In a little over five weeks, voters will head to the polls or mail in their ballots to determine which path forward our great country will take over the coming four years.

Although there are aspects to fiscal governance that have nothing to do with Wall Street, some of the laws crafted on Capitol Hill by elected officials do have bearing on corporate America and/or taxpayers.

Arguably the biggest question mark for Wall Street and the investing community is what might happen to corporate tax rates. Whereas former President Donald Trump’s flagship Tax Cuts and Jobs Act permanently reduced the corporate tax rate from 35% to a historically low 21%, current vice president and Democratic Party presidential nominee Kamala Harris has proposed increasing the corporate tax rate by a third to 28% in order to generate additional revenue.

The million-dollar question is: Will raising the corporate tax rate by 33% cause stocks to plunge? For this answer, I’ll allow history to do the talking.

Kamala Harris aims to increase the corporate tax rate by 33% — should investors be concerned?

Before diving into the meat-and-potatoes of what history has to say about previous instances of corporate tax increases and the response of equities, it’s important to understand the “why” that’s compelling Harris to propose raising taxes of businesses.

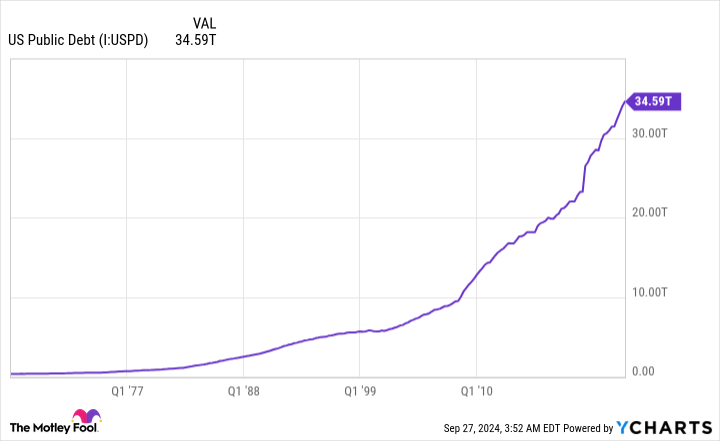

With the exception of 1998 through 2001, the U.S. federal government has spent more than it’s generated in revenue every year since 1970. These nominal-dollar deficits have ballooned over the past two decades, following the dot-com bubble, the financial crisis, and the COVID-19 pandemic. In 2023, the federal deficit neared $1.7 trillion, which has increased U.S. national debt to around $35 trillion.

The cost to service and sustain our national debt is climbing at a worrying pace and simply isn’t sustainable over the long run, which is necessitating proposals from elected officials, including presidential nominee Harris, to raise revenue and/or cut spending.

Harris’s plan to increase the corporate tax rate to 28% would play a vital role in lifting federal tax revenue by an estimated $4.1 trillion from 2025 through 2034, according to an analysis by the Tax Foundation, a Washington, D.C.-based think tank. Keep in mind this estimate includes the entirety of Harris’s tax proposal and isn’t solely based on increasing corporate taxation.

Raising the corporate tax rate, on paper, would seem to be bad news for businesses. A higher tax rate would be expected to leave less income for hiring, acquisitions, and innovation. But what makes sense on paper doesn’t always translate to the real world.

A study by Fidelity analyzed the impact of three separate types of tax increases — personal, corporate, and capital gains — over a roughly seven-decade stretch, beginning in 1950. All told, the analysts at Fidelity examined 13 separate years where at least one of these tax types increased and took into account the performance of the benchmark S&P 500 (SNPINDEX: ^GSPC) in the calendar year prior to, during, and after the tax change in question was made.

There have been five instances since 1950 where the corporate tax rate was increased: 1950, 1951, 1952, 1968, and 1993. The annual price return for the S&P 500 in these years, per Fidelity, was 22%, 16%, 12%, 8%, and 7%, respectively. On average, the S&P 500 has gained 13% when the corporate tax rate climbs.

