The market has finally been cheering PayPal (NASDAQ: PYPL) again. It’s demonstrating progress under new leadership, and PayPal stock is up more than 15% during the past six months.

But several billionaires have been piling into lesser-known fintech stock Bill Holdings (NYSE: BILL). Bill is a younger company with lots of growth on the horizon. Should you take a chance on it?

Billionaires like Bill

Bill provides software-as-a-service financial solutions for small businesses. Its platform automates tasks like accounts payable and receivable, and connects users to a large network of financial institutions. Clients love its technology, which frees up time from tedious tasks.

Some of the billionaires that recently bought Bill stock include:

-

Ken Griffin of Citadel Advisors, who increased his position by 61%

-

John Overdeck and David Siegel, formerly of Two Sigma Investments, who increased their position by 553%

-

Steven Cohen of Point 72 Asset Management, who increased his position by 394%

More than billing

Bill’s growth rate has sharply decelerated in the inflationary environment, but the growth is still solid. Revenue increased 16% year over year in the 2024 fiscal fourth quarter (ended June 30).

The company has 475,000 client subscribers and 7.1 million network members, creating a network effect in which its value increases as more members join the platform. It makes most of its money through payment processing, but subscription fees are an important part of its model. Subscription fee growth has been slow because of inflationary pressure and fell in the fourth quarter, but higher transaction volume has been picking up the slack. The company also makes money through float revenue, through which it earns interest on money as it passes through transactions.

While it waits for business to pick up again, Bill management is working on cutting expenses and improving profitability. It has an 81% gross margin, although that narrowed year over year in the fourth quarter. Operating loss narrowed from $41.4 million last year to $22.2 million this year.

The company should be well-positioned to grow more efficiently when economic conditions improve and become sustainably profitable.

Better than PayPal?

Is Bill a better deal than PayPal? That probably depends on what kind of investor you are. PayPal is a value play, and although it hasn’t exactly been a stable investment during the past few years, it’s moving in the right direction. It’s still the industry leader in fintech, and it has millions of customers and merchant clients who rely on its tools. Bill, on the other hand, has expanded its network, but it’s still building up its name and presence.

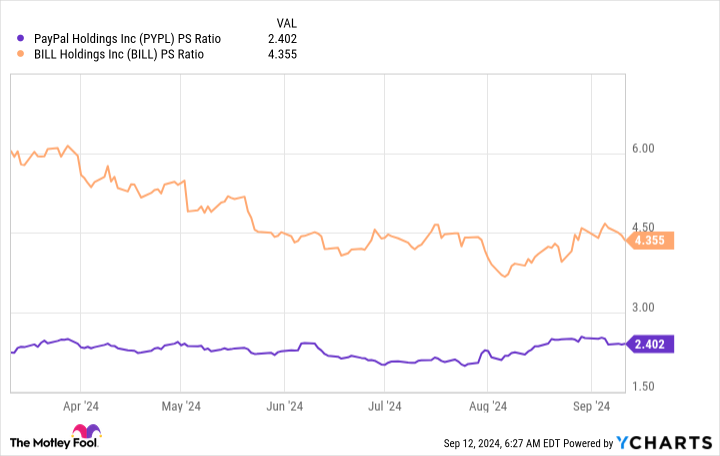

As you would expect, PayPal is much cheaper than Bill, and it’s also profitable. But at 4 times trailing-12-month sales, Bill has a fair valuation for a growth stock and it offers better opportunities for growth investors.

Analysts see it gaining more in the next 18 to 21 months — the average target for PayPal stock is an 11% gain today, but 26% for Bill.

Should you be like the billionaires?

Bill has a tremendous market opportunity and a platform that creates value for clients. It continues to launch improved features and attract new business.

However, it’s having a hard time with profitability. It could be the environment, and when the economy improves, Bill will do better. It’s making the right moves to get there, but it’s yet to prove that it can turn sales dollars into profit dollars. It has a very high gross margin, but that’s not trickling down to the bottom line.

Down the road, Bill could become more efficient and reward shareholders. But individual investors should only follow billionaires into this position if they have a strong risk tolerance.

Should you invest $1,000 in Bill Holdings right now?

Before you buy stock in Bill Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bill Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bill Holdings and PayPal. The Motley Fool recommends the following options: short September 2024 $62.50 calls on PayPal. The Motley Fool has a disclosure policy.

Forget PayPal: Billionaires Are Buying Up This Fintech Stock Instead was originally published by The Motley Fool