The Federal Reserve lowered interest rates last week and could further cut rates in the coming months. Lower interest rates lower the cost of capital and can increase the return on investment for capital-intensive projects.

Here’s how the Fed’s move can benefit energy pipeline company Kinder Morgan (NYSE: KMI) and why the high-yield dividend stock is worth buying now.

Room for further balance-sheet improvements

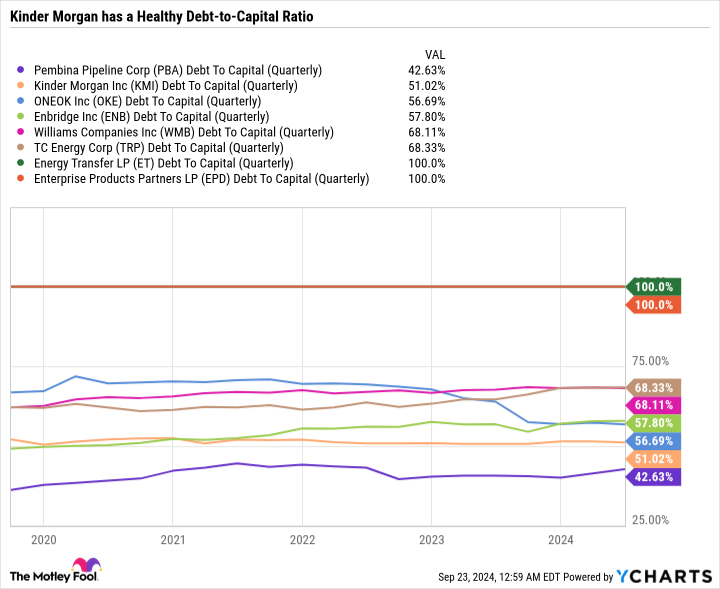

Since the oil and gas downturn of 2014 and 2015, Kinder Morgan has worked hard to restore its balance sheet and rebuild investor confidence in its dividend. In the past nine years, it has reduced its total net long-term debt position by 29% and lowered its leverage. As you can see in the following chart, Kinder Morgan’s debt-to-capital (D/C) ratio is now just 51%, which is among the lowest of its peer group.

The D/C ratio is a company’s total debt divided by its total debt plus total equity. The lower the D/C ratio, the less debt-dependent the company’s capital structure.

Despite the improvements, Kinder Morgan still has a high-interest expense. Its trailing-12-month interest expense is $1.85 billion. For context, Kinder Morgan spent $2.5 billion on capital expenditures and $2.54 billion on dividends in the trailing 12 months.

The company has kept a tight lid on spending as it prioritizes free-cash-flow generation, a low-leverage ratio, and dividend growth. Lower interest rates could help Kinder Morgan refinance existing debt or take on new debt at a lower interest rate.

Accelerating capital investment

At its core, Kinder Morgan’s business model involves building and operating infrastructure assets — like pipelines, terminals, and storage facilities — and then generating future cash flow from those assets. When discounted to account for capital costs, the future cash flows should exceed the investment cost. A lower cost of capital or higher amount of future cash flows can benefit Kinder Morgan and help justify expensive projects.

Infrastructure is needed to support growing U.S. oil and gas production. But Kinder Morgan no longer depends just on domestic consumption.

Liquefied natural gas (LNG) is a major tailwind for the industry. It involves the transportation of natural gas from production areas to liquefaction facilities at export terminals, which cool and condense the gas into a liquid state that allows for transport overseas. The U.S. is now one of the largest LNG exporters in the world. A global market for LNG expands the pool of buyers for the natural gas that Kinder Morgan transports.

Another area of growth is in biofuels. Infrastructure will be needed to support increased demand for natural gas, diesel, and other fuels produced from renewable feedstocks like seed oils, sugar cane, corn, algae, food waste, cow manure, wastewater, and landfill gas.

Natural gas is primarily used for power generation. According to 2021 Department of Energy data, natural gas and biofuels made up less than 10% of the transportation industry energy mix. Compressed natural gas can be used for long-haul trucking or blending natural gas and/or biofuels with diesel or gasoline to lower emissions.

Like many other midstream companies, Kinder Morgan has recognized the potential role natural gas can play in powering energy-intensive data centers. Artificial intelligence (AI) is driving higher electricity demand, which could kick-start yet another growth avenue for Kinder Morgan.

In sum, Kinder Morgan has plenty of ways to put capital to work. Lower interest rates make it less expensive to explore these opportunities.

A passive-income powerhouse

There are plenty of ways to generate passive income, from Treasury bills to high-yield savings accounts, and more. High-yield dividend stocks are less appealing when the risk-free rate is higher. But when the risk-free rate is lower, there’s more incentive to invest in dividend stocks.

Kinder Morgan sports a yield of 5.3%, which is higher than the 10-year Treasury rate of 3.7%. It’s also higher than the 3% yield that investors can get from an exchange-traded fund (ETF) like the Vanguard Energy ETF or the mere 1.3% yield from the S&P 500.

Kinder Morgan’s recent dividend raises have been fairly small, but the company remains committed to gradually growing the dividend over time.

Shifting into a new growth gear

Higher U.S. production and demand for the fuels and products that Kinder Morgan handles present a compelling growth opportunity for the company. However, it’s paramount that Kinder Morgan does not get ahead of itself by overly investing at the expense of its capital commitments to shareholders.

Investors should watch to see if the data-center opportunity is the real deal, monitor progress with the energy transition and low-carbon fuels, and evaluate how Kinder Morgan balances these opportunities with the need for more LNG infrastructure.

In sum, Kinder Morgan stands out as a solid dividend stock for generating passive income, but it also has plenty of ways to expand its business, boost free cash flow, and reward shareholders in a variety of ways.

Should you invest $1,000 in Kinder Morgan right now?

Before you buy stock in Kinder Morgan, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kinder Morgan wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Enbridge and Kinder Morgan. The Motley Fool recommends Enterprise Products Partners, Oneok, Pembina Pipeline, and Tc Energy. The Motley Fool has a disclosure policy.

The Fed Just Lowered Interest Rates. My Top High-Yield Dividend Stock to Buy Now. was originally published by The Motley Fool