Microsoft has regularly outpaced the stock market, more than tripling over the past five years. The stock is a little less than 10% removed from its all-time high, but it won’t be like that for long. Microsoft Cloud and the company’s AI initiatives prompt me to be bullish on the stock. These two parts of Microsoft’s business can help the stock reach a new high.

Microsoft Is Gaining Ground On AWS

To begin with, Microsoft isn’t the only cloud giant in town, but it’s gaining ground on the largest cloud provider, warranting a bullish stance. Microsoft now has a 25% market share in the cloud computing industry. It’s an improvement that narrows the gap with Amazon (AMZN). AWS is currently the largest cloud platform and has 31% of the market. Alphabet (GOOGL) is in a distant third place, with 11% of the total market share.

Moreover, Microsoft gained even more ground in the second quarter of Fiscal 2024. Cloud revenue grew by 21% year-over-year in Q4 FY24, while AWS revenue only increased by 19% year-over-year in Q2 2024. If Microsoft maintains an elevated growth rate compared to AWS, it can continue to gain market share.

In addition, more market share is good in any industry, but it’s even better in a growing industry. Artificial intelligence should result in more demand for cloud platforms. These platforms offer a pathway for many businesses to use generative AI. Microsoft also regularly updates its cloud platform with new AI features that help it stand out from the competition.

Microsoft Investors Get More Exposure to Cloud Computing

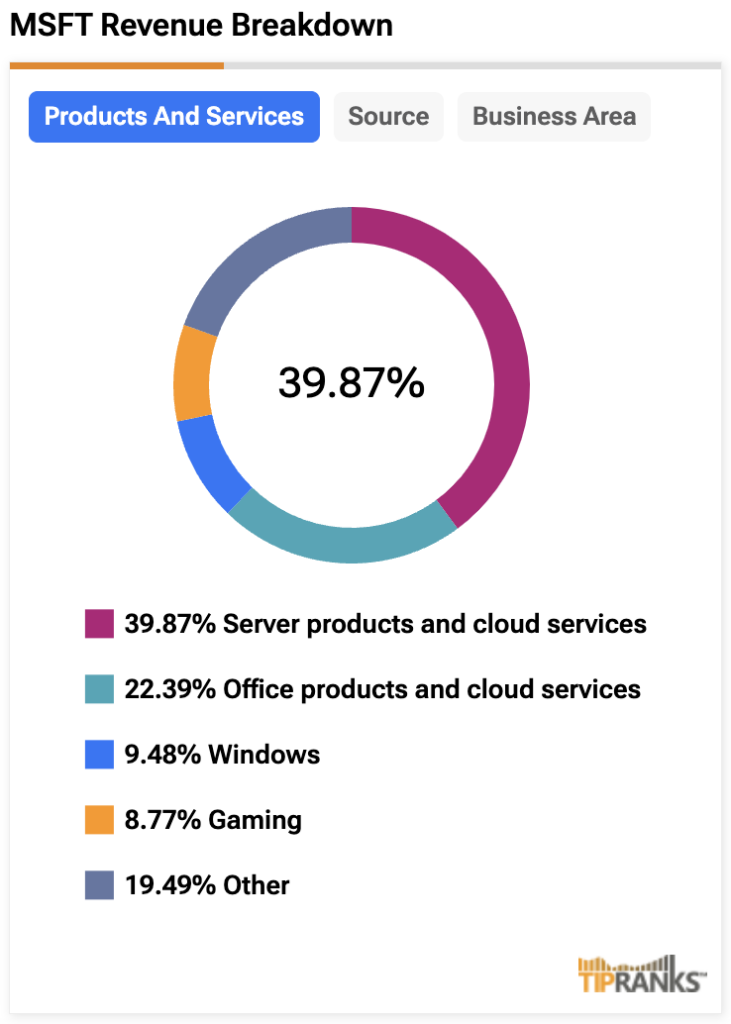

The unique angle with Microsoft compared to other tech giants in the cloud industry is that most of Microsoft’s revenue comes from cloud computing. That’s another reason for my bullishness since cloud computing is a promising industry.

