Are you currently receiving Social Security retirement benefits? If so, you’ll want to mark Oct. 10 on your calendar. That’s when you’ll hear how much bigger 2025’s monthly payments will be. Hopefully it will be enough of an improvement to offset the rising prices of… well, pretty much everything so far this year.

But how much of an increase are we due, and for that matter, what does it mean — in practical terms — for the program’s current beneficiaries? Keep reading.

COLA coming up!

What the heck’s a COLA? It’s an acronym for “cost-of-living adjustment.” Recognizing that living costs rise over time, the Social Security Administration regularly raises the payments made to beneficiaries of all its programs. The most watched COLA update, of course, is the one that affects 67.7 million people, including roughly 53.2 million people age 65 and older.

The Social Security Administration doesn’t offer any official hints at what any particular year’s COLA will be. But we have a rough idea of what’s coming. Data from the Bureau of Labor Statistics indicates overall consumer costs are up 2.5% since the last time the entitlement program announced a COLA in October 2023. Removing ever-volatile prices of food and fuel from the calculation, consumer prices are higher by 3.2% for the same 12-month stretch. The Senior Citizens League’s most recent estimate is for a 2.5% increase.

In other words, it would be surprising if the increase wasn’t at least in that ballpark.

As for what this means in more relatable terms, in that this year’s average monthly Social Security payment stands at $1,907, a 2.63% increase would put 2025’s average monthly benefit somewhere around $1,957. That’s $50 more per month. Note, however, that people receiving larger payments will see bigger nominal increases, while retirees cashing smaller-than-average checks right now will see less net improvement. Everyone sees the same COLA, but it’s a percentage-based improvement relative to their current monthly benefit.

You can beat a lackluster cost-of-living adjustment

But that’s not going to be enough no matter how much more money you end up getting? If you feel that way, you’re not alone.

Although Social Security’s COLA is based on the U.S. Bureau of Labor Statistics’ official inflation data, it comes after underlying price increases are in place and have already taken their financial toll. You may be playing catch-up on your bills by the time you see any benefit from it.

It’s also arguable that the annual COLA doesn’t reflect reality — particularly for retirees, since they’re more likely to spend more on healthcare than the average worker does. That’s what number-crunching from The Senior Citizens League indicates, anyway. It suggests that over the course of the past 15 years, the average U.S. retiree collecting Social Security benefits has actually lost $370.23 worth of monthly buying power they theoretically weren’t supposed to lose.

While there’s not a lot you can do about Social Security’s upcoming cost-of-living adjustment, there are some things retirees can do to offset an inadequate COLA. Here are the three that could help the most.

1. Revisit your dividend stocks

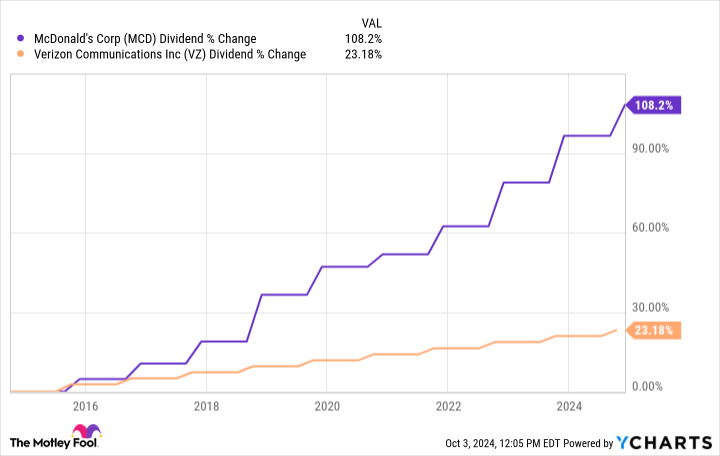

If you own any stocks at all, then you’re probably holding at least some dividend-paying names. But are your dividend stocks the best dividend stocks for your portfolio? They may not be, if your overall dividend growth isn’t firmly outpacing inflation. For example, while Verizon‘s forward-looking dividend yield of 6% is impressive, since 2014 the telecom giant’s payout has only grown at an average annual pace of about 2%. Conversely, McDonald’s current yield of 2.33% is just so-so, but its quarterly dividend has more than doubled over the past 10 years.

The point is, if you’re relying on dividend stocks to provide spendable income, you may actually be losing buying power over time without even realizing it.

2. Rethink your fixed income holdings

Since you’ll want to take a fresh look at your dividend stocks, it wouldn’t hurt to review bonds, CDs, and other fixed-income instruments either… especially now, with interest rates apt to continue sliding from their multi-year peak.

You’ll still always want to diversify your bond portfolio, just as you do with stocks. It just might not hurt to lock in a few more holdings at higher rates than you might normally choose to, before the Federal Reserve makes good on its plans to push rates lower over the course of the coming couple of years.

3. Not all “cash” is the same

Given the likelihood that you’ve got at least some of your savings currently held as cash, think about moving part of that money over to a higher-yielding money market fund. These funds are only paying a little less than 5% right now, and those yields are likely to sink in step with overall interest rates. Given that you’re earning practically nothing on the cash in your checking or savings account, though, that’s huge.

There’s a catch… sort of. Whereas the money in most checking accounts is always immediately available, and savings accounts can often be accessed next-day, cashing out most money market holdings shortly after buying them might incur a small early redemption fee. You’ll have to check with your bank or broker for the specifics on the money market you had in mind. Fortunately, the minimum expected holding period is usually only a few weeks, and if you really need this cash in the meantime, you can get to it.

There’s a fourth, less desirable option… although it may not be quite as miserable as you might fear. That is, go back to work.

Returning to the workplace probably wasn’t what you had in mind for this time of your life. Living with the stress of not having enough spendable income, however, likely wasn’t what you had planned either. There’s a balance to be found.

Don’t worry. Working once you’ve started collecting Social Security retirement benefits won’t affect your payments until and unless your earnings reach a certain threshold. For perspective, beneficiaries can earn as much as $22,320 this year before the Social Security Administration begins to reduce the size of your monthly checks. If your only aim is keeping up with the rising cost of living, you won’t even need to make that much.

Keep your eyes and ears open on the 10th. That’s when the big COLA question will be answered.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

James Brumley has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

The 2025 Social Security COLA Will Be Announced This Month. Here’s What That Means for Retirees. was originally published by The Motley Fool