Amazon (NASDAQ: AMZN) has been one of the biggest winners since the start of this millennium and has delivered stellar returns for long-term investors. On the other hand, the e-commerce and cloud-computing giant has actually been lagging behind the broader market in 2024.

While Amazon stock has risen roughly 17.5% across this year’s trading, the S&P 500 index has delivered a dividend-adjusted total return of 19.5% as of this writing.

Even though Amazon has underperformed the benchmark index this year, investors shouldn’t bet on that continuing to be the case over the long term. In fact, the stage appears to be set for the stock to deliver market-crushing returns over the next five years — and artificial intelligence (AI) could be at the center of an incredible transformation.

Amazon can still deliver huge earnings growth

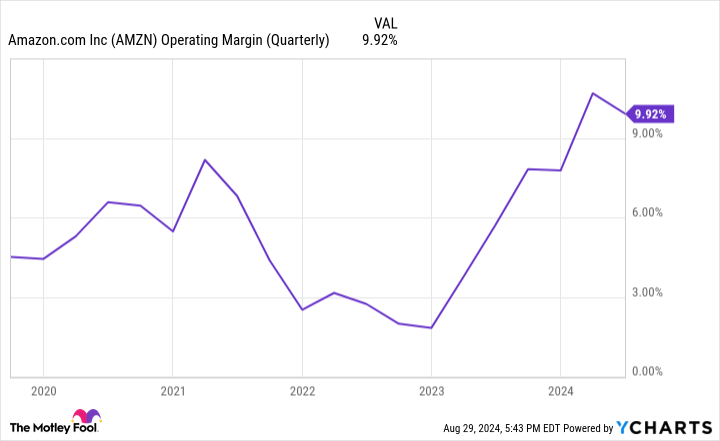

Take a look at the chart below, which tracks Amazon’s quarterly operating margin over the last five years.

As the chart shows, the tech giant’s operating margin has seen some big swings — but it’s trending in an encouraging direction. Some key macroeconomic pressures began easing in 2023, and performance across two quarters in 2024 seemingly has the company on track to record its highest-ever annual operating margin. There are good reasons to think that performance will continue to improve.

Driven by the still growing, higher margin Amazon Web Services (AWS) cloud services business, and the rapidly expanding — and highly profitable — digital advertising business, overall margins have expanded since 2023.

While the e-commerce business still accounts for the majority of total sales, AWS and the digital ads business should continue to account for a growing portion of sales, helping push margins and overall profits higher. Even better, there’s a good chance its massive online retail business will become significantly more profitable thanks to the rise of AI and robotics.

Despite generating huge amounts of revenue, e-commerce is still a relatively low-margin business for Amazon. If automation meaningfully reduces costs for this segment, the company’s earnings and share price should soar.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

Prediction: Amazon Stock Will Soar Over the Next 5 Years. Here’s 1 Reason Why. was originally published by The Motley Fool