The fast-growing adoption of artificial intelligence (AI) in multiple industries has given shares of several companies a massive boost in the past year and a half, helping the tech-laden Nasdaq-100 Technology Sector index clock terrific gains of 80% since the beginning of 2023.

Thanks to AI, many technology companies have seen a parabolic jump in their share prices. These include Nvidia, SoundHound AI, Super Micro Computer, and Broadcom, among others. A parabolic move refers to the rapid increase in the stock price in a very short period, similar to the right side of a parabolic curve.

Let’s take a closer look at two such stocks that could go parabolic due to the proliferation of AI.

1. ASML Holding

ASML Holding (NASDAQ: ASML) is arguably one of the most important companies in the AI revolution. Its extreme ultraviolet (EUV) lithography machines are helping chipmakers and foundries shrink the sizes of their chips. More specifically, EUV lithography enables semiconductor companies to manufacture chips based on 7 nanometer (nm), 5 nm, and 3 nm process nodes.

The smaller the node size, the more powerful and power-efficient a chip is considered to be. A smaller process node allows a chipmaker to pack more transistors into a smaller area, leading to more computing power and reduced heat generation. Not surprisingly, popular AI chips, such as Nvidia’s H100 and AMD‘s MI300 series of accelerators, are based on 4 nm process nodes.

These chipmakers can only produce these smaller chips through ASML’s machines, as the Dutch semiconductor giant has a monopoly in this market. This solid position puts ASML on track to deliver outstanding long-term growth as the size of the EUV lithography market is expected to grow at a 22% annual rate through the end of the decade, generating annual revenue of $37 billion in 2030.

More importantly, semiconductor companies around the globe are set to invest huge amounts of money in upgrading their infrastructures. The U.S., for instance, is expected to triple its semiconductor manufacturing capacity by 2032. The country’s capital expenditure on semiconductors is expected to be around $2.3 trillion between 2024 and 2032, compared to $720 billion in the preceding 10 years.

On the other hand, Taiwan Semiconductor Manufacturing (TSMC), the world’s largest semiconductor foundry, will reportedly buy $12.3 billion worth of EUV machines going forward. All this bodes well for TSMC, and there is a good chance that the company could also sustain its impressive growth in the long run, considering the AI chip market could grow at an annual rate of almost 41% through 2032.

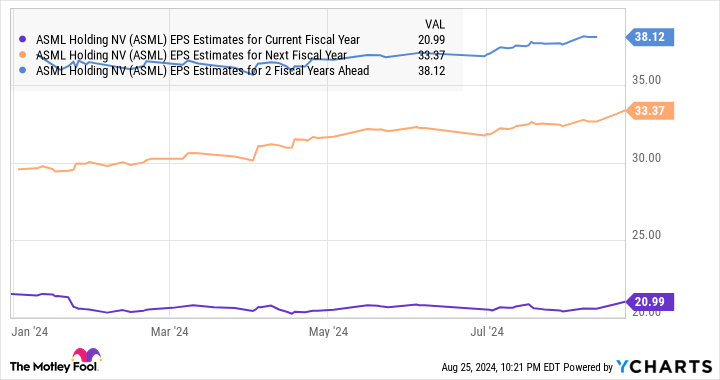

Not surprisingly, ASML’s earnings are expected to grow at an impressive pace from next year, following a flat performance in 2024.

Additionally, analysts expect the company’s earnings to increase at a healthy annual rate of 21% for the next five years. An improvement in ASML’s growth could lead the market to reward the stock with more upside. Shares of the semiconductor bellwether have gained 20% so far in 2024. Still, as the discussion above indicates, there is a good chance it could end the year with much stronger gains, as the increase in semiconductor equipment spending could spark a parabolic move in ASML stock.

2. Palantir Technologies

It would be safe to say that Palantir Technologies (NYSE: PLTR) stock has already made a parabolic move of late, jumping nearly 32% since releasing its second-quarter 2024 results on Aug. 5.

This sharp jump in Palantir’s stock price this month can be attributed to the fast growth in the company’s revenue pipeline thanks to AI. More specifically, Palantir’s AI software platform is gaining healthy traction among customers, leading to an acceleration in the company’s growth. It reported Q2 revenue growth of 27% on a year-over-year basis to $678 million.

That was much faster than the 13% year-over-year revenue growth Palantir clocked in the same quarter last year. On the company’s recent earnings conference call, Palantir management remarked that its Artificial Intelligence Platform (AIP), which allows customers to integrate AI for their use cases, is playing a direct role in boosting its growth.

The company is not only attracting new customers for its AI services, but its existing customers are also signing bigger deals to use Palantir’s AI offerings. For instance, the company’s commercial customer count in the U.S. increased 83% year over year, while the overall customer count was up by 41% from the same quarter last year.

The company also closed 27 deals worth at least $10 million, an increase of 50% from the same quarter last year. The improving customer count and an increase in deal sizes explain why Palantir’s revenue guidance of $699 million for the current quarter points toward a 25% year-over-year increase. That would be better than the 17% revenue growth it clocked in the same quarter last year.

More importantly, Palantir seems capable of sustaining the improvement in its revenue growth in the future as well, considering its remaining deal value stands at an impressive $4.3 billion. This metric refers to the total remaining value of the company’s contracts at the end of a quarter, and it increased 26% from the same quarter last year.

What’s more, the expansion in Palantir’s customer base and spending is accompanied by an improvement in the company’s margin profile. The company’s adjusted operating margin increased to 37% in the previous quarter from 25% in the same period last year. Palantir management says its business has “strong unit economics,” meaning it can generate more profit from each customer and is enjoying lower customer acquisition costs.

As such, there is a solid chance that Palantir’s margin profile could continue to improve in the future and help the company clock healthy earnings growth. Not surprisingly, consensus estimates are projecting Palantir’s earnings to increase at a compound annual growth rate of 85% for the next five years. This indicates that the stock could keep heading higher, even after its latest parabolic move.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Advanced Micro Devices, Nvidia, Palantir Technologies, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic was originally published by The Motley Fool