“The time has come for policy to adjust.” Those were the words of Federal Reserve Chairman Jerome Powell on Friday at the annual Jackson Hole Economic Symposium.

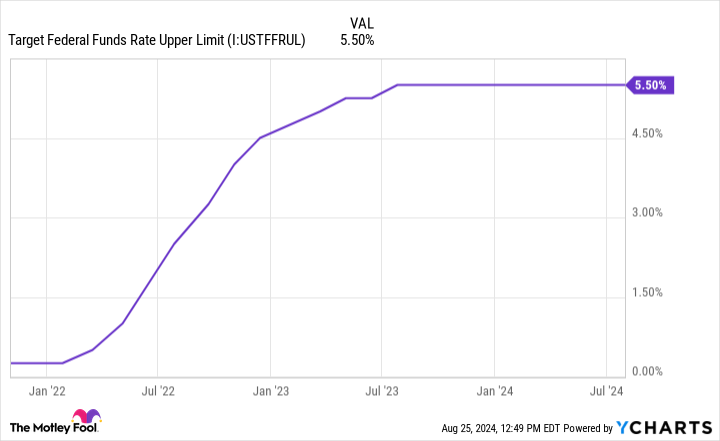

The Fed has been locked in an intense battle to tame inflation, which hit a 40-year high in 2022 when the Consumer Price Index (CPI) soared to 8%. That was far above the Fed’s annual target of 2%, and the central bank responded with the most rapid string of interest rate hikes in its history.

But inflation has cooled significantly this year, and the Fed is now set to cut the benchmark federal funds rate for the first time since March 2020. While lower rates can be great for stocks over the long term, history suggests the initial response in the S&P 500 (SNPINDEX: ^GSPC) index might actually be negative.

A September rate cut appears certain

The inflation surge during 2022 was a product of the pandemic. The U.S. government delivered trillions of dollars worth of stimulus during 2020 and 2021 to fight the negative impacts of the COVID-19 crisis on the economy. At the same time, the Fed slashed the federal funds rate to a historically low range of 0% to 0.25%, and used quantitative easing (QE) to inject trillions of dollars into the financial system.

Those factors eventually combined with global supply chain disruptions and shortages to create an inflationary cocktail that forced the Fed to drastically raise interest rates. In the 17 months between March 2022 and July 2023, the central bank ratcheted the federal funds rate up from near zero to a range of 5.25% to 5.50%.

Thankfully, tighter monetary policy is doing its job. The CPI fell to 4.1% in 2023, and it came in at an annualized rate of 2.9% in July 2024, which was the latest reading. That’s closing in on the Fed’s 2% target, which is part of the reason why Chairman Powell believes it’s time to adjust the federal funds rate downward.

According to the CME Group‘s FedWatch tool, traders are pricing in a certain chance of a rate cut at the Fed’s next meeting on Sept. 17 and 18 — the only point of debate is whether it will be 25 basis points or 50 basis points. FedWatch predicts additional rate cuts in both November and December.

The stock market doesn’t always like rate cuts

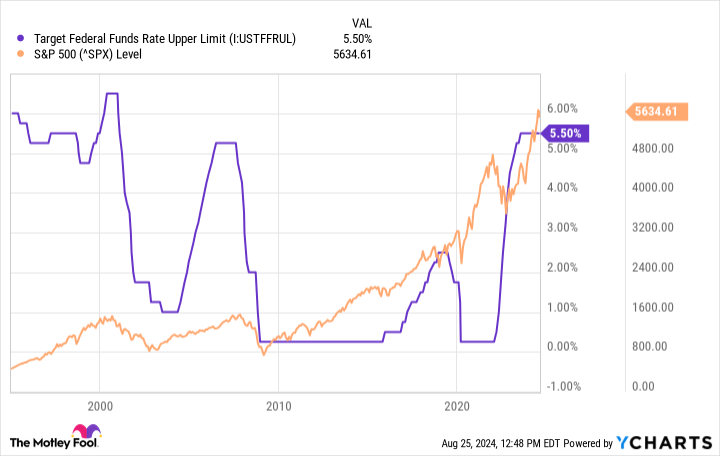

The stock market’s response to rate cuts has been quite negative in recent history, at least initially. Every rate cut cycle since the year 2000 has foreshadowed a drop in the S&P 500, as highlighted by the chart below, which overlays the index with the federal funds rate.

However, the Fed cut rates in the early 2000s because the dot-com bubble burst, which triggered a recession. Then, it cut rates in 2008 because of the global financial crisis. Finally, it slashed rates in 2020 because of the pandemic.

Therefore, it’s possible the S&P 500 fell on each of those occasions because of the major economic shocks the Fed was responding to, not because the Fed was cutting rates. Thankfully, there doesn’t appear to be an economic catastrophe looming now, so perhaps investors will respond to these rate cuts more positively.

Plus, in each of those prior cases, the S&P 500 recovered to set new all-time highs. Lower rates are positive for businesses over the longer term because companies can borrow more money to fuel their growth, and their interest payments are smaller, which is a tailwind for their earnings.

Also, lower benchmark rates reduce the yields of risk-free assets like cash and bonds, which pushes investors who want better returns into growth assets like stocks. So, investors definitely shouldn’t rush to sell their stocks when the Fed cuts rates in September.

Will September’s rate cut be 25 basis points or 50 basis points?

Although the U.S. economy is in relatively good health right now, its growth is clearly slowing. The unemployment rate, for example, was 3.7% at the start of 2024, but it has since ticked higher to 4.3%. Higher unemployment can trigger a slowdown in consumer spending, which would be a drag on the economy.

The Fed is taking notice. On Friday, Powell commented that inflation posed a diminishing risk to the U.S. economy, whereas the unemployment situation now presents an increasing risk. In that context, the upcoming non-farm payrolls (jobs) report that is scheduled for release on Sept. 6 could determine whether the Fed cuts rates by 25 basis points or 50 basis points at its September meeting.

If the U.S. economy creates fewer jobs than expected — or if the unemployment rate ticks even higher — the central bank might opt for a 50-basis point cut to prevent the situation from deteriorating further. In that scenario, it’s possible that the S&P 500 will slide due to fears among traders that the economy is weaker than it currently appears.

In any case, long-term investors should stay the course because history suggests that any dip in the S&P 500 is likely a buying opportunity rather than an excuse to sell. Over time, consumers and corporate America alike will benefit from lower interest rates, which will be positive for stocks.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool recommends CME Group. The Motley Fool has a disclosure policy.

The Fed Just Flagged Its First Interest Rate Cut Since March 2020. It Might be Bad News for Stocks. was originally published by The Motley Fool