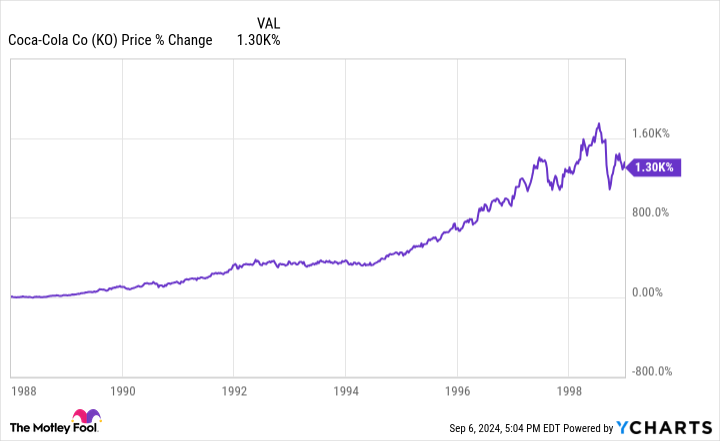

One of Warren Buffett’s best investments was in Coca-Cola. He bought around $1 billion in shares back in 1988, or 6.2% of the company.

This occurred after the market crash of 1987 and gave Buffett a buying opportunity at a cheap price-to-earnings ratio (P/E). It was also right before Coca-Cola rapidly expanded internationally. By 1998, the company’s stock was up over 10x for Buffett, excluding dividends.

When consumer products with a strong brand expand internationally, there’s huge growth potential. If the brand succeeds and becomes a globally known brand, such as Coca-Cola, shareholders generally do quite well — although this isn’t guaranteed.

The key is investing before a huge spurt in international growth. Celsius Holdings (NASDAQ: CELH) is making moves to expand outside of North America and become an international energy-drink brand. Shares are down 66% from their all-time highs.

Is Celsius stock ready to grow tenfold and become the next Coca-Cola?

A big year for international growth

With an energy drink that’s sugar-free and focused on health-conscious consumers, Celsius has taken the U.S. energy-drink market by storm in the last few years. Revenue is now around $1.5 billion and growing at a quick pace every year. It’s the third largest energy-drink brand in the U.S., only behind Red Bull and Monster Beverage.

So far, it hasn’t replicated this success around the globe. Last quarter, Celsius generated $402 million in revenue, and only $19.6 million of this revenue came from outside North America. Management hopes to fix this with focused investments into new markets next year. It has officially launched in countries like the United Kingdom, Australia, and New Zealand, with plans for more in the coming years.

Investors betting on Celsius becoming the next Coca-Cola need to track international revenue growth closely in the coming years. Last quarter, the segment grew revenue 30% year over year. This will need to accelerate to a much faster growth rate if international markets are going to become a meaningful part of this business.

The good thing is that there’s plenty of room to grow Celsius around the world. The bad news is that Celsius hasn’t proven that customers outside the United States want these energy drinks.

Continued growth in the energy-drink category

In the 1990s, more and more people around the world were drinking sodas such as Coca-Cola. This provided a tailwind for volume growth that the company could ride and an extra boost to international expansion. Now, soda consumption has stagnated and is even falling in many places.

What has replaced it? Energy drinks, in many places.

The energy-drink category is expected to grow at 8% per year through 2030, which is a massive tailwind that Celsius can take advantage of. Celsius has a revenue base of just $1.5 billion today, so it’s not unrealistic that the company could eventually generate over $10 billion in revenue 10 years from now if it succeeds with this international expansion.

There is a huge sector tailwind at its back. On top of this, there’s inflation and pricing power that these brands have continuously passed on to consumers with little pushback. This is another driver of revenue growth, along with the sector tailwind and international expansion.

Are shares a buy right now?

Luckily for investors today, Celsius stock is down 66% from its all-time high set earlier this year. This puts the stock at a much cheaper P/E of 31. Previously, it had a sky-high P/E of 50 or more.

If you believe in the international expansion story, there’s a lot to like about Celsius stock at current prices. There’s a broad industry tailwind, the company keeps taking market share, and it’s a rational market with pricing power. Add it all together, and I think it’s likely that Celsius can keep growing revenue at a double-digit rate for the next 10 years.

The stock will do well if this occurs. If you’re an investor who’s bullish on the Celsius growth story, now might be a good time to scoop up some shares on the cheap.

Should you invest $1,000 in Celsius right now?

Before you buy stock in Celsius, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Celsius wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Celsius and Monster Beverage. The Motley Fool has a disclosure policy.

Is Celsius Stock The Next Coca-Cola? was originally published by The Motley Fool