You may recall that a few years ago many companies took an nontraditional route to going public. Special purpose acquisition companies (SPACs) — more colloquially referred to as “blank check companies” — became a popular method of pursuing an initial public offering. An influential player in the SPAC boom was a billionaire venture capitalist named Chamath Palihapitiya. Palihapitiya is a prominent technology investor and has a closely followed social media presence, largely thanks to his popular All-In podcast.

Palihapitiya’s support of SPACs may have contributed to the illusion that many of these businesses were lucrative investment opportunities. The unfortunate reality, however, is that many SPAC businesses were far less mature and financially stable than most companies that pursued the more traditional IPO underwriting process. As a result, a lot of money has been lost investing in SPACs.

One SPAC stock that is down substantially from its IPO is an electric vehicle (EV) business called Archer Aviation (NYSE: ACHR). A hallmark of Cathie Wood’s ARK Invest exchange-traded funds (ETFs), Archer develops vertical takeoff and landing (VTOL) EVs.

Is the market underestimating the potential for Archer’s flying taxis, making the pronounced sell-off and $3 stock price a lucrative opportunity hiding in plain sight? Let’s explore Archer’s market potential and assess whether now is a good time to scoop up some shares.

What problem is Archer Aviation solving?

Public transportation is a market ripe for disruption. Ride-hailing apps such as those made by Uber Technologies and Lyft completely revolutionized how people travel, particularly in urban environments. The idea of an on-demand driver who can pick you up and drop you off at a destination brings a level of convenience and solves supply and demand constraints that traditional taxi services simply cannot replicate.

But despite the convenience of calling an Uber or Lyft, there is one problem those companies can’t really solve: getting stuck in traffic. Congested roads aren’t something a ride-share can magically make disappear.

Archer is looking to introduce another layer to urban mobility. Its EVs are essentially air taxis. In theory, this method of travel can lead to fewer cars on the road while serving as a greener form of mobility.

Outside of urban air mobility, Archer also has real opportunities that it’s working on with the U.S. military, as well as with various airline companies.

According to Precedence Research, the total addressable market (TAM) for electric VTOL aircraft will grow at a compound annual growth rate (CAGR) of 12.4% between 2023 and 2032 — ultimately reaching a size of $35.8 billion by early next decade.

All of these points may inspire some confidence, and give the impression that Archer is destined to land somewhere between Uber and Tesla. Unfortunately, there’s a world of difference between investing in the idea of something and investing in the actual business.

It takes money to make money

For both EVs and aircraft, assembly is an expensive endeavor requiring hefty research and development (R&D) and capital expenditures (capex).

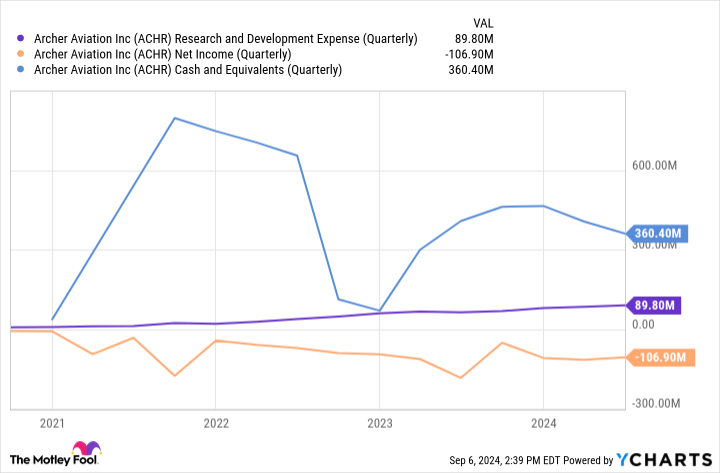

The financial profile illustrated below is a little perplexing upon first glance. Although R&D expenses continue to rise and net losses continue to mount, Archer’s cash balance has risen from its low points. That’s quite peculiar given that Archer is pre-revenue.

There are a couple of ways Archer has managed to keep its liquidity afloat while consistently burning cash. The company has a number of strategic relationships with other aircraft companies. Stellantis, for example, works closely with Archer on the manufacturing side and has been a strong financial supporter of the business.

In addition to these investments, Archer more recently relied on a $175 million private investment in public equity (PIPE) from Stellantis and United Airlines. While this solves liquidity concerns in the short term, the opportunity cost of such a transaction dilutes Archer shareholders.

Should you invest in Archer stock at $3?

As of this writing Archer boasts a market capitalization about $1.1 billion. Since Archer has purchase orders valued at $6 billion, the valuation might look like a steal.

However, I just haven’t bought into Archer’s whole narrative. In general, I don’t think purchase orders carry much value. Considering that Archer is still working with the Federal Aviation Administration (FAA) on its commercialization efforts, and there are question marks about its mass production and manufacturing capabilities, it’s hard to make a case for Archer shares being cheap simply because they’re “only” $3.

On top of that, I think Archer may not fully reach considerable scale. It’s difficult to believe that the same number of people who can afford an Uber will also be able to access a flying taxi if need be; from afar, it looks like a luxury and a niche service. If you’re curious why Archer may compel Cathie Wood, I’m going to theorize that her position in the stock is an industry basket approach since ARK also owns shares of Joby Aviation — one of Archer’s closest competitors.

For all of these reasons, I think Archer is too speculative for most investors right now. While a $3 share price might make the company seem like a dirt cheap opportunity, it’s hard to justify a billion-dollar valuation on a company with zero revenue, high cash burn, outside financial lifelines from larger companies that may eventually turn away, and questionable long-term viability.

Should you invest $1,000 in Archer Aviation right now?

Before you buy stock in Archer Aviation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Archer Aviation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Adam Spatacco has positions in Tesla. The Motley Fool has positions in and recommends Tesla and Uber Technologies. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

Down 69%, Is This Cathie Wood Stock a Bargain for Just $3? was originally published by The Motley Fool