When it comes to the technology industry, many of the high-profile storylines this year have revolved around something related to artificial intelligence (AI). There is one notable exception, though.

For the last few months, cybersecurity company CrowdStrike (NASDAQ: CRWD) has been bogged down by disastrous PR following its errant July 19 update and the resulting outage for millions of computer systems worldwide. Since the incident, shares of CrowdStrike have fallen 16% as of this writing.

But in late August, CrowdStrike reported earnings for its fiscal 2025 second quarter. After learning just how much the outage actually impacted the business so far, you might be inspired to scoop up some shares on the dip.

Hope for the best, prepare for the worst

When CrowdStrike reported earnings last month, many investors were expecting bad news anchored by customer churn, decelerating growth, and a murky outlook. But that largely didn’t happen.

CrowdStrike CEO George Kurtz discussed the outage at the start of the earnings call. After explaining what happened and the lessons the company took away from the experience, Kurtz addressed some of the fallout, including deals that were expected to close in the quarter that are now delayed (but still remain in the pipeline for the most part). Of course, dynamics like that can make growth unpredictable in the short term.

But in an effort to retain customers, management explained that CrowdStrike is offering “customer commitment packages,” which include things like price concessions or more flexible payment options. Management called the initiative an effort to build “long-term loyalty and seed long-term platform adoption.” The idea here is that by offering more price-friendly packages, CrowdStrike may be able to lock in customers for longer contract periods and cross-sell additional applications over the lifetime of the deal.

In the end, management forecasts these new packages will impact recurring revenue to the tune of $60 million throughout the latter half of the year. However, should the company execute on its plan to bolster retention by signing longer-term deals and cross-selling additional products, management believes the packages “will ultimately lead to higher platform and module adoption and deeper partnerships with customers” in the long run.

In other words, it appears CrowdStrike is hoping to sacrifice $60 million of annual recurring revenue (ARR) in the near term in order to support a foundation for longer-term customer relationships. Considering the company reported $3.86 billion of ARR as of July 31, that $60 million seems like a worthwhile sacrifice to help rebuild its reputation.

When in doubt, zoom out

Management’s focus on maintaining its long-term customer relationships is encouraging. During such a tumultuous and abnormal event such as the outage, it can be easy to get bogged down by the current issue and forget about the big picture. This doesn’t appear to be the case with CrowdStrike.

So, while price concessions and flexible payment structures may result in some near-term weakness, the opportunity for CrowdStrike’s engineers, sales teams, and product managers to continue working closely with customers will give them further insight into customer pain points and use cases. This could eventually provide opportunities to get to know customers better while also identifying new cross-selling opportunities.

During the earnings call, CFO Burt Podbere left shareholders with this optimistic outlook, “I think the biggest piece for us is that when we get to the back half of next year, we’ll start to see an acceleration in the business.”

Is CrowdStrike a good stock to buy right now?

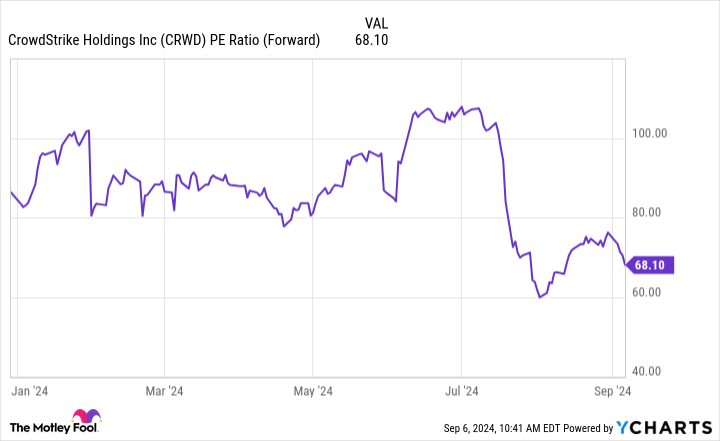

CrowdStrike currently trades at a forward price-to-earnings (P/E) multiple of 68. This is expensive, even for an industry-leading growth stock, but below, you can see just how much the company’s valuation has contracted in the wake of the outage.

Furthermore, even after reporting solid results overall last month, CrowdStrike stock has yet to witness much of a rebound. Given the disparity between the negative sentiment around CrowdStrike’s business and its strong position in reality, I think this is a great time to take advantage of the recent weakness and scoop up shares.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 702% — a market-crushing outperformance compared to 161% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and CrowdStrike made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of September 3, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike. The Motley Fool has a disclosure policy.

1 Growth Stock Down 16% That’s Just Begging to Be Bought Right Now was originally published by The Motley Fool