From time to time, companies may repurchase shares of their own stock. Two leading artificial intelligence (AI) players currently buying back stock are Apple (NASDAQ: AAPL) and Nvidia (NASDAQ: NVDA). While buyback programs are often viewed positively by investors, I see the respective decisions from Apple and Nvidia quite differently.

Below, I’ve broken down why it’s important for investors to pay attention to share repurchases, and explain which AI buyback stock I see as the more compelling opportunity right now.

Why do companies repurchase stock?

There are several reasons companies may choose to repurchase stock. One reason for doing so could be that management believes the current share price is below its intrinsic value. Additionally, buyback programs can be a better way to create shareholder value over paying a dividend. Why is that? Well, share repurchase programs have some nuances that are worth noting.

Namely, even if the board of directors authorizes a buyback, the company isn’t required to do it. This means that if a company doesn’t end up buying back shares at all, or only completes a portion of its authorized program, investors are likely to be less disappointed compared to a situation in which management decides to cut its dividend all of a sudden.

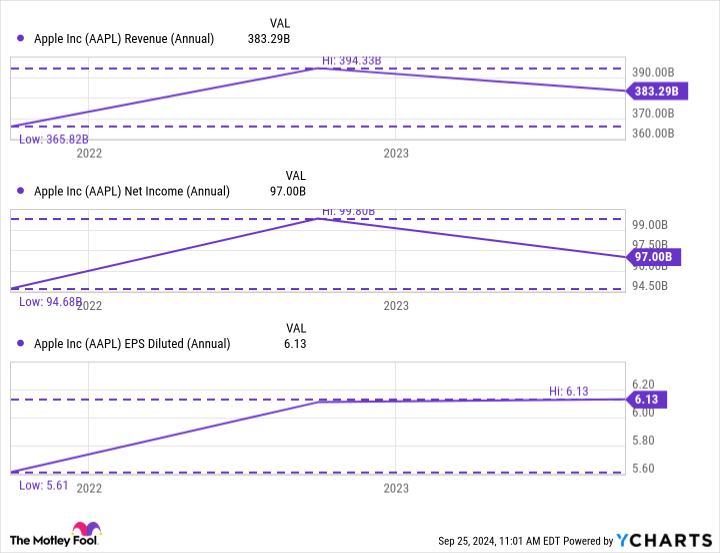

One last important detail to note is that buybacks reduce the outstanding share count for a company. This can give the illusion that earnings per share (EPS) is growing at a faster rate than it really is. This financial engineering mechanism can be particularly useful for businesses that are witnessing decelerating sales or profit growth. In fact, this is the case with Apple.

The stock buyback stock to buy: Apple

Let’s get one thing established right up front: Apple’s revenue and profit growth have been uninspiring for a few years now. The chart below illustrates the lack of growth between the company’s revenue and net income over the last three fiscal years. Despite the inconsistencies, Apple’s EPS has continued to trend upward over the same time period. This EPS growth is largely attributable to consistent buybacks.

You’re probably wondering why I like Apple — a company that isn’t really growing — over Nvidia, the de factor poster child of the AI revolution.

For starters, Apple’s business has been hit hard by macroeconomic forces such as high inflation and rising interest rates over the last couple of years. It’s reasonable that the average consumer hasn’t been in a hurry to upgrade their expensive iPhone.

However, I think consumer spending will start to accelerate given that inflation is showing consistent signs of slowing and the Federal Reserve finally started tapering rates.

These macro factors have come at an interesting time for Apple, as the company just released its new iPhone 16. Moreover, as the company starts rolling out additional hardware integrated with AI-powered services featuring OpenAI, I’m optimistic that Apple’s next growth narrative has arrived.

Last quarter Apple repurchased $26 billion of stock, bringing its trailing-nine-month total to a whopping $70 billion. Moreover, back in May Apple’s board authorized an additional $110 billion buyback program.

When you account for these buybacks overlapping with Apple’s long-anticipated dive into the AI landscape, I’m bullish that even better days are ahead for shareholders. For these reasons, I think Apple stock is a great buy right now.

The stock buyback stock to avoid right now: Nvidia

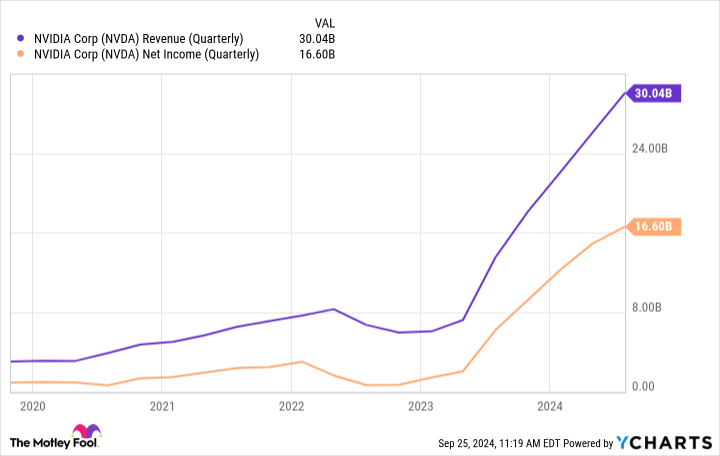

Just look at the slope of the revenue and net income lines for Nvidia. It’s basically the opposite of Apple. Nvidia has been a major beneficiary of the AI movement, largely thanks to sales of its chipsets known as graphics processing units (GPU), which are used for a variety of generative AI applications.

What is really unique about Nvidia is that its earnings are actually growing faster than revenue. This means that the stock is actually less expensive on a price-to-earnings (P/E) basis today than it was a year ago.

Given its valuation compared to historical levels, Nvidia’s management might see the stock as undervalued. This could be something that influenced its recent $50 billion buyback program. One really important detail to highlight is that the new repurchase program does not have an expiration date.

To me, the biggest drawback of investing in Nvidia stock right now stems from competition. Many of Nvidia’s own customers are starting to develop their own GPUs in an effort to compete more directly with the chipmaker and move away from an overreliance on the company’s hardware.

Although it will take some time, I think Nvidia’s pricing power will weaken as more GPUs come to market. In turn, Nvidia’s revenue will decelerate — a dynamic that will likely take a material toll on profit margins.

On top of this, Nvidia currently boasts about $35 billion of cash and equivalents on its balance sheet — less than the authorized $50 billion buyback. Considering there is a good chance that the company’s profitability starts decelerating, I see Nvidia’s buyback as a poor capital allocation strategy in the long run.

In a way, I hope Nvidia does not complete this buyback in its entirety (if at all), as I see this decision as unwise.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 773% — a market-crushing outperformance compared to 168% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Apple made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of September 23, 2024

Adam Spatacco has positions in Apple and Nvidia. The Motley Fool has positions in and recommends Apple and Nvidia. The Motley Fool has a disclosure policy.

1 Artificial Intelligence (AI) Stock-Buyback Stock to Buy Hand Over Fist, and 1 to Avoid (for Now) was originally published by The Motley Fool