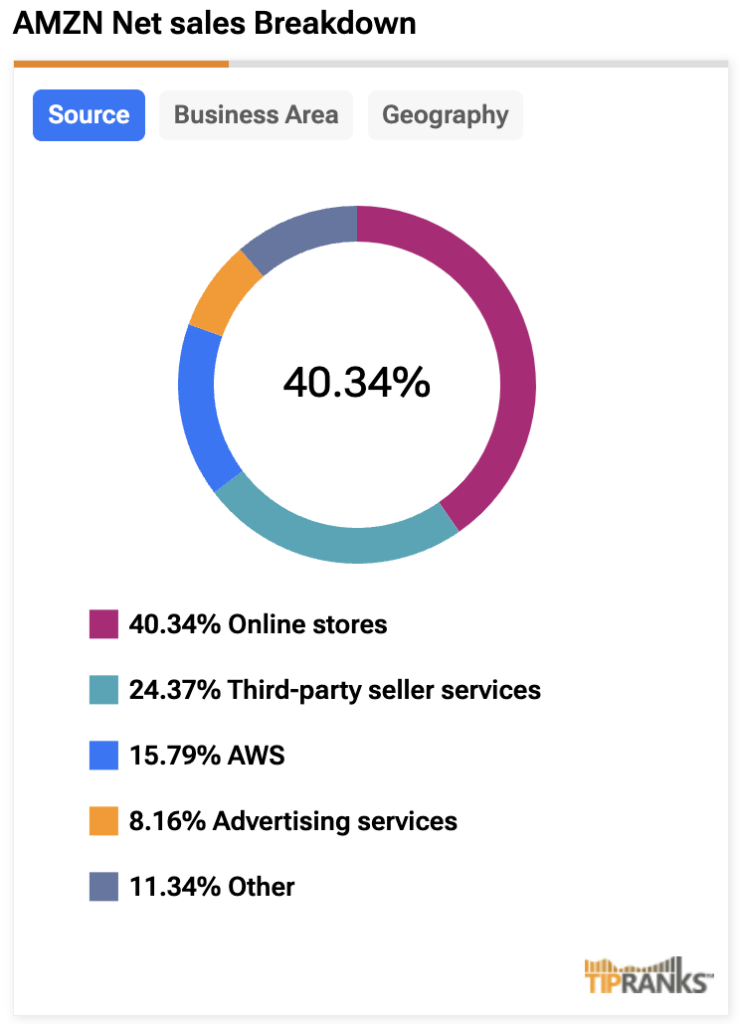

What’s important to note is that cloud revenue makes up less than 20% of total revenue for Amazon (as seen below in the TipRanks Revenue Breakdown tool) and Alphabet. Investors in those stocks are getting limited exposure to cloud computing since the other components of those companies generate most of the revenue.

On the other hand, Microsoft regularly pulls in more than half of its revenue from cloud computing – as seen in the TipRanks Revenue Breakdown tool below. The tech giant generated $64.7 billion in Q4 FY24, which was up by 15% year-over-year. Diving deeper into the numbers, Microsoft Cloud generated $36.8 billion in the quarter, up by 21% year-over-year. That’s almost 60% of total revenue.

Microsoft Is Leading in Artificial Intelligence

Microsoft Cloud gave the company a head start in artificial intelligence, but the cloud platform isn’t the only AI catalyst. Microsoft’s investments in OpenAI and the release of Copilot are some of the reasons I’m bullish. Microsoft CEO Satya Nadella used the Q4 FY24 results to emphasize Microsoft’s desire to ensure it is leading the AI era.

Additionally, while tech giants have been catching up, Microsoft has done a good job at incorporating AI across its offerings. For instance, you can find autogenerated suggestions underneath LinkedIn posts. Microsoft Copilot also helps boost productivity by simplifying repetitive tasks across Microsoft products. The tech giant also revealed Copilot for Security earlier this year, which makes cybersecurity more accessible to small businesses.

Although Microsoft was always bound to cede some of its market share to rivals, the tech giant’s first-mover advantage suggests that it can maintain its current position. As the AI pie continues to grow, Microsoft should report elevated revenue and net income growth.

It’s Not Just AI and Cloud Computing

While AI and cloud computing are the main reasons to be bullish about Microsoft, it also has other business segments that continue to perform well. For instance, LinkedIn delivered 10% year-over-year revenue growth in Q4 FY24. The social network has become a top resource for business professionals who want to grow their careers and build their networks.

Furthermore, Microsoft delivered 19% year-over-year revenue growth for search and news advertising revenue, excluding traffic acquisition costs. Microsoft also fortified its position in the gaming industry with its Activision Blizzard acquisition. As a result, Xbox revenue jumped by 61% year-over-year, with Activision Blizzard contributing 58 percentage points to the growth rate.

Overall, Microsoft’s well-diversified business is hard to find among other publicly traded corporations. In addition, the company’s investments in artificial intelligence can help the company discover more growth opportunities with these parts of the business.

Is Microsoft a Buy or Sell Right Now?

Microsoft is currently rated as a Strong Buy by 30 analysts, with 28 Buys and 2 Holds. The average MSFT price target of $501.15 implies an upside potential of 16%.

The Bottom Line on Microsoft Stock

Microsoft is the only Magnificent Seven stock that generates more than half of its total revenue from cloud computing. That unique setup has translated into solid long-term gains, and it’s also positioning Microsoft to reach new highs. The company’s AI investments have given it a respectable lead over competitors and have strengthened Microsoft’s product line. The tech giant is well-diversified and presents a promising opportunity for patient investors.