including using generative AI to streamline its e-commerce business and its ubiquitous voice-powered echo devices.

In summary, Amazon’s large and growing sales figures show that the company continues to find new ways to serve its existing customers and attract new ones. Over the next decade, Amazon remains a no-brainer stock to own thanks to its combination of proven businesses and innovative new ventures.

Meta Platforms

The next no-brainer stock to own is Meta Platforms (NASDAQ: META). The reason Meta is such an obvious pick is that the company delivers on the most important factor for any stock: It drives shareholder value.

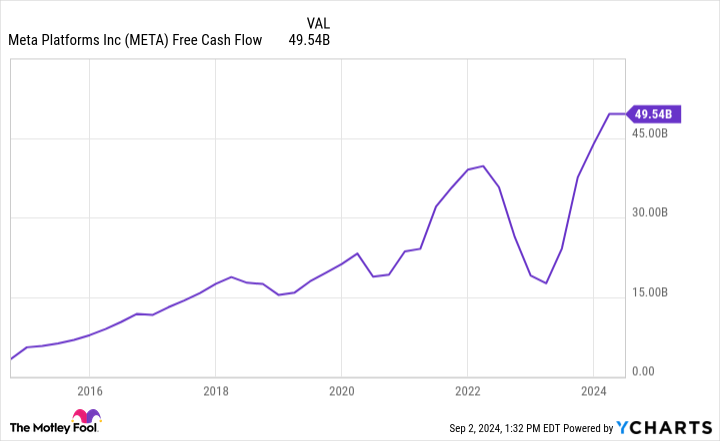

What I mean is that Meta generates a ton of free cash flow — which is the lifeblood of any great stock.

Think of a garden hose. When the spigot is fully open, water comes flying out at a rapid pace. The more the valve is closed, the less water makes it out the other end of the hose.

In the case of a company, the valve represents operating expenses and capital spending, and the water represents free cash flow — it’s what’s left over after employee salaries, taxes, capital expenditures, and many other costs have been subtracted from revenue.

What’s so great about Meta is that the company generates a ton of free cash flow. Moreover, its total keeps on growing larger.

Over the last 10 years, Meta has increased its free cash flow from about $3 billion to almost $50 billion. That’s astounding. Bear in mind that many large companies you’ve heard of don’t generate $50 billion in sales, let alone free cash flow.

Simply put, Meta’s free cash flow makes it a stock market juggernaut. With so much free cash flow at its disposal, the company can return value to its shareholders in any number of ways, including paying dividends, repurchasing shares, or making acquisitions.

In short, it gives Meta’s management many ways to increase its share price. And that’s something that should make investors happy for many years to come.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Meta Platforms, and Walmart. The Motley Fool has a disclosure policy.

2 No-Brainer Stocks to Buy and Hold for the Next Decade was originally published by The Motley Fool