Super Micro Computer (NASDAQ: SMCI) stock is still up more than 1,000% over the last three years, thanks to rising demand for its high-performance rack servers tied to artificial intelligence (AI). Its share price is also down 66% from the lifetime high it reached earlier this year.

While a wide range of factors will play a role in shaping the server specialist’s future stock performance, investors should pay particular attention to one key metric.

Gross profit margins will be central to Supermicro’s stock performance

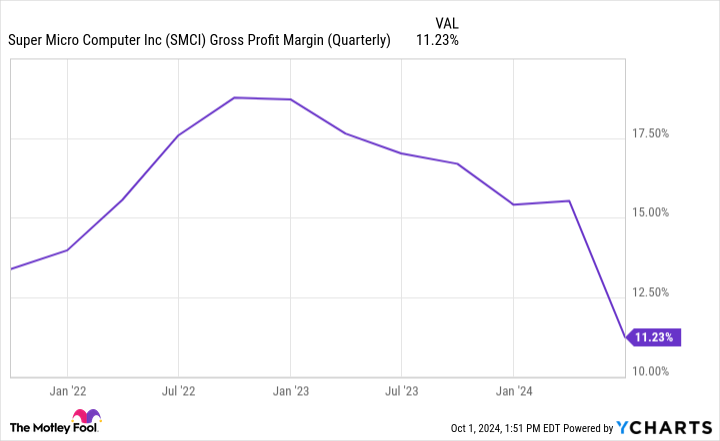

Gross profit is calculated by subtracting the cost to produce a product from the revenue generated on the sale of that product. Gross profit margins are a key indicator of pricing power and have a major impact on the overall profitability of a business. Notably, Supermicro’s gross profit margins have been on a downward trend lately.

The company’s gross margin slipped to 11.2% in the fourth quarter of its 2024 fiscal year, which ended June 30. That performance was down from a gross margin of 15.5% in last year’s third quarter and a gross margin of 17% in Q4 of fiscal 2023.

Supermicro’s high-performance rack servers are built around graphics processing units (GPUs) from Nvidia and hardware from other providers. On the heels of a sales and margin surge driven by AI-related demand, reliance on third-party hardware may have set the stage for gross margin contraction.

Supermicro is betting on strong pricing power and differentiating its products through liquid-cooling technologies. Packing and running a group of high-powered GPUs and other hardware together can generate a lot of heat, and overheating can lead to system failures and permanent hardware damage.

If Supermicro’s liquid-cooling technologies for servers prove to be a major selling point, that could bolster the business’s gross margins and power strong stock performance. If not, competitive pressures and moderating demand may drag the company’s gross margins and share price lower.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Every Super Micro Computer Stock Investor Should Keep an Eye on This Number was originally published by The Motley Fool