The old saying “the higher the risk, the higher the reward” can be true. It certainly seems to be the case for some big-time dividend stocks. Several currently offer monster yields:

|

Dividend Stock |

Investment |

Current Yield |

Annual Dividend Income |

|---|---|---|---|

|

AGNC Investment (NASDAQ: AGNC) |

$1,000.00 |

14.14% |

$141.40 |

|

Annaly Capital Management (NYSE: NLY) |

$1,000.00 |

13.41% |

$134.10 |

|

Community Healthcare Trust (NYSE: CHCT) |

$1,000.00 |

10.91% |

$109.10 |

|

Delek Logistics Partners (NYSE: DKL) |

$1,000.00 |

9.48% |

$94.80 |

|

NextEra Energy Partners (NYSE: NEP) |

$1,000.00 |

14.17% |

$141.70 |

|

Total |

$5,000.00 |

12.42% |

$621.10 |

Data source: Google Finance.

As that table shows, a $5,000 investment into these five high-yielding dividend stocks could produce more than $620 of annual dividend income.

However, there is one huge caveat. They also have a high risk of reducing their payouts if something goes wrong, so they’re not for the faint of heart.

High-yielding mortgage REITs

AGNC Investment and Annaly Capital Management are very similar. They’re both mortgage REITs that focus on owning mortgage-backed securities (MBS) protected against credit losses by government agencies. While MBSes are very low-risk investments, they also have low returns.

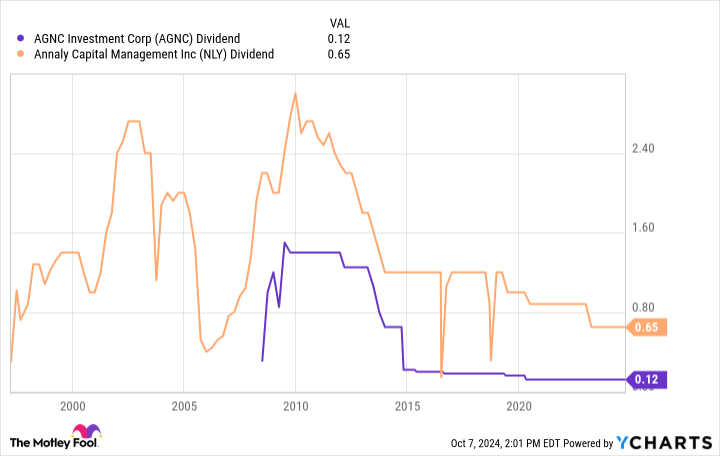

Mortgage REITs like AGNC and Annaly boost their returns by using leverage, or debt, which also increases their risk profile. They make money on the spread between their costs — interest and other expenses — and the interest income their MBS investments generate. That spread can rise and fall depending on various factors, including interest rates. Right now, both REITs are making enough money to cover their lucrative dividend payments, which AGNC pays monthly and Annaly pays on a quarterly basis. However, they’ve run into trouble earning enough income to cover their dividends in the past, which has caused both REITs to cut their payouts several times:

If market conditions deteriorate in the future, the REITs might need to cut their payouts again.

A sickly tenant

Community Healthcare Trust is a healthcare REIT. It owns a diversified portfolio of properties in the sector. The company currently has an unbroken record of dividend growth. It has increased its payment every single quarter since it came public in 2015.

That growth streak could be about to come to an abrupt end. Community Healthcare disclosed last quarter that a geriatric inpatient behavioral hospital tenant is experiencing staffing and patient levels challenges, which is negatively affecting its financial results. The REIT wasn’t sure if this tenant, which has six leases, would be able to continue paying rent. That’s a concern given the REIT’s high dividend payout ratio of 87% of its adjusted FFO in the second quarter.

On a positive note, the REIT has a conservative balance sheet, which is allowing it to continue acquiring income-generating healthcare real estate. However, if its tenant issues persist, the REIT might need to reduce its dividend in the future.

High-octane dividends

Delek Logistics Partners and NextEra Energy Partners operate on opposite ends of the energy industry. Delek Logistics Partners is a master limited partnership (MLP) focused on operating oil and gas midstream assets, like pipelines and processing plants. Meanwhile, NextEra Energy Partners owns renewable energy assets. Those energy infrastructure assets generate fairly stable cash flow backed by long-term capacity contracts, which supports their big-time payouts.

Delek Logistics has an unbroken streak of increasing its payout. It recently hit 46 consecutive quarters of distribution growth. The MLP also has a sound and improving financial profile. It generates enough cash to cover its distribution by a comfortable 1.3 times. Meanwhile, its leverage ratio has declined from 4.3 last year to 3.8 at the end of the second quarter. The MLP has also made strides to reduce risk by lessening its reliance on its parent, Delek US Holdings, which is on track to fall from 50% of its income to 36% next year following several recent new investments. However, it has an elevated risk profile overall, which could affect its ability to continue increasing its distribution in the future.

NextEra Energy Partners has also steadily increased its high-yielding payout. The company currently expects to grow its dividend by 5% to 8% annually through 2026, with a target of 6%. It believes it can achieve that growth by investing in wind repowering projects while also selling its remaining gas pipeline assets to pay off existing funding and finance new renewable energy acquisitions.

However, the company expects that its dividend payout ratio will be in the mid-90s through that period, which is very high. Furthermore, it’s unclear how it will fund its growth after 2027. There’s a high risk that NextEra Energy might need to cut its payout in the future.

High-risk, high-reward dividend stocks

AGNC, Annaly, Community Healthcare, Delek Logistics, and NextEra Energy Partners expect to sustain or continue increasing their dividends in the coming years. However, they all have elevated risk profiles, so there’s a higher probability that they might need to cut their dividends in the future. So while they could potentially generate a lucrative passive income stream for those with a high-risk tolerance, risk-averse investors will want to look elsewhere for income.

Should you invest $1,000 in AGNC Investment Corp. right now?

Before you buy stock in AGNC Investment Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AGNC Investment Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $782,682!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Matt DiLallo has positions in NextEra Energy Partners. The Motley Fool recommends Delek Us. The Motley Fool has a disclosure policy.

Got $5,000? Supercharge Your Passive Income With These 5 Ultra-High-Yield, High-Risk Dividend Stocks. was originally published by The Motley Fool