After a blistering run since early 2023, Nvidia (NASDAQ: NVDA) has hit a wall. The stock has surged 730% since the start of last year (as of this writing), but over the past three months, Nvidia has tread water, down roughly 4%.

A number of factors have weighed on the stock. Fears regarding a potential slowdown in the adoption of generative artificial intelligence (AI), rumors about a delayed release of Nvidia’s next-generation Blackwell platform, concerns about a decline in the company’s gross margin, and a pricey valuation have some investors fearing the stock may have gotten ahead of itself.

However, a quick look at the available evidence suggests that while those concerns are understandable, they are also largely unfounded. I believe there’s still plenty of room for Nvidia to run, and I predict the stock will continue to reach new all-time highs into 2025. Here’s why.

A speed bump in the adoption of AI?

The accelerating adoption of AI has helped fuel the run-up in technology stocks since the start of 2023, but investors have begun to wonder if that breakneck pace could continue. There’s evidence that suggests it can.

To close out the calendar second quarter, Alphabet, Microsoft, Amazon, and Meta Platforms all announced plans to increase capital expenditures (capex) for the remainder of 2024, while also laying out plans for significant increases next year. The vast majority of that spending will be allocated to outfitting the servers and data centers needed to support AI. Since these tech titans are Nvidia’s biggest customers, this suggests the company’s growth streak has legs.

Taking a step back and looking at the big picture can also provide context. Generative AI is expected to add between $2.6 trillion and $4.4 trillion to the global economy in the coming years, according to estimates provided by management consulting firm McKinsey & Company. This suggests that the adoption of AI will continue for the foreseeable future.

Blackwell is on track

Reports emerged in early August that Nvidia’s next-generation Blackwell chips would be delayed by as much as three months due to production issues. The stock skidded on these reports as investors feared the worst.

When Nvidia released its quarterly results in late August, CFO Colette Kress put the matter to rest:

We shipped customer samples of our Blackwell architecture in the second quarter. We executed a change to the Blackwell GPU mask to improve production yield. Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal 2026. In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue.

This suggests the reported delays were much ado about nothing.

Fears regarding slowing growth are myopic

When Nvidia reported the results of its fiscal 2025 second quarter (ended July 28), there was much to like. The company generated record quarterly revenue, record quarterly data center revenue, and robust profits. However, there were two issues investors seemed to focus on in Nvidia’s otherwise stellar results.

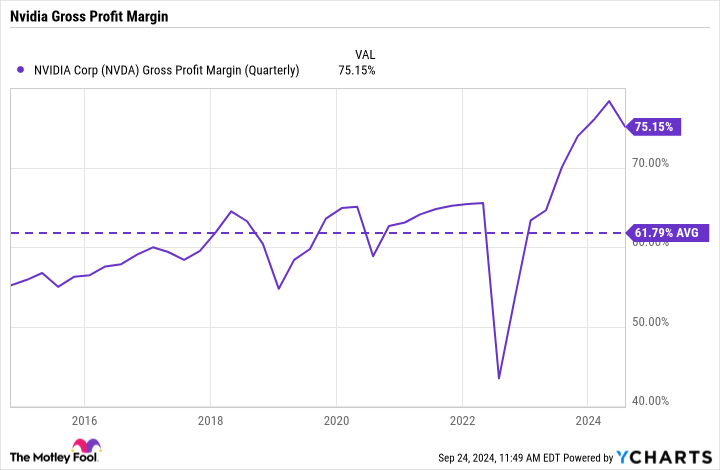

The first was the company’s gross margin, which declined from a record 78.4% in Q1 to 75.1% in Q2. During the earnings conference call, CFO Colette Kress noted that a combination of product mix and inventory provisions related to the rollout of Blackwell were the culprits.

That said, the company is forecasting gross margins for the remainder of the year in the mid-70% range. While that’s below the record results in the first quarter, it’s still well ahead of Nvidia’s 10-year average gross margin of 62%.

The other issue that seemed to spook some investors was Nvidia’s forecast for its fiscal third quarter, which ends in late October. The company is guiding for record revenue of $32.5 billion, which would represent growth of 79%. That would mark a deceleration from the triple-digit growth Nvidia has delivered in each of the previous five quarters, but it’s still a remarkable performance nonetheless.

Savvy investors knew that the company’s growth rate would eventually slow, particularly as Nvidia faces tough comps from last year. That said, the company’s revenue growth is still exceptional and should be viewed in that context.

Not as pricey as you might think

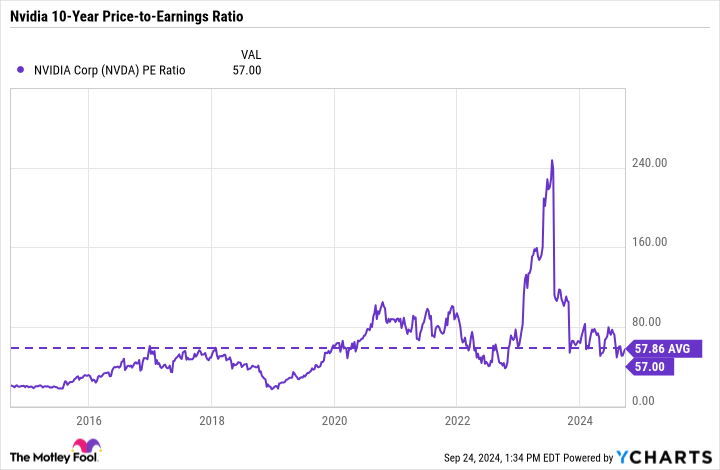

One of the biggest issues weighing on Nvidia is the notion that the stock is exorbitantly expensive. That view is certainly understandable, given that the stock is currently selling for 57 times earnings, compared to a price-to-earnings ratio of 30 for the S&P 500. However, investors willing to take a step back will see that Nvidia isn’t as expensive as it might appear at first glance.

A quick look at the stock chart reveals that Nvidia is actually trading slightly lower than its average P/E ratio over the past decade. It’s also worth noting that during the past 10 years, Nvidia stock has gained more than 25,000%, evidence that the stock has been — and continues to be — deserving of a premium.

However, a look ahead suggests the stock is even cheaper. Wall Street is forecasting earnings per share of $4.02 for the coming fiscal year, which kicks off in late January. That means Nvidia is currently trading for less than 29 times forward earnings (as of this writing), which is a bargain, particularly given the company’s continuing growth prospects.

An objective view

Given the run-up of Nvidia stock since early last year, it’s understandable that investors are taking a step back to survey the landscape. Yet it’s clear the factors that have been weighing on the stock are much ado about nothing.

Nvidia’s largest customers continue to spend heavily on its products, its next-generation platform is on track, its gross margin remains near a record high, and its valuation isn’t nearly as pricey as it appears at first glance.

This all suggests a clear runway ahead for Nvidia, and I predict that the stock will continue to reach new heights well into 2025.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: Nvidia Stock Will Surge Into 2025. Here’s Why. was originally published by The Motley Fool