Nvidia (NASDAQ: NVDA) has been one of the best performing stocks the past few years, as demand has skyrocketed for its graphics processing units that help build out artificial intelligence (AI) infrastructure.

The company is used to seeing high demand for its products, so it was noteworthy when in a recent CNBC interview, CEO Jensen Huang called demand for chips based on its new Blackwell architecture “insane.”

Let’s take a closer look at Huang’s comments and what it could mean for the stock.

“Insane” Blackwell demand

Blackwell is the newest architecture for Nvidia’s graphics processing units (GPUs). The company introduced it earlier this year, saying it was the world’s most powerful chip and that it would help customers run their real-time generative AI large language models (LLMs) at much lower cost and energy consumption than its predecessor chips.

Huang told CNBC that after an initial delay due to a minor design flaw that affected manufacturing, Blackwell is in full production and going as planned.

He then explained why the company decided to accelerate the pace of its innovation cycle to once a year, saying that if it can increase performance by two to three times each year, it will increase revenue and decrease costs and energy consumption for its customers each year.

Undoubtedly this will also benefit Nvidia. It will keep it in the lead in a fast-moving technology, while also maintaining high demand and pricing power. The company already announced its next GPU architecture, called Rubin, scheduled for 2026.

At an estimated cost of $30,000 to $40,000 per chip, having “insane” demand for Blackwell bodes very well for the company. When it introduced the technology, it said that a number of leading tech companies were already set to adopt Blackwell, including Alphabet, Amazon, Dell, Meta Platforms, Microsoft, OpenAI, Oracle, Tesla, and xAI. That’s a lot of large companies fighting over Nvidia’s latest GPUs.

Demand is unlikely to slow

Based on the actions of Nvidia’s customers, it does not appear that demand for its GPUs is likely to slow down anytime soon.

For example, Oracle executive chairman Larry Ellison was asked on the company’s second-quarter earnings call whether the demand for computing power would slow if there is a transition from AI training to AI inference. He replied that there was likely no end in sight over the next five to 10 years for demand as companies battle for AI technical supremacy. His company, for example, plans to double its own capital expenditures (capex) for fiscal 2025, which ends next May.

Meanwhile, Alphabet and Meta Platforms said there’s more risk by underinvesting in AI infrastructure than by overinvesting. Both companies are spending heavily on AI-related capex, with Meta already saying it expects its 2025 budget to be significantly higher than in 2024.

Cloud computing leaders Amazon and Microsoft are pouring money into data centers to keep up with AI demand, while start-ups OpenAI and xAI are spending a boatload of money to develop more-advanced AI models.

This race for more sophisticated AI models is creating the need for exponentially more computing power to train them. That power is provided by GPUs, which most likely were designed by Nvidia.

For example, Meta says its Llama 4 LLM would likely need 10 times the GPUs as its predecessor Llama 3, while xAI’s Grok-3 AI model requires five times as many GPUs to be trained as Grok-2 needed.

Is Nvidia stock a buy?

All of this points to a need for a lot more GPUs in the future. In the world’s race for more and more computing power, no company is in a better position than Nvidia. Besides the domination of its chips, there’s the wide moat created by its CUDA software, which long ago became the de facto platform to program GPUs.

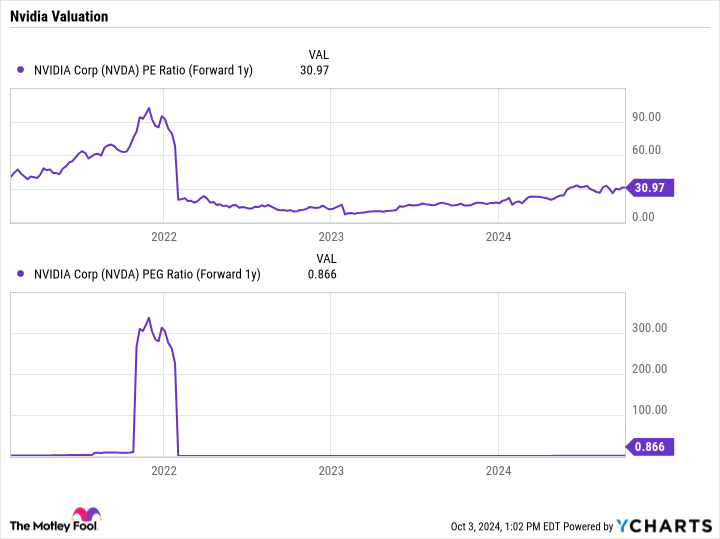

At the same time, the stock is still reasonably priced despite its parabolic performance the past few years. Trading at a forward price-to-earnings ratio (P/E) of about 31 based on next year’s analyst estimates, and a price/earnings-to-growth ratio (PEG) of 0.87, the stock is attractively priced given the demand that appears to still be ahead for its GPUs. A PEG under 1 is usually viewed as undervalued, and growth stocks will often have PEGs well above 1.

With Nvidia talking about the insane demand for its Blackwell chips and its customers continuing to ramp up their AI spending, the stock remains a buy.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia’s CEO Says Demand for Its New Chips Is “Insane.” Is It Time to Buy the Stock? was originally published by The Motley Fool