There’s no doubt about it: Rivian (NASDAQ: RIVN) stock has massive long-term upside potential. Its current market cap is just $13 billion — $800 billion less than its biggest competitor in the electric vehicle (EV) space, Tesla. With new mass-market models on the way, we could see Rivian’s valuation soar over the coming years. But how have the shares performed since the company went public roughly three years ago?

High hopes for an upstart EV maker

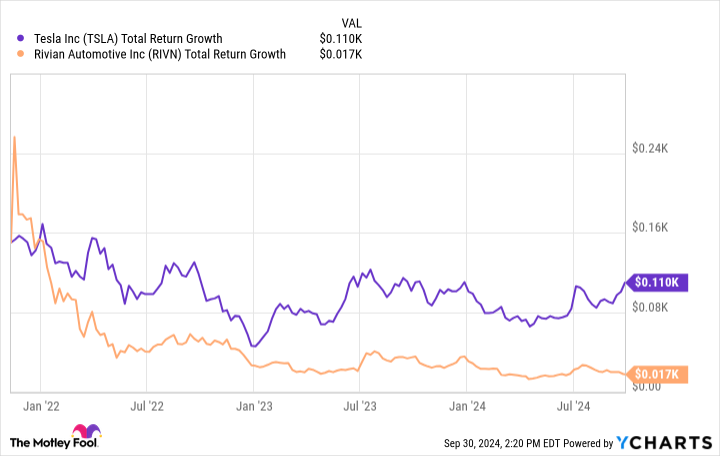

Rivian held its initial public offering (IPO) on Nov. 9, 2021, with a price of $78 per share, and closed that first trading day at just over $100. If you had invested $150 into the company when shares first debuted, though, your stake would be worth just $17 today. That’s not a typo. In three years, your $150 stake would have shrunk to only $17.

The problem hasn’t been revenue growth. Over that time frame, the EV maker’s top line has gone from $55 million in 2021 to more than $5 billion over the past year. The issue isn’t its future growth outlook, either. Rivian’s new mass-market models, which are expected to hit the roads starting in 2026, could help expand the company’s sales base by an order of magnitude or more. That’s what happened when Tesla started shipping its mass-market models, the Model 3 and Model Y.

What then has been the problem with Rivian stock? In part, its poor performance relates to the fact that the company operates in a capital-intensive and highly competitive industry. But the larger issue was a simple overpricing of the stock. Shortly after it went public, Rivian’s market cap peaked at $153 billion — almost 3,000 times its 2021 revenue.

Expectations have come down sharply since then, and even Tesla shares have suffered due to a slowdown in EV sales growth. But if you’re looking to buy into a former growth darling at a historically deep discount, this could be your chance.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

If You’d Invested $150 in Rivian Stock 3 Years Ago, Here’s How Much You’d Have Today was originally published by The Motley Fool