If you want high-yield stocks, the oil and gas sector offers plenty of great options that are worth considering as part of a diversified portfolio. The challenge, of course, if finding the right ones.

If you are looking for some high-yield stocks to add to your portfolio in September, you might want to consider Devon Energy (NYSE: DVN), Diamondback Energy (NASDAQ: FANG), and/or Vitesse Energy (NYSE: VTS). All three are excellent dividend stock candidates worth a closer look. Here’s why.

1. Devon Energy (dividend yield of 4.5%)

The stock for this U.S.-based oil and natural gas producer is trading slightly down year to date despite the price of oil holding up much better than many investors anticipated. In addition, Devon’s focus on investing in its core Delaware Basin assets has improved productivity, and the company has already upgraded its production volume estimates twice this year, implying a 5% increase over its original guidance.

The company is getting in on the sector’s acquisition frenzy of late by announcing a $5 billion acquisition of Grayson Mill’s Williston Basin assets for a mix of cash and stock. Management believes the deal will expand its oil equivalent production by 15% and its free cash flow by a similar amount.

The market didn’t react so positively to the plan, possibly because it’s a relatively conservative deal, and Devon is paying for producing assets rather than reserves. It’s a strategy that could backfire if the price of oil slumps over the medium term. Still, investors and Devon’s management are unlikely to invest in the sector if they are worried about a significant oil price decline.

Indeed, if the price of oil stays where it is now, Devon will generate significant amounts of cash flow to reduce debt and continue to return tremendous dividends to investors in the coming years. Devon’s $0.44 per share quarterly dividend fluctuates from quarter to quarter (both up and down) and it currently yields 4.5%, topping the sector average of 3.75%.

2. Diamondback Energy (dividend yield of 5.5%)

In contrast to Devon Energy, Diamondback Energy’s stock is up significantly this year with a nearly 26% increase in the stock price. Just as with Devon Energy, Diamondback has agreed on a deal to add significant energy assets. In this case, Diamondback has a merger agreement with Endeavor Energy Resources. Diamondback will contribute 117.3 million shares and $8 billion in cash to own 60.5% of the combined company.

However, in contrast to Devon Energy’s deal, the market warmed to this one, possibly because it adds Permian Region assets to Diamondback’s existing assets.

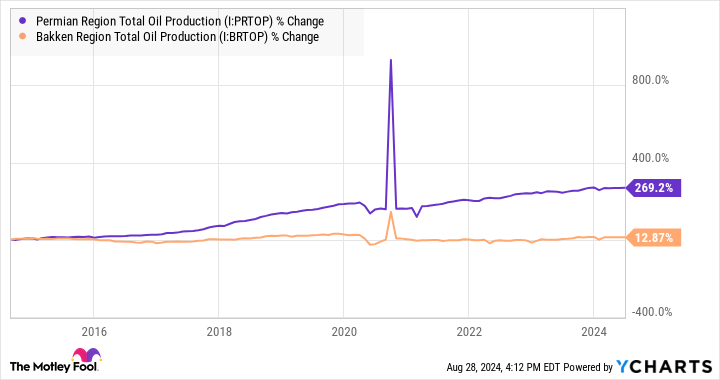

As the chart below shows, oil production in the Permian Basin has expanded significantly more than in the Bakken over the last decade, and investors are willing to pay a premium for assets in the Permian.

Moreover, the deal brings about significant opportunities for synergy generation — management is aiming for $550 million in annual synergy, representing over $10 billion in net present value if discounted at 10% over the next 10 years.

While management plans to reduce its “return of capital commitment to at least 50% of free cash flow to stockholders from at least 75% of free cash flow previously” as a result of the deal (implying some pressure on the dividend), the growth in assets and production (which will more than double with the addition of Endeavor) supports significant dividend growth in the future.

Diamondback’s $2.34 per share quarterly dividend fluctuates from quarter to quarter (both up and down) and it currently yields 5.5%, topping the sector average of 3.75%.

3. Vitesse Energy (dividend yield of 8.3%)

Returning to the Bakken oil field, oil and gas exploration and production company Vitesse Energy is an interesting small-cap stock with a management team dedicated to generating dividends for investors. It has an unusual business model: It doesn’t operate its own wells. Instead, its experienced executive team uses a proprietary system and its management’s experience to invest in minority interests in oil and gas assets operated by larger peers.

Management claims it invests in 30% to 55% of the rigs drilled in the Bakken, including those operated by Grayson Mill; as noted above, Devon Energy is buying these assets. In addition, management uses a hedging strategy to try and isolate the risk in the stock to management’s ability to identify and invest in productive wells rather than rely on a rising price of oil.

It’s an interesting strategy, and it places a lot of onus on management to deliver, both in investing wisely and in hedging successfully. As such, it’s probably not a stock to overload on. But management has a good track record, and the company has already hiked its hefty dividend this year. So it’s a worthy option for investors looking to diversify their energy holdings and benefit from significant dividends too.

Vitesse’s $0.52 per share quarterly dividend has been consistent or growing since it started paying one in early 2023. It currently yields 8.3%, more than double the sector average.

Should you invest $1,000 in Devon Energy right now?

Before you buy stock in Devon Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Devon Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vitesse Energy. The Motley Fool has a disclosure policy.

3 Top High-Yield Stocks to Buy in September was originally published by The Motley Fool