Investing doesn’t have to be complicated. Sometimes, it’s just about checking a few important boxes. Amazon (NASDAQ: AMZN) has checked those boxes for years, and that’s primarily why it’s one of the best-performing stocks Wall Street has ever seen.

But what are those boxes, and does Amazon still have what it takes to make investors money? Let’s explore whether Amazon is a buy, sell, or hold today.

Are Amazon’s competitive moats still intact?

Amazon started as an online bookstore in the late 1990s and has become a one-stop shop for consumers across America. Today, you can buy almost anything from Amazon; roughly 200 million households pay for Amazon’s Prime subscription to unlock all of the company’s products, services, and perks. Amazon didn’t stop there; it began selling its information technology services to customers via Amazon Web Services (AWS) in 2006, and it’s the world’s leading cloud platform today.

Amazon does over $600 billion in annual revenue across its businesses. It dominates U.S. e-commerce with an estimated 38% of the U.S. market. AWS controls 31% of the world’s cloud market. Being the largest comes with competitive advantages. For example, its tremendous supply chain and logistics network can deliver more products faster than other e-commerce stores. It can also use its size as leverage with sellers to achieve the lowest prices. It’s a similar story in AWS, where companies get more value from Amazon than others, aside from maybe Microsoft‘s Azure, the next-largest cloud platform with a 25% market share.

At this point, Amazon’s biggest threat could be U.S. regulators, who may want to break up Amazon’s dominance rather than other companies knocking it off its top spot in e-commerce and cloud.

Can Amazon still grow?

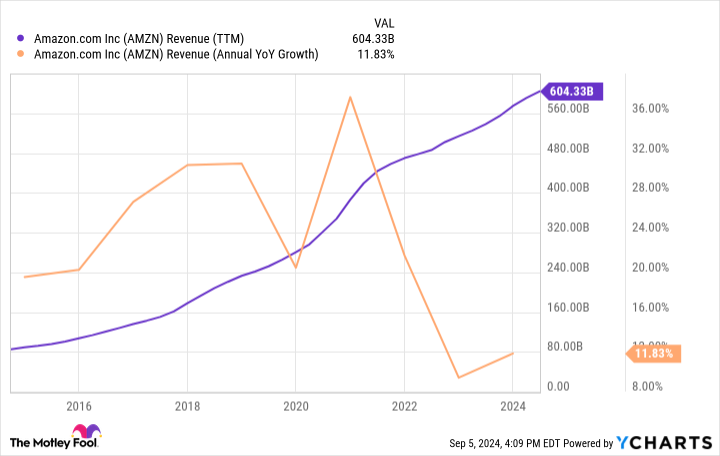

All companies mature and slow down eventually, and Amazon is no different. However, the fact that Amazon can still grow revenue at a double-digit rate at its size is remarkable:

Amazon’s growth-oriented culture means the company could keep growing larger. For starters, e-commerce still represents only 16% of total retail spending in the United States. Amazon should benefit if that continues to expand. Meanwhile, the world’s shift from on-premise computing to the cloud is ongoing. Experts believe the global cloud services market could grow by 21% annually through 2030, so there is still a lot of opportunity there, too.

These are just Amazon’s two core businesses. The company has invested in media to grow its advertising business, including securing rights to live sports in the NFL and NBA. The company is also wading into the healthcare field. Amazon has the deep pockets to continue pushing into new categories and is willing to make those efforts.

Is the stock priced right?

So far, so good, right? Amazon is a juggernaut with the means to grow for years to come, but no stock is worth paying any price for. The good news is that high-quality stocks like Amazon only need a fair price to create fantastic long-term returns. However, Amazon is offering something even better: It’s a relative bargain.

Shares trade at a forward P/E of 38, while analysts believe Amazon will grow earnings by an average of 23% annually over the long term. Its PEG ratio of 1.6 indicates a reasonably priced stock for its expected earnings growth. I usually look for PEG ratios around 1.5 or lower if possible.

So, what makes the stock a bargain? Amazon is known for aggressively reinvesting profits into the business to grow the company, so earnings don’t always tell the whole story. Instead, investors can value the stock against the day-to-day cash flow Amazon’s business generates. Using that, the stock is near its lowest ratio in a decade!

Amazon’s stock is reasonably priced or a flat-out deal, depending on how you want to value it.

Buy, sell, or hold Amazon?

Great investments happen when you can check all the boxes.

Amazon does that today. The company is as dominant as ever in e-commerce and continues to lead in the cloud. These existing businesses could still grow for years to come. Meanwhile, Amazon is leaning into new opportunities. Lastly, the stock trades at a price that should allow Amazon’s wonderful business traits to translate to similarly stellar investment returns over time.

That makes the stock a no-brainer buy for any long-term investor.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Amazon Stock: Buy, Sell, or Hold? was originally published by The Motley Fool