The two big trends for the rest of the decade will be artificial intelligence and electrification.

Behind both of those megatrends? Electricity … and lots of it.

In fact, electricity demand is growing in the U.S. at a rate we haven’t experienced in over 20 years. According to Goldman Sachs (NYSE: GS), U.S. electricity demand will grow at a 2.4% annualized rate through the end of this decade. While that doesn’t sound like much, consider that electricity demand growth for the past 10 years has been zero.

That growth will require some $50 billion of investment in new power production, not to mention billions more in connecting these sources of power to the grid. That massive investment should handsomely benefit the following three stocks.

Quanta Services

Quanta Services (NYSE: PWR) is a full-solutions provider for electricity infrastructure, including design, construction, and recurring maintenance and repair. The company serves the traditional electric power, renewable energy, and underground infrastructure industries.

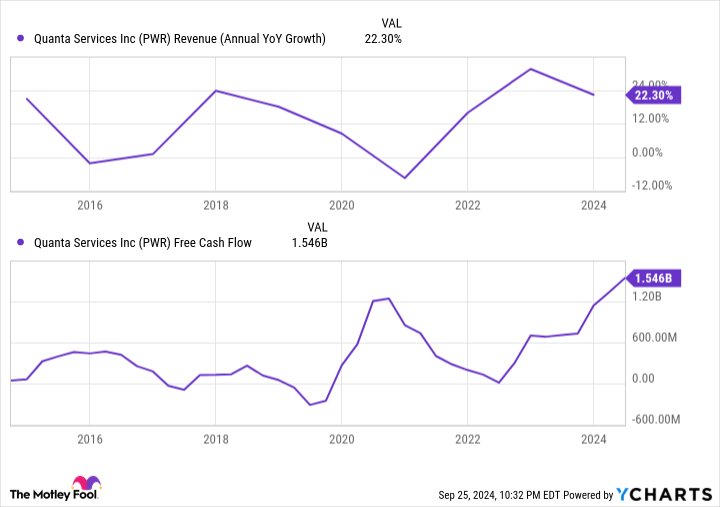

Quanta is a giant in the industry, with a $44 billion market cap and $22 billion in trailing 12-month revenue. But despite its already large size, growth has been solid, especially since the passage of the large infrastructure bills under the Biden administration in 2021 and 2022. Meanwhile, free cash flow has inflected higher with scale, surging to roughly $1.5 billion.

PWR Revenue (Annual YoY Growth) data by YCharts

Quanta has also been growing through acquisitions, with the most recent being its purchase of Cupertino Electric Inc. (CEI). CEI has a particular specialty in modular data center electrical systems, and it has a particularly close relationship with the technology industry.

Given that AI data centers are supposed to contribute 0.9% of the 2.4% electric power demand growth through 2030, the largest contributor to growth, this looks like a smart purchase by Quanta, giving it inroads into the fastest-growing part of the market.

Emcor Group

The Emcor Group (NYSE: EME) performs design, construction, and maintenance services like Quanta, but is a tad more diversified, operating both within and outside of the electrical power sector. No doubt, its electrical segment is a big one. Emcor’s electrical division not only handles power generation and distribution, but also installs solar modules and electric charging stations, and it provides electrical systems such as lighting and control automation to end customers.

Emcor serves other verticals outside of electricity that also have tailwinds behind them, thanks to the public-private investments spurred by the Bipartisan Infrastructure Act of 2021. These include installing manufacturing facilities, data centers, communications infrastructure, warehouses, roadway and traffic control, chemical and refining plants, water and wastewater systems, and others.

In addition, Emcor performs ongoing maintenance on all of these projects, with services accounting for about 30% of revenue, leading to relatively stable revenue and profit growth.

Like Quanta, Emcor has had an excellent few years of low-teens growth and surging free cash flow, which just exceeded $1 billion over the past 12 months. Revenue even accelerated last quarter to over 20% growth.

At just 25 times trailing earnings and 20 times cash flow, Emcor’s stock isn’t expensive for a company growing that fast and expanding margins. So, analysts appear to think growth will slow in the years ahead.

Yet with the AI and electrification buildouts still ongoing, stimulus still flowing through the economy, and interest rates beginning to fall, it’s quite possible Emcor keeps up better-than-expected growth.

American Superconductor Corp.

American Superconductor Corp. (NASDAQ: AMSC) is a small-cap player in electrical systems, with a market cap of just $920 million today. But the company is growing fast, with revenue up about 33% in its recent quarter.

For the grid, AMSC makes power systems, voltage control equipment, transformers, fast-switching equipment, and other systems that help make grid interconnects more efficient. Its equipment is installed both at the power source as well as through the distribution and transmission system.

American Superconductor’s secret sauce is its know-how of novel materials. The company pioneered the use of yttrium barium copper oxide to make its high-temperature superconductors. This material is able to conduct more electricity than traditional copper or aluminum wire, with minimal power loss. AMSC combines its equipment with full software and management systems, offering turnkey solutions for power generators and grid operators everywhere.

In addition to solutions for the grid, AMSC also has wind power solutions and turbine designs that it licenses to operators.

Finally, as a display of its technological process, AMSC sells power solutions to the U.S. Navy. One particularly interesting technology is its degaussing systems, which lower a ship’s magnetic signature, allowing naval ships to avoid detection by mines at sea.

AMSC just further bolstered its military business with the recent acquisition of NWL, which makes power supplies and controls to military and industrial customers. AMSC only paid about one times sales for NWL, and will likely garner substantial synergies from the deal.

With strong revenue growth and the company’s bottom line just about reaching breakeven, AMSC is a small-cap electrical stock that could do exciting things in the future.

Should you invest $1,000 in Quanta Services right now?

Before you buy stock in Quanta Services, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Quanta Services wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Billy Duberstein and/or his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group. The Motley Fool has a disclosure policy.

U.S. Electricity Demand is Exploding: 3 Stocks to Play its Monster Growth was originally published by The Motley Fool