With the S&P 500 index up 17% in 2024 and now trading at a historically lofty price-to-earnings (P/E) ratio of 27, it may seem reasonable to think there aren’t many attractively priced securities remaining on the market.

However, the “Magnificent Seven” accounts for nearly one-third of the index’s allocation, and these stocks have an average P/E of 39. This outsize allocation makes the “true” valuation of the remaining S&P 493 somewhere closer to 21 or 22 times earnings — which is slightly below historical averages.

Long story short, it remains as good a time as ever to buy and hold for the long haul. Here are my three favorite consumer goods stocks for patient investors to consider.

1. Dutch Bros

Up-and-coming coffee and hand-crafted beverage chain Dutch Bros (NYSE: BROS) may be my favorite growth stock on the market today. Home to over 900 stores across the western and southwestern portion of the United States, Dutch Bros has doubled its store count and tripled its sales since 2020.

And the future looks even brighter.

Despite this growth since 2020, roughly three-quarters of its 918 stores reside in just five states: Texas, Arizona, California, Oregon, and Washington. Furthermore, Dutch Bros only has a presence in 18 states across the U.S., which is why management believes it can reach a store count of more than 4,000 over the long term.

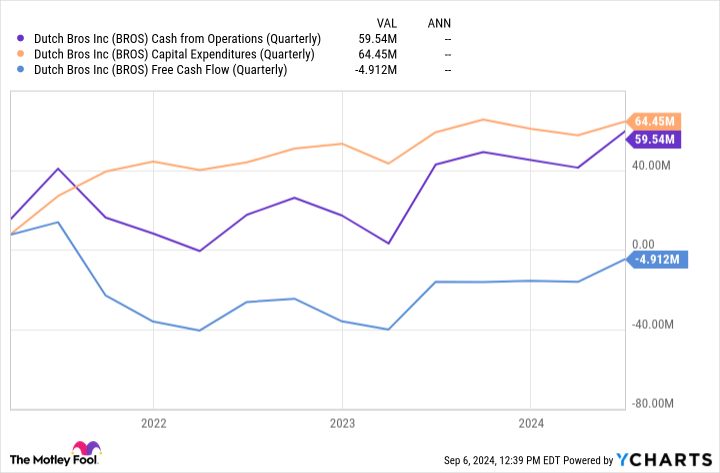

As tantalizing as these growth prospects are, Dutch Bros’ nearly positive free cash flow (FCF) is what makes the company so interesting to me right now.

FCF equals cash from operations (CFO) minus capital expenditures (spending on new stores and maintenance on existing ones), meaning that Dutch Bros is very close to being able to fund its expansion out of its own pocket. It’s delivered positive same-store sales growth for six straight quarters, and I’m optimistic that the company will soon reach positive FCF, leaving it less reliant upon shareholder dilution to raise funds for new stores.

Trading at 13 times CFO — compared to its mega-peer Starbucks‘ mark of 16 — Dutch Bros’ expansion potential and blistering 30% sales growth in its latest quarter look attractively priced.

2. Chewy

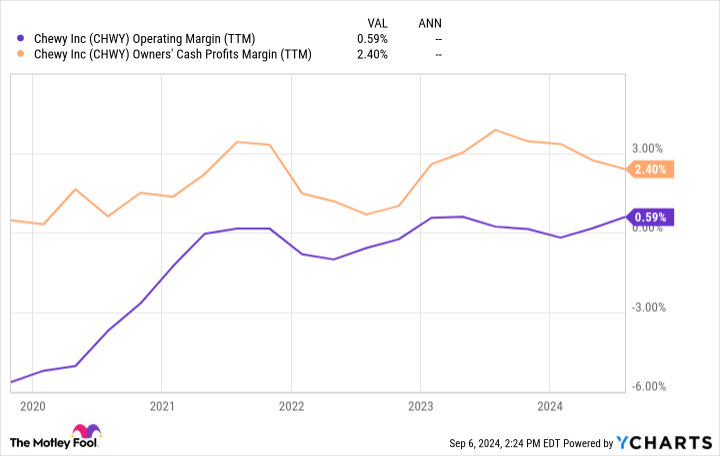

It is no secret that Chewy (NYSE: CHWY) — the U.S.’s largest e-commerce pet retailer — is beloved by its customers, earning a No. 1 ranking on Forrester Research‘s customer experience index. However, what is not as widely known is that Chewy finally reached profitability.

