Broadcom (NASDAQ: AVGO) stock is climbing higher in Tuesday’s trading. The company’s share price was up 5.2% as of 2 p.m. ET, according to data from S&P Global Market Intelligence.

Broadcom stock is gaining ground today following Apple‘s presentation of new mobile and wearable hardware yesterday. Following the event, KeyBanc published a report that listed Broadcom as one of the likely components winners from the launch of Apple’s upcoming iPhone 16 lines.

Is Broadcom poised to score new wins in the iPhone 16?

At its “Glowtime” event yesterday, Apple unveiled four new phones: iPhone 16, iPhone 16 Plus, iPhone 16 Pro, and iPhone 16 Pro Max. The mobile hardware leader also unveiled new AirPods, two new Apple Watch devices, accessories, and software, but it’s the mobile hardware line that’s most significant for Broadcom.

Each of the new iPhone 16 devices will support Wi-Fi 7, which will allow the hardware to send and receive data faster and with more reliable connectivity. KeyBanc expects that Broadcom will be providing key hardware that facilitates the connectivity upgrade, and that seems to be a likely scenario.

What’s next for Broadcom stock?

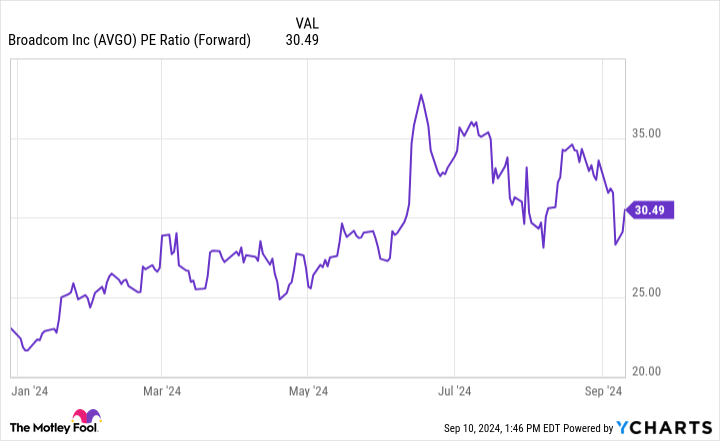

Broadcom stock has seen volatile trading lately. In addition to an uptick in cautiousness about valuations for artificial intelligence (AI) stocks, the company’s most recent quarterly report arrived with forward guidance that disappointed Wall Street and spurred big sell-offs. The company’s share price is down roughly 19% from the high it reached earlier this year, but it’s also up roughly 32% across 2024’s trading.

Following today’s gains, Broadcom is now valued at roughly 30.5 times this year’s expected earnings. The company’s growth-dependent valuation could set the stage for more volatility in the near term, but the technology specialist has strong positioning in connectivity hardware and software categories that look poised to benefit from strong growth trends. For risk-tolerant investors seeking long-term plays in the AI space, Broadcom deserves a close look.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,404!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Why Broadcom Stock Is Gaining Today was originally published by The Motley Fool