Using Wall Street analysts’ price targets to determine whether a stock is a buy or a sell isn’t the best strategy. While it should help inform investors of how others think of the stock, it shouldn’t be the be-all and end-all. One popular artificial intelligence (AI) stock that these analysts (on average) say to sell now is Palantir (NYSE: PLTR).

According to an average of 15 analysts, the average price target for Palantir stock is $27.08, which indicates a nearly 30% downside. So, should investors heed their advice and sell Palantir stock?

Palantir’s AI services have never been more popular

Palantir has become a popular AI investment due to its expertise in this field. However, Palantir hasn’t decided to offer an AI solution in the past two years because it is popular. Instead, it has built its entire software package around AI from the beginning, giving it a leg up on many competitors in the space.

Palantir started as a company that made AI software for the government. The basic idea was to take data streams in and deliver real-time insights, equipping users with the most up-to-date information possible. After management saw a strong use case for its software outside the government realm, it expanded to the commercial side. As of its most recent results, government clients are still the largest customers, accounting for 55% of revenue.

However, Palantir’s latest run-up was due to huge demand for its Artificial Intelligence Platform (AIP) product. AIP allows AI integration throughout a business rather than using a generative AI model on the side. By integrating AI into workflows, businesses can control how they want AI to be used within their operations. This is a key step forward in the integration of AI, and it has become wildly popular, especially with the U.S. commercial customer base.

In the company’s second quarter (ended June 30), U.S. commercial revenue rose 55% year over year to $159 million. While this is only 24% of total revenue, it’s the fastest-growing business segment. U.S. customer count also exploded, rising 83% year over year to 295 customers. This low figure may cause some investors to think that Palantir has a much larger opportunity ahead, as other software-as-a-service companies often list their client base in the thousands.

However, if you annualize the Q2 revenue and divide it by the customer count, you get an average revenue per U.S. customer of $2.16 million. Few businesses can afford more than $2 million per year for a software package, so this limits the size of clients Palantir can sign up.

Still, that hasn’t stopped Palantir from succeeding as a company. In Q2, revenue grew by 27% to $678 million while posting a profit margin of nearly 20%.

However, the market has given the stock an unbelievable price tag, which has caused its valuation to swell.

It will take years for Palantir’s valuation to make sense

If you look at the price tag of Palantir’s stock, you may be tempted to think it’s “cheap” because it only costs about $40. However, when you look at the valuation of the company, it has become absurd.

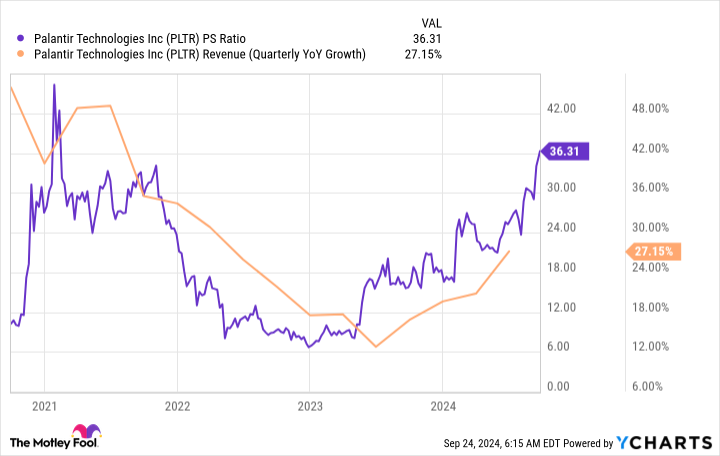

Palantir trades at more than 36 times sales. The last time it traded this high, it didn’t end well for the stock. Furthermore, a good rule of thumb when using the price-to-sales (P/S) ratio is to avoid stocks that trade above their growth rate.

Let’s say Palantir can achieve a 30% profit margin and grow its revenue by 30% for the next five years to give you an idea of how expensive this price tag is. If it does that, it would be valued at 31 times earnings, a historically expensive price to pay for a stock. Bear in mind that valuation would only be achieved if the stock price didn’t move for five years.

So, Palantir’s growth rate must accelerate to a level higher than what it’s already at and maintain it for an unbelievable five years just to reach a normal valuation point.

This shows how expensive Palantir’s stock is, and it’s no wonder that Wall Street says to sell the stock.

Palantir’s business may be excelling, but the stock has run up to a point where its valuation no longer makes sense. As a result, I think the stock is a sell, but at the very least, investors should avoid purchasing any more shares until the valuation has returned to more reasonable levels.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

1 Popular Artificial Intelligence (AI) Stock That Wall Street Says to Sell Now was originally published by The Motley Fool