Usually, a company’s deletion from the S&P 500 index makes it feel like a stock to avoid. However, a study from Research Affiliates analyzed stocks deleted from the S&P 500, Nasdaq-100, and Russell 2000 indexes and showed that the exact opposite may be the case.

Running a backtest from 1991 to 2018, Research Affiliates found that stocks removed from the major indexes went on to outperform the broader market by five percentage points annually over the next five years.

As counterintuitive as this sounds, it makes some sense. Typically, following the announcement that a stock is leaving an index, it is sold off heavily — often into “value” territory. Thanks to this lower share price and, subsequently, lower valuation, these stocks seem to go on to outperform, partly because they have a lower bar that they need to clear to produce market-beating returns.

One company recently removed from the S&P 500 that looks primed to deliver this bounce-back over the next five years (and beyond) is creativity-focused e-commerce stalwart Etsy (NASDAQ: ETSY). In addition to history suggesting that Etsy could be poised to outperform, here’s what else makes the company an attractive investment as it trades at a once-in-a-decade valuation.

Etsy’s wild ride

Powered by its two-sided network of 9 million sellers and 96 million active buyers, Etsy’s core mission is to “keep commerce human.” Empowering its small-business sellers — 97% of whom operate out of their homes — Etsy’s unique, often personalized, and hand-crafted goods stand in stark contrast to the commoditized goods offered by Amazon or Walmart.

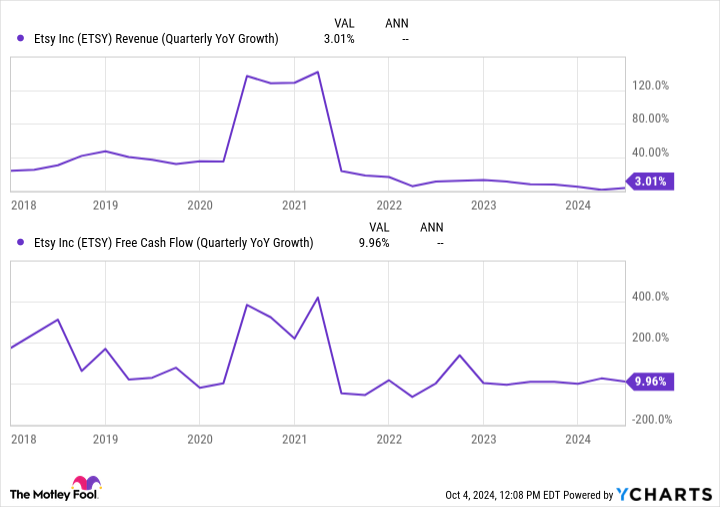

Thanks in part to this counter-positioning moat and the company’s one-of-a-kind product offering, Etsy has grown sales and free cash flow (FCF) by a respective 36% and 42% annually since 2017. However, the ride to generate these impressive growth rates over that time was anything but smooth.

Pulling forward a mind-boggling amount of growth during the pandemic thanks to homemade mask sales and the need to shop from home, the company has struggled to shift gears back to higher sales growth rates. Due to this slowdown, Etsy’s market capitalization plummeted from above $30 billion to its current mark of around $6 billion, which required the S&P 500 to remove it from its index.

Ultimately, there is no denying that Etsy is a much stronger business than it was in 2017. FCF alone is 11 times higher now than it was seven years ago — it just didn’t feel like a great ride. Even so, the company remains home to two promising indicators that point toward outperformance and has one specific growth area that could restart the company’s upward trajectory.

Etsy’s indicators for outperformance

First, there is Etsy’s impressive cash return on invested capital (ROIC) of 40%, which would rank strongly among S&P 500 stocks. A high and rising cash ROIC like Etsy’s, comparing the company’s cash generation to its debt and equity, is often an indicator of future outperformance.

Thanks to this high cash ROIC and robust FCF margin of 25%, the company has begun buying back its shares rapidly at much lower prices, dropping its share count by 9% in just the last three years. Historically, stocks like Etsy, with strong FCF generation and hefty share repurchases, have outperformed the overall market by 5.5 percentage points annually between 2000 and 2019, according to a study from S&P Global.

One final reason to believe in Etsy’s turnaround story is management’s focus on improving its mobile app. Currently, only 45% of the company’s buyers have the Etsy mobile app. Compare this to the fact that the vast majority of millennial digital shoppers already have the Amazon app downloaded, and it is clear to see that this is an area where Etsy needs to grow.

If Etsy can prove successful in converting its buyers over to its mobile app, it could be a massive development for the company as mobile app shoppers generate 75% more purchase days, meaning they buy nearly twice as often.

A once-in-a-decade valuation

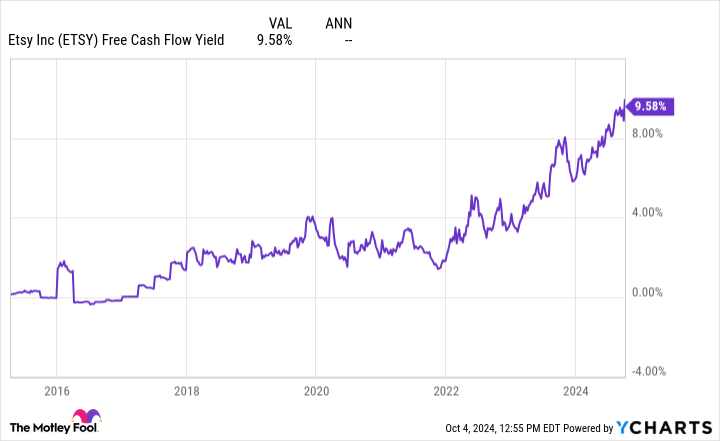

With the stock now down 82% from its all-time highs, Etsy’s 9.6% FCF yield (the inverse of its price-to-FCF ratio, so higher is cheaper) remains at its highest level of the last decade.

Even after accounting for stock-based compensation, Etsy only trades at 15 times FCF, making it roughly half as expensive as the S&P 500 index’s average.

Should Etsy deliver even minor improvements to its mobile app penetration rate or see slight success with its search experience and international operations, it could quickly outgrow this discounted valuation. And if it unfortunately remains cheap for a while, the company’s buybacks will become all the more valuable.

Ultimately, Etsy’s growth story has been a wild one. But it has matured into a cash-generating behemoth that investors shouldn’t ignore now that it isn’t in the S&P 500. In fact, history suggests buying.

Should you invest $1,000 in Etsy right now?

Before you buy stock in Etsy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Etsy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Josh Kohn-Lindquist has positions in Etsy. The Motley Fool has positions in and recommends Amazon, Etsy, and Walmart. The Motley Fool has a disclosure policy.

1 Former S&P 500 Stock Down 82% That History Suggests Buying at a Once-in-a-Decade Valuation was originally published by The Motley Fool