The Dow Jones Industrial Average is chock-full of reliable blue-chip dividend stocks. It is a go-to list for investors looking for industry-leading companies that can fuel their portfolios with passive income.

Walmart (NYSE: WMT), Coca-Cola (NYSE: KO), Procter & Gamble (NYSE: PG), and Johnson & Johnson are the only four companies that are both Dow components and Dividend Kings — which are companies that have paid and raised their dividends for at least 50 consecutive years.

Here’s why Walmart, Coca-Cola, and Procter & Gamble just hit all-time highs but could still be worth buying now.

Walmart’s meteoric ascent is justified

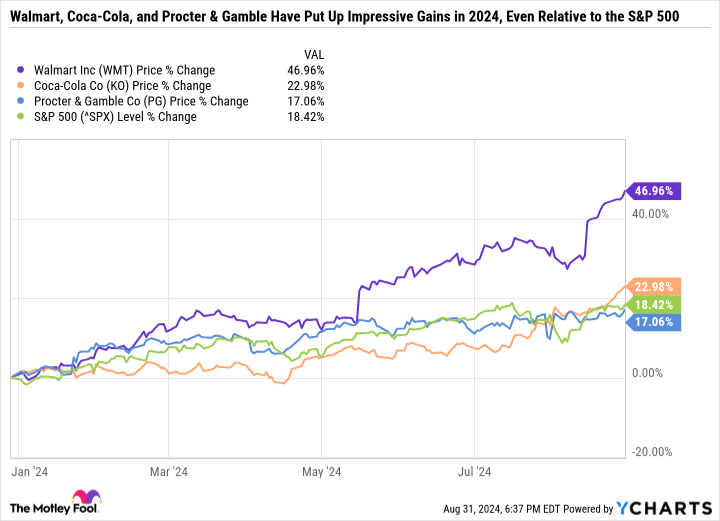

Outside of Nvidia and a few other growth stocks, I would argue that Walmart has had the most impressive performance in 2024. It is the best-performing Dow dividend stock in 2024 and is up 47% year to date while Target is up around 8% in that period.

On Aug. 30, Walmart hit an all-time high while Dollar General hit a five-year low. Discount retailers and companies that depend on discretionary spending are struggling, and yet Walmart is thriving.

When a company is doing well, and so many of its peers are doing poorly, it’s usually a sign that management has made some savvy strategic moves. And sure enough, Walmart’s top brass deserves a lot of credit for making the necessary investments over the last few years to improve existing stores, build better stores, make supply chain and organizational improvements, and more.

Walmart already has the advantage of size, which has allowed it to be cost-competitive with just about any other retailer or grocer. But now, it is also an extremely well-run company with a clear vision for unlocking future growth.

Walmart has a proven business model, is allocating new capital efficiently, and is on track to deliver record adjusted earnings despite a challenging business climate. For these reasons, Walmart deserves to be hovering around an all-time high.

Coca-Cola is finally a winner

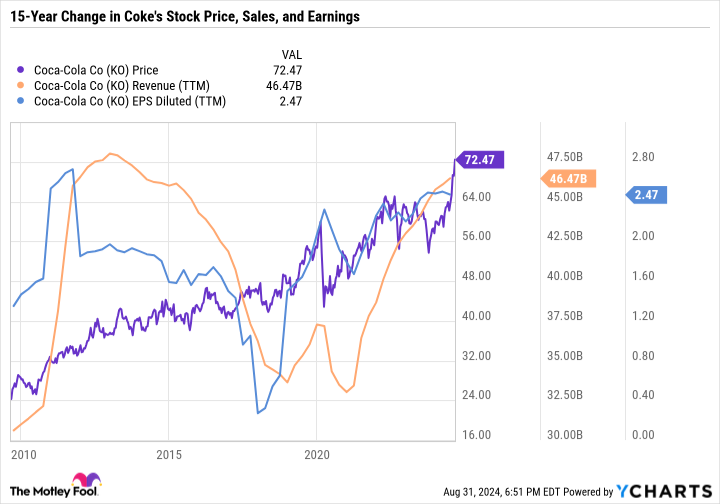

Coke is up 23% year to date but just 32% over the last five years. The beverage king had spent years improving its profitability even at the expense of slowing sales growth. Then, it bought a 15% stake in Bodyarmor in 2018, Costa Coffee in 2019 for $4.9 billion, and the remaining 85% stake in Bodyarmor in 2021 for $5.6 billion. Despite the added revenue from these brands, Coke’s sales continued to languish in the early 2020s.

