After a strong run in the first half of the year, technology stocks have come under pressure recently. Recent stock price trends suggest investors are taking a more cautious stance on the economy while the mania around artificial intelligence (AI) has also eased. Even high-flying Nvidia has been affected, with the stock trading down nearly 20% over the past six months.

But this recent sell-off also presents some opportunities.

Let’s look at three tech stocks (that aren’t named Nvidia) that investors should consider buying amid this latest market adjustment.

1. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (NYSE: TSM), or TSMC for short, is the leading semiconductor fabrication contractor in the world. Today, many semiconductor companies don’t produce their own chips. Instead, they outsource the process to companies that specialize in chip manufacturing.

While outsourced manufacturing may not sound like an exciting business, don’t be fooled — this is a highly complex process that is ruled by the companies that can do it best. In fact, the contract manufacturing unit of Intel, which was created in 2021 to compete with TSMC, recently suffered a large setback after chip designer Broadcom said tests it conducted showed that Intel’s newest process was not ready for high-volume production.

At the same time, TSMC has been leading the way in technological innovations, with the company set to introduce 2-nanometer production technology next year. The smaller the chip density, the better the performance and consumption power. With demand for AI chips becoming insatiable, the company has been increasing its capacity and building new fabrication facilities.

Given the high demand for its services, TSMC is also set to raise prices on its more advanced technologies. Morgan Stanley analysts estimate it will raise prices this year by 10% for AI semiconductors and chip-on-wafer-on-substrate (CoWoS), 6% for high-performance computing, and 3% for smartphones.

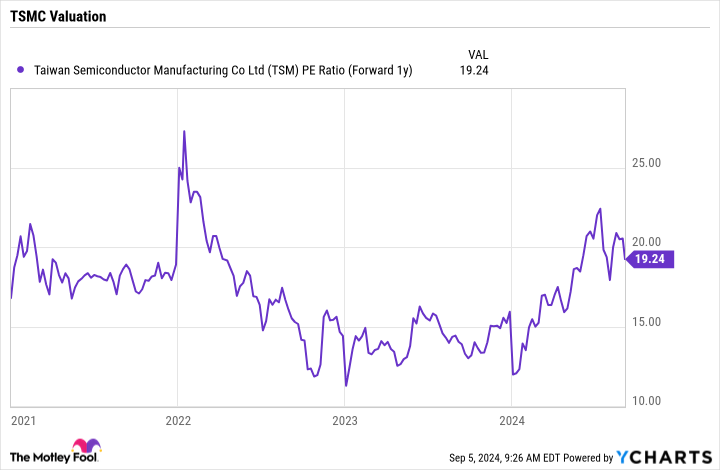

Trading at a forward price-to-earnings (P/E) ratio of about 19 based on next year’s analyst estimates, the stock is still attractively valued, especially given the growth prospects in front of it.

2. ASML

While TSMC makes the chips for semiconductor companies, ASML (NASDAQ: ASML) makes the highly specialized equipment used by companies like TSMC to manufacture these chips. As TSMC and others expand their production to meet the increasing demand for AI chips, they will need more equipment to produce those chips.

Not surprisingly, the semiconductor equipment manufacturing business can be lumpy, as these are very expensive pieces of equipment. These machines have a typical life cycle of about seven years before they need to be replaced or refurbished.

Meanwhile, 2024 is a bit of a transitional year for ASML as it introduces its newest technology: a high numerical aperture extreme ultraviolet lithography system, or high NA EUV. The company says the new machines will increase chip manufacturing productivity while lowering production costs and improving chip functionality.

The company has shipped two of its high NA EUV systems thus far, with one running qualification wafers. With a price tag of $380 million per unit, these new systems are pricey and should help drive revenue for ASML next year and beyond as chip manufacturers move to the newest technology to help meet demand for AI chips. That, combined with the number of new fabs set to come online over the next few years, bodes well for ASML’s long-term prospects.

At a prior analyst day, ASML management set targets to grow revenue to between 30 billion to 40 billion euros ($33.3 billion to $44.4 billion) in 2025 and to 44 billion to 60 billion ($48.8 billion to $66.6 billion) by 2030. The company produced 27.6 billion euros ($30.6 billion) in revenue last year, and it expects similar revenue this year.