Not only is the specialty pet retailer generating net income, but it is also targeting five higher-profit revenue streams: Chewy Vet Care, Chewy Health, pet insurance, private-label products, and sponsored ads. Combined with the streamlining efficiencies Chewy sees from 78% of its sales being recurring autoship purchases, these high-margin concepts should continue bumping the company’s profitability higher.

Chewy Vet Care looks particularly promising after the company opened six locations in the last two quarters. According to management, early indications show that the clinics are a promising acquisition funnel for new customers and have immense cross-sell potential. Compared to the negatively viewed private equity firms that have started to dominate the veterinary industry over the last few years, Chewy Vet Care is being welcomed by both vets and pet owners alike.

Trading at 21 times forward earnings, Chewy’s budding profitability, devout customer base, and veterinary growth potential look reasonably priced for prospective investors.

3. Vail Resorts

Consisting of 37 ski resorts across North America — including three of the top five and five of the top 10 most visited annually — Vail Resorts (NYSE: MTN) is the biggest player in its home continent’s ski resort industry. The main reason that Vail is one of my favorite stocks for the long term is the simple fact that no new ski resorts of scale have been built in over 40 years — giving the company a unique geographic advantage over any would-be competitors.

However, following a post-lockdown boom, Vail’s share price has slid 50% from its 2021 highs due to a weak consumer spending environment, lower snowfall totals at many North American resorts, and worries over its debt levels.

Currently, Vail is home to a formidable net debt balance of $2.1 billion versus $825 million in earnings before interest, taxes, debt, and amortization (EBITDA). However, after extending the maturity date on a $600 million note from 2026 to 2032 and also moving the maturity date on its $969 million term loan and $500 million revolver from 2026 to 2029, Vail gained some financial wiggle room.

Despite these extensions, the company’s debt load means that Vail may be more focused on trying to maintain its precious 4.7% dividend yield rather than raising it, which is typically a bad sign for investors.

However, with Vail trading at just 11 times EBITDA — which looks like it might be a once-in-a-decade valuation — I’m happy to take on the risk of a potential dividend cut.

After briefly pausing its dividend during the pandemic as a precaution, management returned the company’s dividend yield near all-time highs. With 83% of its FCF being used to fund these payments today, though, Vail’s attention will probably turn to simply maintaining this dividend so it can focus on managing its debt balance.

However, Vail has been FCF-positive every year since 2010, so the company’s cash generation has proven as solid as the mountains upon which its resorts are built. Now generating 65% of its sales from a season pass subscription model (up from 26% in 2008), Vail should produce less cyclical cash flows going forward, adding additional stability to the FCF needed to fund its hefty dividend and debt balance.

While it is anyone’s guess as to when the broader consumer spending environment will improve, I’m happy to collect Vail’s well-funded 4.7% dividend yield while I wait for a turnaround and hopefully see the company deleverage in the meantime.

Should you invest $1,000 in Dutch Bros right now?

Before you buy stock in Dutch Bros, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dutch Bros wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Josh Kohn-Lindquist has positions in Chewy, Dutch Bros, Starbucks, and Vail Resorts. The Motley Fool has positions in and recommends Chewy, Starbucks, and Vail Resorts. The Motley Fool recommends Dutch Bros. The Motley Fool has a disclosure policy.

My 3 Favorite Stocks to Buy Right Now was originally published by The Motley Fool