With the major stock market indices up near all-time highs, finding stocks that pay satisfying dividend yields isn’t nearly as easy as it used to be. Before you give up, though, consider Brookfield Renewable Partners (NYSE: BEP), Royalty Pharma (NASDAQ: RPRX), and Bristol Myers Squibb (NYSE: BMY).

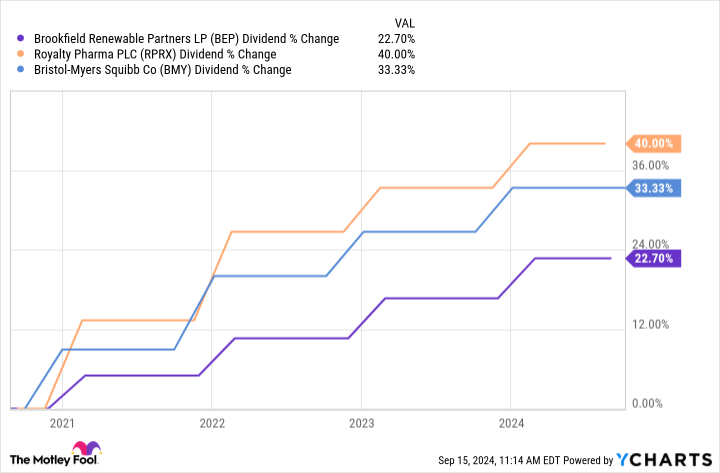

Since 2020, these three dividend payers have increased their quarterly payouts between 22.7% and 40% higher. Despite the increased payments, their stock prices are way down from the all-time highs they reached in 2021.

Rising dividend payments coupled with sinking share prices is a recipe for high yields. At recent prices, these stocks offer dividend yields that are way above average. Here’s why investors can look forward to steadily climbing payouts from these three exceptional stocks for at least another 10 years.

Brookfield Renewable Partners

If you’re looking for businesses that can steadily raise their payouts, the utilities sector is right up your alley. Instead of focusing on fossil fuels, though, consider Brookfield Renewable Partners. At recent prices, it offers a 5.4% dividend yield. That’s more than four times the average yield of dividend payers in the benchmark S&P 500 index.

The stock is down about 37% from an all-time high it reached a few years ago, but its dividend payout is up by about 22.7% since 2020. At recent prices, it offers a juicy 5.4% yield.

As its name implies, Brookfield Renewable invests in sources of hydroelectric, wind, solar, and nuclear power. Investors seeking a steadily growing source of income love this stock because its customers tend to sign contracts that last decades and include inflation-adjusted rate increases.

In addition to steadily climbing demand for electricity from consumers, Brookfield Renewable investors can look forward to steady gains driven by a long development pipeline for corporate customers. In the second quarter alone, it inked agreements to deliver an additional 2,700 gigawatt hours per year of generation, around 90% of which was contracted to corporate customers.

Royalty Pharma

Sales for individual products can be highly unpredictable, but overall spending on prescription drugs is rising steadily. Americans spent $405 billion on prescription drugs in 2022, which was 8.4% more than they spent a year earlier.

With a financial stake in more than 35 commercial-stage products, Royalty Pharma is arguably the safest way to bet on steadily rising demand for new drugs.

Shares of Royalty Pharma are down about 38% from the all-time high they reached in 2021 even though its dividend payout has risen by 40% since 2020. At recent prices, the stock offers a 3% dividend yield.

This specialty financier’s recent results are a lot more encouraging than you’d expect after looking at its stock chart. Second-quarter royalty receipts jumped 11% higher year over year. The company expects royalty receipts to reach at least $2.7 billion this year, or 9% more than it reported last year.

Royalty Pharma isn’t resting on the 35 commercial-stage products that are already generating revenue. In the first half of 2024, the company announced about $2 billion worth of new transactions. They can’t all be zingers, but there are probably enough blockbusters in its rapidly growing portfolio to keep pushing its needle forward in the decade ahead.

Bristol Myers Squibb

Shares of Bristol Myers Squibb, a pharma giant more than a century old, have fallen about 39.4% from their peak a few years ago. The stock is down even though the company has raised its dividend every year since 2009.

A rapidly growing portfolio will allow Bristol Myers Squibb to raise its dividend in the years ahead, too. In the first half of 2023, five drugs in Bristol Myers Squibb’s portfolio rose more than 10% year over year. The company is also recording sales for three new cancer therapies that earned approval from the FDA in 2024. Breyanzi is a cellular therapy for advanced lymphoma, Krazati is a targeted colon cancer treatment, and Augtyro is approved to treat just about anyone with solid tumors driven by an NTRK gene mutation.

Any day now, Bristol Myers Squibb could also receive a green light for a highly anticipated anti-psychotic treatment called KarXT. If approved, it will be the first anti-psychotic drug that doesn’t act on dopamine receptors. With far fewer side effects that make adherence to recommended dosage schedules a challenge, KarXT sales are expected to top $10 billion annually at their peak.

Bristol Myers Squibb’s dividend raises in recent years haven’t been small ones. The drugmaker’s quarterly payout is up by 46% since 2019. At recent prices, the stock offers a big 4.9% dividend yield. With a large slate of recently launched drugs, and potential blockbusters in late-stage development, this company could keep raising its payout for another 15 years.

Should you invest $1,000 in Brookfield Renewable Partners right now?

Before you buy stock in Brookfield Renewable Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Brookfield Renewable Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Cory Renauer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bristol Myers Squibb. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

3 High-Yield Dividend Stocks Down by More Than 39% to Buy Now and Hold at Least a Decade was originally published by The Motley Fool