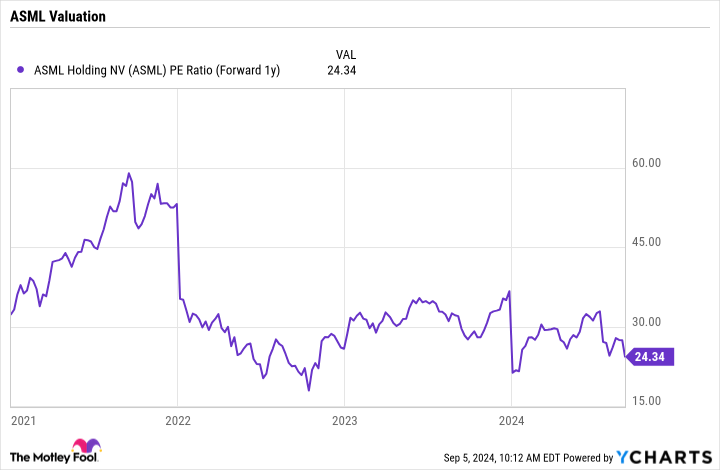

Trading at a forward P/E of just over 24 times based on 2025 analyst estimates, ASML’s stock looks attractive, given the growth inflection in front of it.

3. Arm Holdings

Arm Holdings (NASDAQ: ARM) is the leading semiconductor company for central processor units (CPUs), which are often described as the brain for devices. The company has a dominant position in the smartphone market, with its technology in virtually all smartphones around the globe.

Meanwhile, Arm is taking aim at the personal computer (PC) market as well. The company’s technology is currently in all Apple computers and laptops, but its goal now is to be in 50% of Windows-based PCs in the next five years. While not as large of a market as smartphones, this is still a nice opportunity for the company. Arm has also been making solid inroads in the automotive market. It reported year-over-year revenue growth of 28% in the sector in Q2.

Arm benefits from AI as well. Last quarter, Arm noted that it saw increased licensing in the AI data center due to the need for customization, while it collaborated on a super chip with Nvidia that combines an Arm-based CPU with an Nvidia graphics processing unit (GPU). Its technology is also the basis for CPU data center chips from Amazon and Alphabet.

While semiconductor companies like Nvidia and Broadcom design their own chips, Arm employs a different model in which it licenses its technology to other companies to allow them to design their own chips based on its technology. Through its licenses, it collects royalties on the number of chips shipped that have incorporated its technology. This revenue stream could last years or even decades.

More recently, the company has been shifting customers to a subscription model, where they can get a wider range of use of its intellectual property. Whether through royalties or subscriptions, Arm has a very high-margin, largely recurring revenue stream.

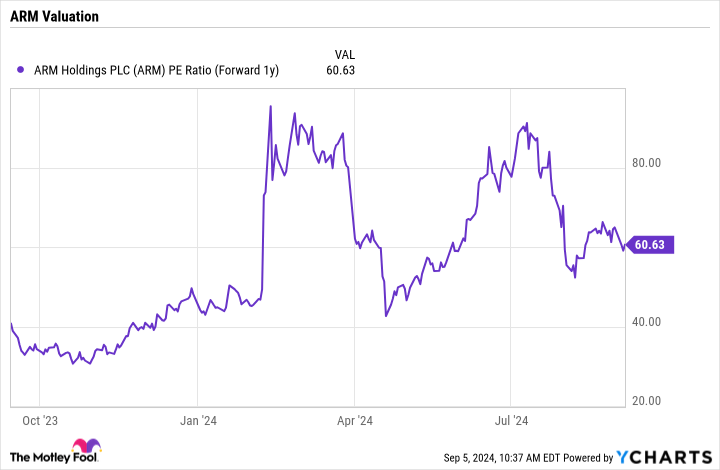

Based on 2025 analyst estimates, Arm stock trades at a forward P/E of just over 60.5 times. While that is not cheap on the surface, it’s down from higher levels, and Arm has one of the most attractive and long-tail business models in the semiconductor space.

Should you invest $1,000 in Arm Holdings right now?

Before you buy stock in Arm Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Arm Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends ASML, Alphabet, Amazon, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

3 Stocks Outside of Nvidia to Buy Amid the Tech Sell-Off was originally published by The Motley Fool