Rivian (NASDAQ: RIVN) stock can’t catch a break. Last month, I explored whether investors should buy the stock after its value fell below $13 per share. Following another decline, Rivian shares are now priced below $12 — just pennies above the $11 mark.

Now trading at its cheapest valuation in years, is now finally the time to buy this growth stock? The answer for many investors is yes — but there’s a catch.

Rivian stock clearly has massive upside potential

It’s not hard to do the math and come to the conclusion that Rivian shares have a ton of upside potential. Its $11 billion market cap alone begs for attention.

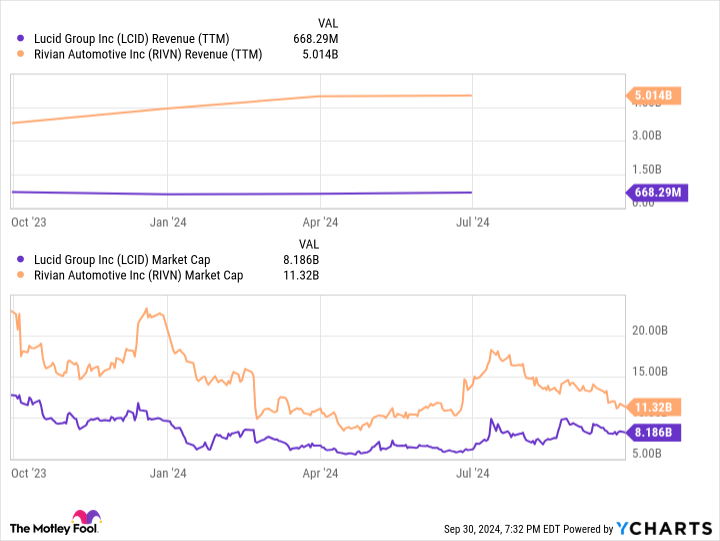

Just look at Lucid Group, another EV manufacturer that is currently valued at $8 billion. Over the last 12 months, the company has generated sales of around $670 million. Rivian, meanwhile, generated sales of around $5 billion over the same time period. These figures price Rivian stock at 2.2 times sales, while Lucid comes in at 12.1 times sales. At least on a relative basis, Rivian’s valuation seems oddly priced versus its primary competitors.

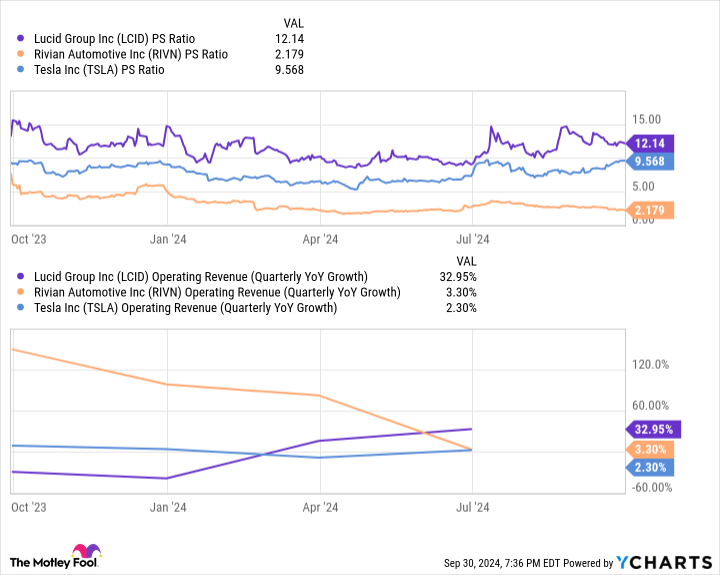

One of the reasons for this gap is each company’s revenue growth rate last quarter. Sales growth picked up to 33% for Lucid last quarter, while Rivian’s growth rate fell to just 3.3%. Yet other competitors like Tesla complicate this simple equation.

Tesla’s shares are currently priced at 9.6 times sales — closer to Lucid’s valuation than Rivian’s. Yet Tesla’s revenue growth rate last quarter was just 2.3% — roughly one-third lower than Rivian’s. Tesla has several key advantages, including name brand recognition, greater access to capital, and a relatively diversified business operation. But Rivian’s growth prospects are arguably much greater over the next few years.

This is the primary issue with Rivian stock right now: Its biggest growth drivers won’t arrive for several more years. And the market seems to be playing it safe, forcing the company to prove itself before earning a premium valuation. But if you’re willing to invest early and remain patient, shares could have significantly upside potential.

Is the stock a buy under $12 per share? Yes, but there’s a catch.

Right now, Rivian’s sales base is around $5 billion. That’s roughly where Tesla’s sales base was in early 2017, just before it delivered on its first mass-market vehicle: the Model 3. Over the next two years, sales more than tripled to more than $20 billion.

In early 2020, the company began deliveries of its second mass-market vehicle: the Model Y. Sales at the start of the year were around $25 billion. In just two years, sales had doubled to above $50 billion.

In summary, it was Tesla’s mass market vehicles that turned the company into a growth machine.

Rivian is ready to repeat this recipe for success. Beginning in 2026, it will begin shipping its R2 model: the first Rivian to be priced under $50,000. By 2027, it expects to also be shipping the R3 and R3X models — two additional mass-market vehicles.

Over the next few years, Rivian should see its sales ramp up as aggressively as Tesla’s. Its $5 billion revenue base, if it were to follow Tesla’s example, could quickly balloon to $30 billion or more.

If Rivian can execute, shares are a screaming bargain under $12. But there’s still a lot of uncertainty. The company will require billions in additional capital, and it remains to be seen if its mass-market vehicles can retain Rivian’s high-quality reputation, as Tesla was able to manage — at least initially — with its Model 3 and Model Y.

But the biggest rewards are generated by investors willing to be early to the party, riding out plenty of volatility along the way. If you’re looking for a growth stock with massive upside potential, and are willing to remain patient for several years, few stocks today offer as lucrative as an opportunity as Rivian.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

Should You Buy Rivian While It’s Below $12? was originally published by The Motley Fool