Overview of Recent Transaction

On September 30, 2024, Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, executed a reduction in its holdings of Blackrock Virginia Municipal Bond Trust (NYSE:BHV). The firm sold 7,635 shares at a price of $11.47 per share, which adjusted its total holdings to 70,728 shares. This move reflects a minor adjustment in the firm’s portfolio, with the position size now standing at a mere 0.01% of its total investments.

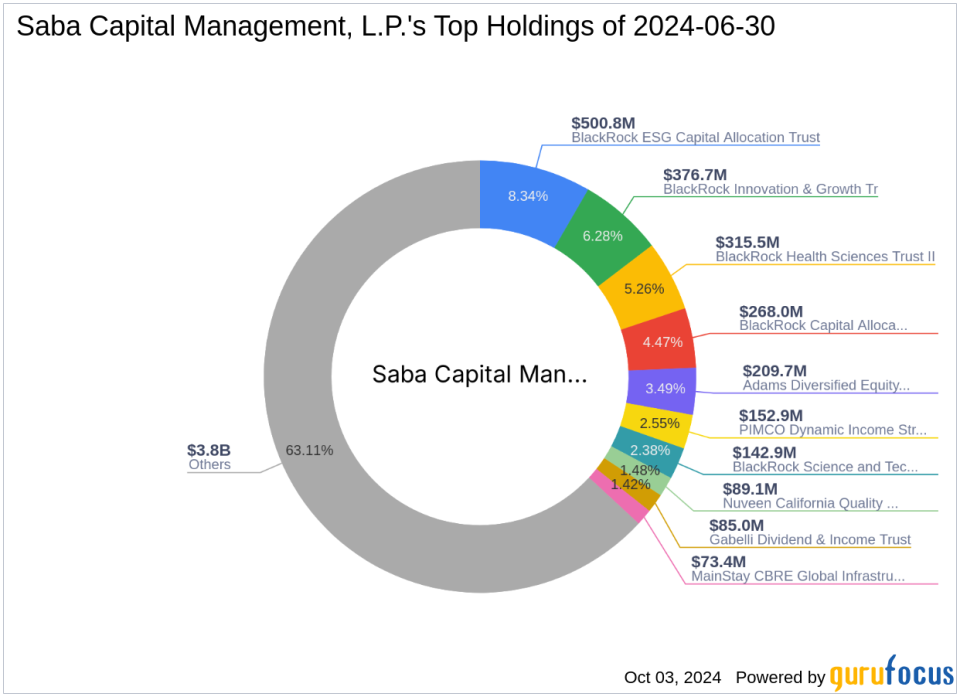

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

Located at 405 Lexington Avenue, New York, NY, Saba Capital Management is a key player in the financial sector, focusing on diverse investment vehicles. The firm manages an equity portfolio worth approximately $6 billion, with top holdings in various sectors including financial services and communication services. Its investment philosophy emphasizes strategic market engagement to maximize returns.

Introduction to Blackrock Virginia Municipal Bond Trust

Blackrock Virginia Municipal Bond Trust, trading under the symbol BHV, is a perpetual closed-end municipal bond fund established in the USA. Since its IPO on April 26, 2002, BHV aims to provide tax-exempt current income, focusing on investments that are exempt from regular Federal and Virginia personal income taxes. Despite a market capitalization of $18.409 million, the fund’s financial metrics suggest cautious investment considerations, with a GF Value indicating a potential value trap.

Analysis of the Trade Impact

The recent transaction by Saba Capital Management has slightly decreased its stake in BHV, which now represents a minimal portion of its portfolio. This reduction might suggest a strategic shift or a reallocation of resources towards more lucrative opportunities, given the fund’s current market performance and valuation concerns.

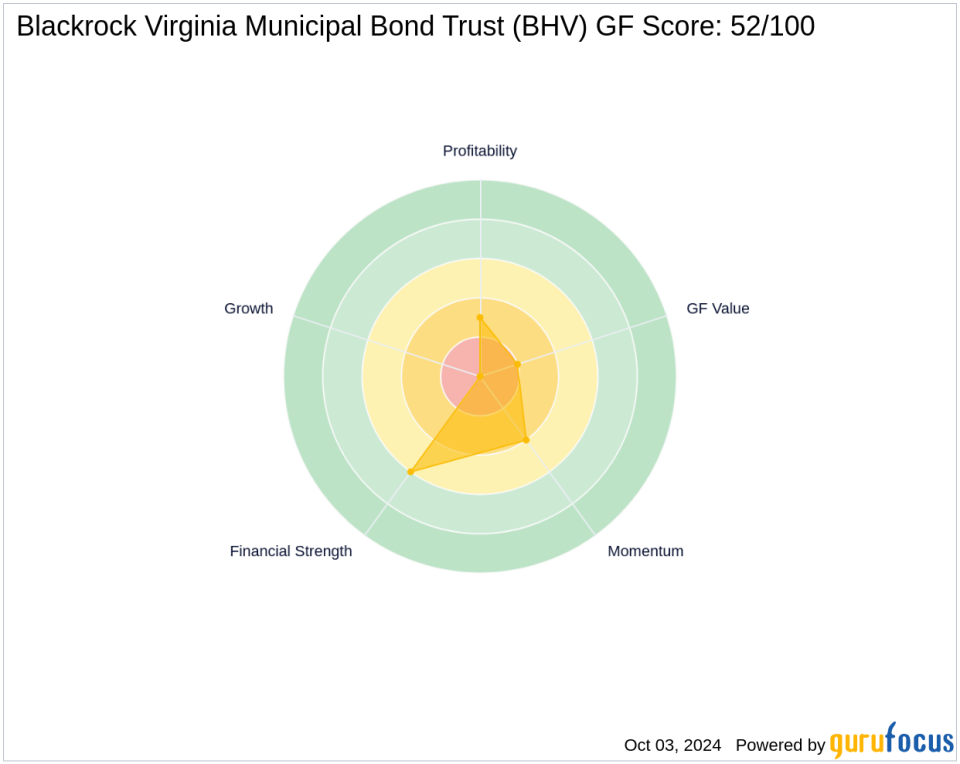

Market Performance of Blackrock Virginia Municipal Bond Trust

BHV’s stock price currently stands at $11.59, with a year-to-date increase of 5.36%. However, the stock has experienced a decline of 23.25% since its IPO. The GF Score of 52 indicates poor future performance potential, further compounded by low ranks in profitability and growth. These factors might have influenced Saba Capital Management’s decision to reduce its holdings.

Sector and Market Context

The asset management industry, where BHV operates, is currently facing various challenges that affect investment decisions. Saba Capital Management’s portfolio predominantly features financial and communication services, sectors that are possibly better aligned with the firm’s strategic objectives than the current trajectory of the municipal bond market.

Future Outlook and Considerations

Investors should be cautious with BHV, considering its designation as a possible value trap and its underwhelming financial metrics. The market’s future movements and the fund’s ability to adjust to economic conditions will be crucial in determining its viability as an investment option.

Conclusion

Saba Capital Management’s recent reduction in its BHV holdings appears to be a strategic decision, reflecting broader market assessments and portfolio realignment. Given the fund’s challenging performance metrics and market valuation, this move aligns with a cautious approach to asset management in the current economic climate.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.