While history can be fallible and no metric is foolproof when it comes to predicting the short-term future, corporate tax hikes have correlated positively for stocks 100% of the time since 1950.

There’s a bigger worry for stocks, and it has nothing to do with Harris or Trump

Though investors shouldn’t concern themselves too much about the prospect of a corporate tax hike if Kamala Harris is victorious in November, this doesn’t mean the stock market has a clean bill of health.

Regardless of who claims the Oval Office come January 2025, Kamala Harris or Donald Trump, they’ll be inheriting one of the priciest stock markets in history.

Thanks to the rise of artificial intelligence (AI), stock-split euphoria, and corporate earnings, as a whole, blowing past tempered Wall Street expectations, we’ve witnessed the iconic Dow Jones Industrial Average (DJINDICES: ^DJI), widely followed S&P 500, and growth stock-fueled Nasdaq Composite (NASDAQINDEX: ^IXIC), climb to multiple record-closing highs in 2024. But the broadest of these three indexes, the S&P 500, is making noise for all the wrong reasons.

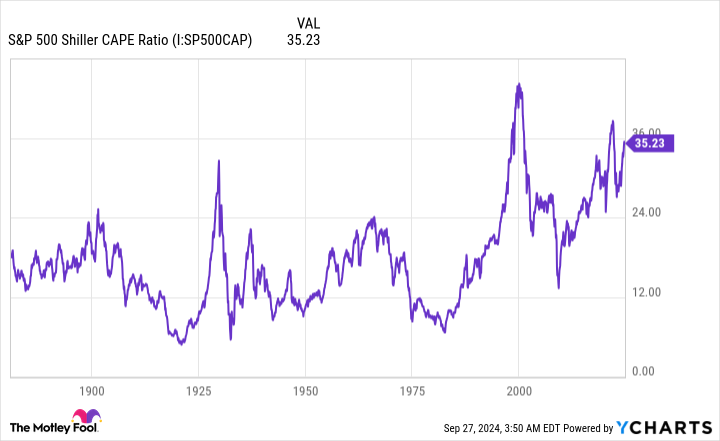

Despite “value” being in the eye of the beholder, the S&P 500’s Shiller price-to-earnings (P/E) ratio, which is also known as the cyclically adjusted price-to-earnings ratio (CAPE ratio), does a remarkably good job of detailing just how outsized valuations are right now compared to the previous 150-plus years.

The P/E ratio is probably the most well-known investing metric. It divides a company’s share price into its trailing-12-month (TTM) earnings per share (EPS) to come up with a figure that can be compared to its peers, the broader market, and history to determine if a company is relatively cheap or pricey.

Meanwhile, the Shiller P/E ratio is based on average inflation-adjusted EPS over the previous 10 years. The advantage of looking at 10 years of inflation-adjusted EPS data as opposed to TTM EPS is that it smooths out shock events (e.g., the COVID-19 pandemic) that can easily throw off shorter-term valuation measures like the traditional P/E ratio.

When the closing bell tolled on Sept. 26, the S&P 500’s Shiller P/E was at 36.9. This more or less matches its high for the current bull market rally and is more than double the average reading of 17.16 when back-tested to January 1871.

What’s more concerning is how stocks have reacted following the previous five instances where the S&P 500’s Shiller P/E topped 30 during a bull market. Though there’s no rhyme or reasons to how long valuations can remain extended, the S&P 500, Dow Jones Industrial Average, and/or Nasdaq Composite have all eventually (key word!) lost between 20% and 89% of their value following these occurrences.

There have only been two other periods in 153 years — prior to the dot-com bubble bursting and late 2021/early 2022 — where stocks have been pricier than they are right now.

Although history doesn’t repeat to a “T” on Wall Street, it often rhymes. No matter what happens on Nov. 5, current stock valuations should be the biggest concern for investors.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Will Kamala Harris’s Plan to Raise the Corporate Tax Rate by 33% Cause Stocks to Plunge? History Couldn’t Be Clearer. was originally published by The Motley Fool