But the pandemic is partially to blame because Coke relies heavily on away-from-home sales (think restaurants, sporting events, concerts, etc.). Only recently has the company begun returning to growth. But zoom out, and its revenue and earnings are roughly the same today as in the early 2010s but the stock price is up 170%.

At first glance, the chart looks concerning, seeing as Coke has not grown over the last 15 years from an earnings and sales standpoint, but its stock price is much higher. However, Coke’s valuation is still not terribly high, with a forward price-to-earnings (P/E) ratio of 25.4. Analyst consensus estimates forecast strong earnings growth in the short term. But even better, the company’s beverage portfolio looks well-positioned to grow thanks to operational improvements and better integration of its recent acquisitions.

Throw in Coke’s stable and growing dividend with a solid 2.7% yield, and the stock isn’t a particularly bad choice even though it’s up considerably in a short period of time.

Investors know what they are getting with P&G

Unlike Walmart, which is having a breakout year, and Coke, which had been performing poorly but is beating the major indexes in 2024, P&G has been a steady performer — both in terms of the stock price and the core business.

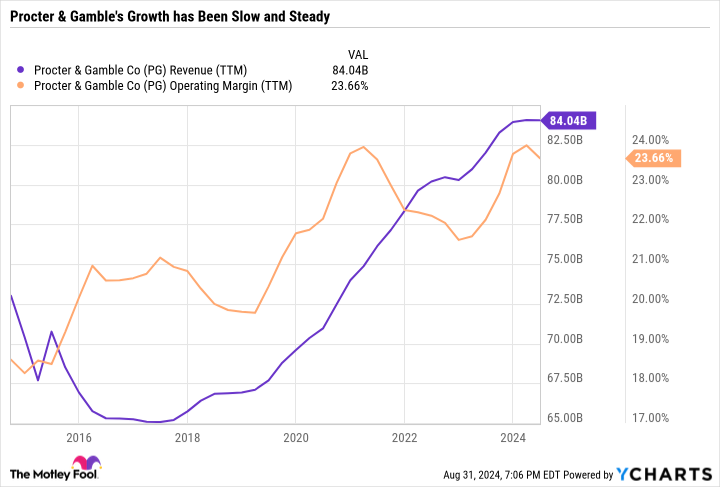

Sales and earnings growth have been moderate. The following chart shows that growth has slowed over the last few years, while margins have been fairly rangebound between 18% and 24% over the last decade.

P&G has a reliable portfolio of top brands that can do well no matter the economic cycle. P&G’s performance has held up despite a difficult operating environment. It has maintained pricing power, which is impressive considering consumers have been more cautious with their spending. P&G benefits by having multiple brands at different price points per category.

For example, owning Crest and Oral-B in the oral care category or Downy, Bounce, Tide, and Gain in the fabric care category helps P&G retain customers even if they jump from one brand to another.

P&G makes up for its stodgy growth by returning capital to shareholders through sizable dividend raises and stock repurchases. Over the past five years, it has reduced its share count and raised its dividend faster than Walmart and Coke. With a forward P/E ratio of 24.6 — P&G is also the least expensive of the three dividend stocks based on that metric — it’s a good choice for investors who care more about value and reliable passive income than growth potential.

Proven winners at premium price points

Walmart, Coke, and P&G are well-known companies. And as Warren Buffett once said, “You pay a very high price in the stock market for a cheery consensus.” This means that if a stock is a well-known winner, it’s probably not going to be cheap.

Defining the qualities that make Walmart, Coke, and P&G top companies provides a blueprint for finding other quality dividend stocks that may go for less expensive valuations. There are also faster-growing companies at comparable valuations — like fellow Dow component Visa, which doesn’t yield as much as these companies but could be an even better long-term investment.

The key is to align your holdings with your personal risk tolerance and financial goals. Walmart, Coke, and P&G could be good fits, but only if you’re willing to pay a premium price.

Should you invest $1,000 in Walmart right now?

Before you buy stock in Walmart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walmart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia, Target, Visa, and Walmart. The Motley Fool recommends Johnson & Johnson. The Motley Fool has a disclosure policy.

There Are 4 Dividend Kings That Are Also in the Dow Jones Industrial Average. Here’s Why 3 of Them Just Hit All-Time Highs. was originally published by The Motley Fool