Semiconductor stocks are a popular industry for investors, but it’s not always easy to pick winners among the chipmakers. These stocks are prone to volatility, and rapid technological developments can shake up market share fairly quickly. However, there are compelling stocks in the semiconductor supply chain, with strong long-term catalysts and reasonable valuations that should translate to long-term investor returns.

Lam Research leads an important market niche

Lam Research (NASDAQ: LRCX) offers exposure to the microchip industry, but the investment thesis is distinctly different from that of typical semiconductor stocks. Lam is a supplier to chip manufacturers, so it occupies a key role in the supply chain.

The company provides vital equipment and machinery for wafer fabrication, and it is among the world leaders in this market. Its broad product portfolio includes a wide variety of specialty devices that allow chipmakers to produce the small, complex components that are necessary for every advanced technology.

Lam Research is among the global leaders in the wafer fabrication equipment market. The company has several competitors for various products in its portfolio, including Applied Materials, Hitachi, and Tokyo Electron. Lam is widely considered the leader of its market. The company’s customer list includes several of the biggest chipmakers on the planet, and it claims that its machines play a role in the production of nearly every semiconductor right now.

Lam Research’s scale and sophistication create a meaningful economic moat. Its research and development budget is around $2 billion annually, making it difficult for potential new entrants to close the technology gap that’s required to create a competitive product.

The company also has established relationships with the most important handful of major enterprise customers around the world. That’s a difficult sales channel for smaller businesses to crack, and these long-term relationships foster partnerships and communication that will guide the design and implementation of future generations of equipment. As chip design gets more complicated to support more advanced functions, it should enhance the strength of Lam’s moat.

Reliable growth and shareholder returns

Lam Research isn’t going to excite growth investors. As a diversified capital equipment supplier, it doesn’t have as much pure upside potential as Nvidia, Broadcom, or other semiconductor stocks that have enjoyed booming momentum over the past few quarters.

The popular chipmakers sell to a broader range of customers, and they can experience rapid growth as new computing equipment is produced around the world in a relatively short time frame. The replacement cycle for fabrication equipment isn’t quite that dynamic.

It might not be an exotic engine for explosive growth, but Lam Research can still provide investors with reliable exposure to a growth industry at a reasonable valuation. The semiconductor industry has clear demand drivers over the long term, which is great news for established leaders throughout the supply chain.

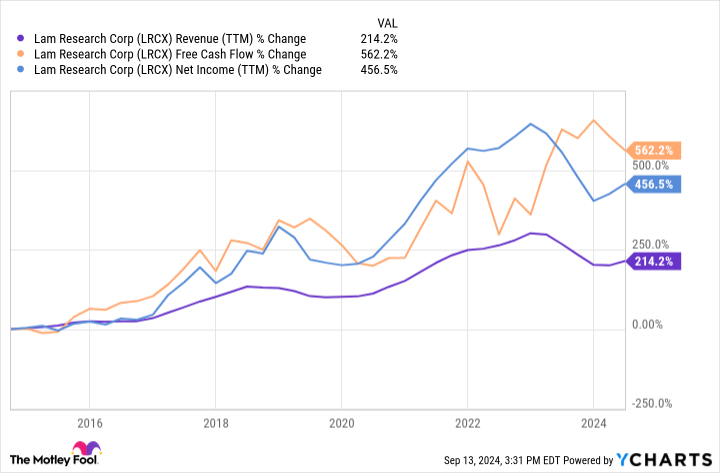

The company’s operating results have supported this approach in recent years. Lam Research delivered a 12% compound annual growth rate (CAGR) for sales over the past decade. Its earnings and cash flows have expanded at an even faster clip during that same period.

Progress isn’t always linear. Lam Research has grappled with difficult macroeconomic conditions, and its financial results reflect its customers’ well-being. The company’s sales tumbled 15% during its past fiscal year as the semiconductor emerged from a recent cyclical downturn.

Fortunately, the long-term trends are impressive, and the industry appears to be entering a new boom phase driven by AI. Lam’s customers are likely to be flush with cash, and some of that will be spent on upgrading their fabrication equipment to support more complicated chip designs. Wall Street expects the company’s revenue to grow nearly 20% over the next year, while earnings per share expand almost 30% as conditions improve.

Lam’s attractive valuation

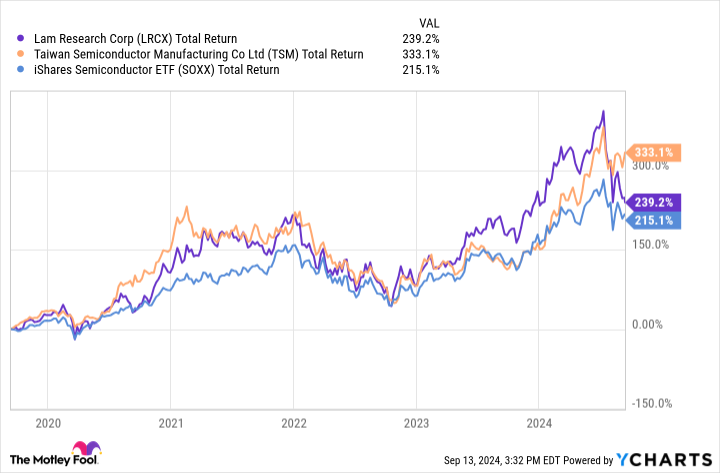

Lam Research has a straightforward long-term investment thesis, and it comes with a discount valuation. The stock’s price chart shows a remarkable correlation to the iShares Semiconductor ETF and Taiwan Semiconductor Manufacturing. If history is a good indication, Lam’s performance should reflect the performance of the semiconductor industry in general.

That narrative is even stronger, given the stock’s valuation. Lam’s forward price-to-earnings (P/E) ratio is down to 22 after climbing to an abnormally high level above 35 earlier this year. Economic uncertainty has played a role, and the market also seems a bit distracted by the company’s higher-growth, more expensive peer ASML. That stock shares many of Lam’s attractive qualities, but investors would have to accept a premium valuation — its forward P/E ratio is 29.

Lam’s aggressive share repurchasing at the current price implies that its board of directors considers it undervalued. There’s compelling evidence that Lam has the potential to achieve strong financial performance over the next few years, and its valuation doesn’t make it particularly risky. If the company’s next decade comes anywhere close to replicating its performance over the past 10 years, then long-term shareholders are likely to enjoy great returns.

Should you invest $1,000 in Lam Research right now?

Before you buy stock in Lam Research, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lam Research wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Ryan Downie has positions in Nvidia. The Motley Fool has positions in and recommends ASML, Applied Materials, Lam Research, Nvidia, Taiwan Semiconductor Manufacturing, and iShares Trust-iShares Semiconductor ETF. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

A Few Years From Now, You’ll Wish You’d Bought This Undervalued Stock was originally published by The Motley Fool