Celsius Holdings (NASDAQ: CELH) is probably best described as a fad stock, even though it is classified as a consumer staples company. PepsiCo (NASDAQ: PEP) is a consumer staples stock that would likely be thought of as a boring industry giant. But if you compare the performance of these two stocks, PepsiCo looks like the better choice for investors. And that’s before considering its incredible long-term gains.

What does Celsius do?

Celsius makes energy drinks. Energy drinks are an attractive segment of the beverage sector, and the company’s products have largely been well received. But step back and look at the broader beverage sector, which is far larger than just energy drinks. Essentially, Celsius is a one-trick pony.

To be fair, that trick is pretty good right now. The company claims that its products accounted for 47% of all energy drink category growth in the second quarter of 2024. It held the No. 3 position for market share in the period, as well. While this is all notable, it doesn’t take into account the inherent limitations of selling into just one niche of a much broader market.

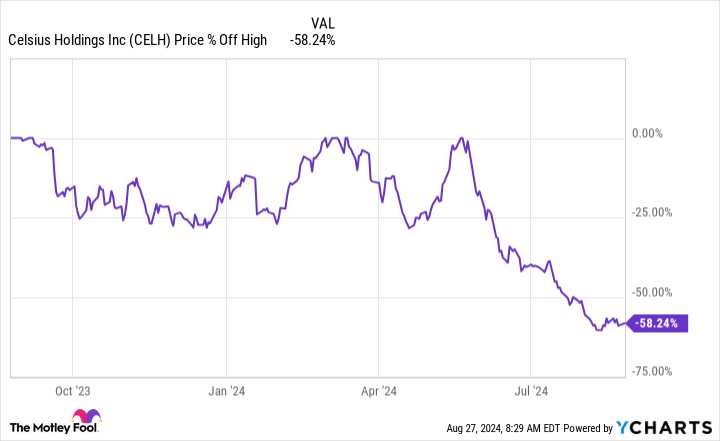

When the company’s performance ebbs or investors simply move on to the next big investment idea, the stock is likely to be dropped quickly. Case in point: The stock has fallen more than 50% from its 52-week highs. It’s worth noting that the peak was in May, which means there has been a very steep decline in a very short period of time.

There’s nothing inherently wrong with Celsius, per se. But if you believe this is the stock that will make you a quick million, you may end up disappointed. A far better choice would be to get rich “slowly” with a larger, more diversified consumer staples company like PepsiCo.

PepsiCo is beating Celsius?

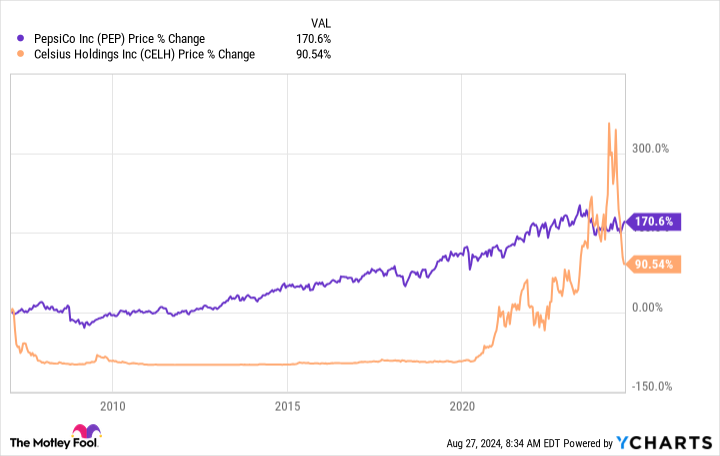

The very first thing to consider when comparing PepsiCo to Celsius is the stock gains each company has produced. From Celsius’ IPO in early 2007, the stock is now up around 90%. That includes the steep share price drop over the last few months. Over that same span, PepsiCo stock is up 170%. Although PepsiCo stock has fallen over the last few months, too, the decline hasn’t been anywhere near as dramatic.

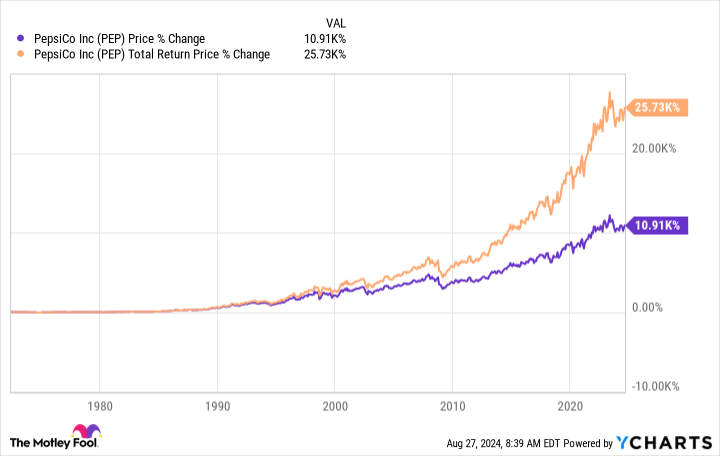

But what happens when you look further back? Since mid-1972, PepsiCo’s stock has risen over 10,000%! That said, PepsiCo pays a dividend, unlike Celsius. The yield is currently around 3% and is backed by over five decades of annual dividend increases (making PepsiCo a highly elite Dividend King).

PepsiCo is clearly no flash-in-the-pan company — it has proven its ability to adjust and grow along with the world around it. To really understand investor returns here, you need to look at total return, which assumes dividend reinvestment. PepsiCo’s total return since mid-1972 is an incredible 25,000%!!!

Although that’s historical performance, it is important to understand the benefits of being an industry leader in the consumer staples sector. PepsiCo has a stable of iconic brands, a global distribution system, and powerful marketing chops. It is hard to compete with PepsiCo, particularly for small start-ups. And, here’s the key: When a smaller company does make vital inroads, PepsiCo is large enough to pursue that company as an acquisition target. This allows PepsiCo to adjust its business over time so it remains relevant with consumers. That’s probably one of the biggest reasons why diversified PepsiCo is likely to end up being a better long-term investment than Celsius.

Slow and steady wins this race

It is completely possible that Celsius will regain investor favor and the shares will rocket higher again, perhaps getting back to, and even above, their 52-week highs. That would lead to some pretty attractive short-term gains. However, over the long term, companies need to execute and grow over time, and Celsius is still a relatively small one-trick pony.

PepsiCo, on the other hand, has deftly managed to become an industry leader in the beverage niche and the broader consumer staples sector. With its industry-leading position, it has the wherewithal to keep growing, albeit slowly, and to buy up smaller competitors like Celsius that have attractive brands.

Trying to get rich quickly by riding hot stocks higher opens you up to steep drawdowns like the one Celsius has experienced. It’s far less risky to build a million-dollar portfolio if you fill it with dominant industry leaders like PepsiCo.

Should you invest $1,000 in Celsius right now?

Before you buy stock in Celsius, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Celsius wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Celsius. The Motley Fool has a disclosure policy.

Forget Celsius Holdings: This Stock Has Made Far More Millionaires was originally published by The Motley Fool