Taiwan Semiconductor (NYSE: TSM) has been a brilliant investment over the past five years. Its total return is around 350%, easily outperforming the NASDAQ 100 and the S&P 500, which rose 170% and 110%, respectively.

Although TSMC has been a market-crushing stock over the past five years, I’m convinced it will do it again in the next five. This makes the stock a strong buy now, and I have three reasons why it’s an attractive purchase.

1. Strong revenue growth

Taiwan Semiconductor’s revenue growth is slated to be strong and steady over the next five years. Multiple tailwinds, especially in artificial intelligence (AI), are blowing in its favor.

Management believes that AI-related chips will grow at a 50% compounded annual growth rate (CAGR) through 2028, when they will make up around the low teens of its overall revenue. That’s a strong growth rate, and much of the future growth will be powered by its 2 nanometer (nm) chip design.

While the current generation of chips are 3nm, the gains for the next generation are impressive. When configured to maintain the same speed as a 3nm chip, the 2nm chips are expected to see a 25% to 30% efficiency improvement. With energy being a massive operating cost for data centers that power AI models, it’s no surprise that this innovation is slated to be a hit with TSMC’s clients. Management is already seeing strong demand, and it has exceeded the pre-production demand of the previous 3nm and 5nm generations.

All this flows into management’s projection to grow revenue at a CAGR of 15% to 20% over the next several years. This is market-beating growth and is a key reason why TSMC will outperform the markets again moving forward.

2. Attractive stock price

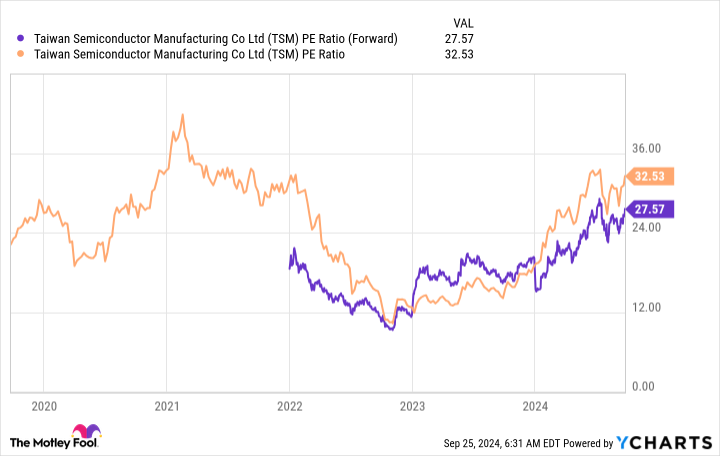

Despite TSMC’s strong outlook, the stock doesn’t command that hefty a price tag. On a trailing price-to-earnings (P/E) ratio basis, Taiwan Semi is nearly at the same price it was at five years ago. This is key, as it shows you’re not drastically overpaying for TSMC’s stock.

Clearly, it would have been better to buy the stock at the start of 2023, but that price is no longer available. Instead, investors will need to pay around 27.6 times forward earnings for TSMC, but that’s not that much of a premium over the indexes it’s being compared to. In comparison, the S&P 500 and NASDAQ 100 trade at 23 and 29.2 times forward earnings. That puts TSMC at a fairly reasonable price tag compared to the broader market, which should alleviate investors’ fears of overpaying for the stock despite a strong two years.

3. TSMC has a growing dividend

Taiwan Semiconductor isn’t on most dividend investors’ radar, which is a shame. While TSMC’s payout isn’t anything massive, it is a decent part of the investing picture.

The dividend isn’t as consistent as other stocks, as TSMC’s payout is based on New Taiwan (NT) dollars, not U.S. dollars. However, from a NT dollar standpoint, management’s policy is to “maintain a sustainable and steadily increasing cash dividend, and to distribute the cash dividend each year/quarter at a level not lower than the year/quarter before.”

TSMC’s policy of raising its dividend every year makes it an excellent dividend investment. Even though the yield is about 1.4%, it’s still a big part of the TSMC investment thesis, especially if management consistently raises it.

Taiwan Semiconductor is slated to have strong growth over the next five years and can be purchased at a fair price. Additionally, it pays a respectable dividend that is slated to grow as well. TSMC is about as no-brainer of a purchase as it gets, and I expect it to easily outperform the market moving forward.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Keithen Drury has positions in Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

3 Reasons to Buy Taiwan Semiconductor Stock Like There’s No Tomorrow was originally published by The Motley Fool