Some investors think Micron Technology (NASDAQ: MU) stock is incredibly expensive. In a certain slant of light, they’re not wrong.

The memory-chip maker’s shares trade at — make sure you have a seat — 151 times trailing earnings and 932 times free cash flow today. That’s a lofty valuation by anybody’s standards.

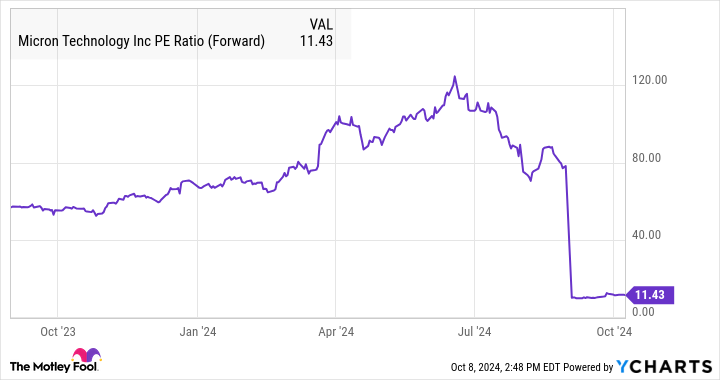

But there are other ways to assess Micron’s market value. The company is in a position to turn a corner and deliver stellar earnings growth in the next few quarters. As a result, Micron’s stock looks downright cheap when its share price is measured against forward-looking earnings estimates:

Micron reported its full-year 2024 results last week. Full-year sales surged 62% higher year over year. The unadjusted bottom line swung from a net loss of $5.34 per share to a profit of $0.70 per share.

This company’s management isn’t in the habit of offering full-year financial forecasts, but the midpoint of Micron’s guidance for the next quarter points to an accelerated 84% revenue jump and a net profit of roughly $1.54 per share. That’s more than double the total profit of the full fiscal-year 2024 in a single quarter.

Micron’s competitive advantages

The financials are soaring for good reason. The cyclical memory-chip industry was due for an upswing, anyway, and that positive trend was accelerated by the artificial intelligence (AI) boom. From engine-training systems to consumer-facing services, the computers involved in AI require a ton of high-speed memory.

Micron is not only a leading provider of these chips, but also boasts an in-house network of advanced manufacturing facilities. The company is also building more factories at the moment while boasting technological advantages over high-end memory makers.

Micron’s stock doesn’t strike me as expensive at all. The memory giant has plenty of growth-boosting balls in the air, and its earnings are about to make a major breakthrough.

It’s an affordable stock in every sense that matters. Yesterday’s results can’t create investor value tomorrow.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $812,893!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Anders Bylund has positions in Micron Technology. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Think Micron Technology Stock Is Expensive? This Chart Might Change Your Mind. was originally published by The Motley Fool