With $200, one can afford many lottery tickets, one of which could be a winner. However, the odds of winning meaningful money by playing the lottery are minuscule. Investing in the stock market might not make anyone rich overnight the way the lottery could, but even with $200, investors can acquire shares of companies in excellent positions to deliver outsized returns over the long run. Let’s consider two stocks trading well below $200 that have what it takes to do that: Novo Nordisk (NYSE: NVO) and DexCom (NASDAQ: DXCM).

1. Novo Nordisk

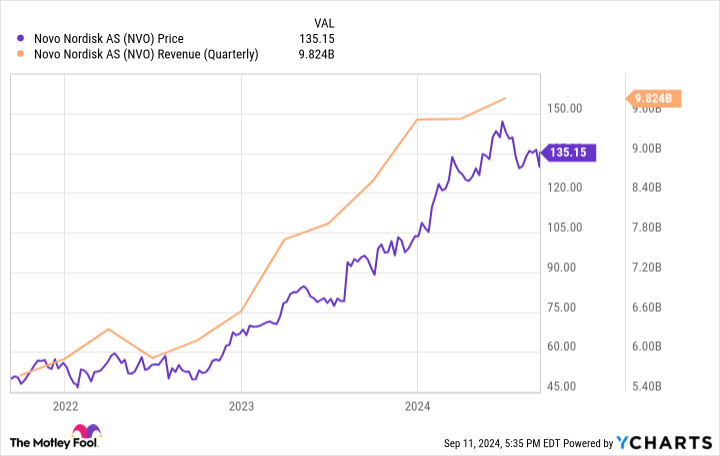

Pharmaceutical companies thrive on innovation. Few have been better at this than Novo Nordisk during the past few years. The drugmaker deserves credit for pioneering GLP-1 medicines for weight loss. Novo Nordisk’s portfolio of approved products, which includes weight loss medicine Wegovy and diabetes therapy Ozempic, is helping it post excellent financial results, leading to above-average returns.

Investors are also excited about the company’s pipeline. Even though Novo Nordisk’s success is attracting plenty of potential competitors — it seems like every drugmaker is now trying to break into the weight loss arena — the Danish pharmaceutical giant still has some of the most promising candidates in development. The most exciting might be CagriSema, a compound combining semaglutide (Wegovy and Ozempic’s active ingredient) and cagrilintide, another GLP-1 medicine. CagriSema seemed more effective than its individual components in a phase 2 study.

CagriSema is currently in phase 3 studies. The research company Evaluate Pharma estimates the therapy could bring in as much as $20.2 billion in annual revenue by 2030. Does that seem too optimistic? At the rate at which Ozempic and Wegovy are growing, the increased popularity of this class of medicines, and the fact that CagriSema could be even more effective, projections of these kinds aren’t surprising. So, plenty of things point to Novo Nordisk’s remaining a dominant force in its core areas of diabetes and obesity care, which should help it to maintain momentum.

Furthermore, the company is developing medicines in several other areas that could help complement and diversify its lineup — more than 90% of its revenue now comes from diabetes or obesity products. This concentration hasn’t been a problem for Novo Nordisk yet, but it could become one if the pool of approved GLP-1 products expands significantly. The company is planning for that eventuality, though, and investors have little to worry about. Novo Nordisk remains a top stock to hold long-term, and its shares are trading at about $137 as of this writing.

2. DexCom

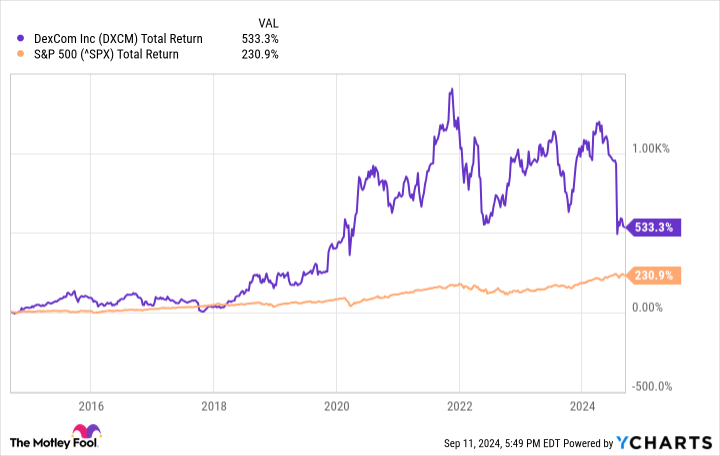

DexCom’s shares dropped by about 40% in July after it released second-quarter results. Some might see that as a bad sign, an understandable reaction. But it’s important to dig deeper. Let’s consider three reasons the medical device specialist remains a top stock. First, DexCom has historically been volatile. The shares have dropped sharply on multiple occasions. However, the company has generally delivered market-beating returns to loyal, long-term shareholders. So, this situation is hardly out of the (historical) ordinary for DexCom.

Second, DexCom’s recent plunge was largely due to issues that won’t affect it long term. For instance, during the company’s rollout of its latest continuous glucose monitoring (CGM) system in the U.S., the G7, patients took advantage of rebates at a rate higher than DexCom expected. The company’s outlook for the third quarter was a bit weak, not on par with what investors expect from richly valued growth stocks: DexCom’s forward price-to-earnings (P/E) ratio of 33 is still high even after the meltdown.

The average forward P/E for the healthcare industry is 19.2. A correction might have been overdue, but the company should eventually rebound if its financial results are strong.

This brings us to the third point: DexCom’s vast worldwide opportunity. DexCom is one of the leaders in CGM technology together with Abbott Laboratories. The latter reported about 6 million users in the world.

Even assuming DexCom has the same installed base (it is likely lower), the 12 million between them doesn’t even come close to the 10% of the half-billion adults with diabetes globally. DexCom will have to develop newer CGM options and enter new territories to increase its addressable market. That’s precisely what it has done historically. After its recent drop, DexCom’s shares are changing hands for about $69. So, $200 can buy two of them with plenty of change to spare.

Should you invest $1,000 in Novo Nordisk right now?

Before you buy stock in Novo Nordisk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Novo Nordisk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories. The Motley Fool recommends DexCom and Novo Nordisk. The Motley Fool has a disclosure policy.

2 Unstoppable Healthcare Stocks to Buy Right Now for Less Than $200 was originally published by The Motley Fool