Celsius Holdings’ (NASDAQ: CELH) energy drink has become wildly popular over the past several years. The company’s rampant sales growth caught PepsiCo‘s attention, leading to an investment and distribution partnership and sizzling investment returns for shareholders. However, Celsius has lost some of its luster throughout this year. The stock has now fallen a whopping 66% from its high.

No stock goes up forever. The question is whether investors should buy the dip or if Celsius’ time in the sun is over.

A sharp decline can completely change a stock’s outlook. Here is why Celsius fell and why investors should consider buying the stock now.

Resetting expectations

Celsius’ energy drink products enjoyed viral popularity beginning during the COVID-19 pandemic. The brand appeals to young and health-conscious consumers with its “Live Fit” marketing angle. Revenue growth accelerated to more than 50% year over year in the pandemic’s early days, then spiked once PepsiCo jumped into the picture in 2022.

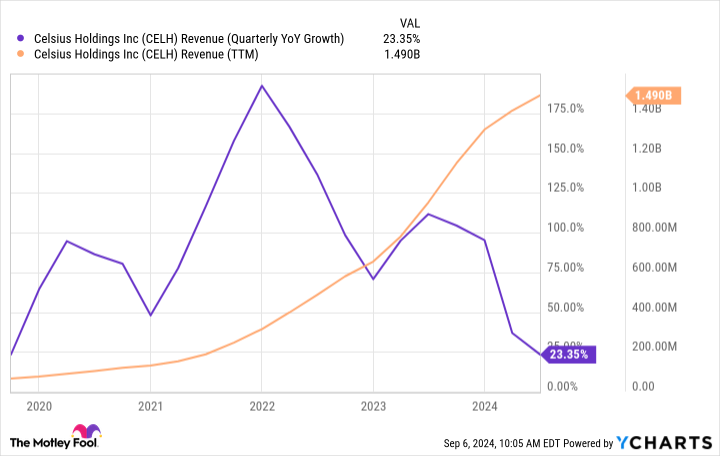

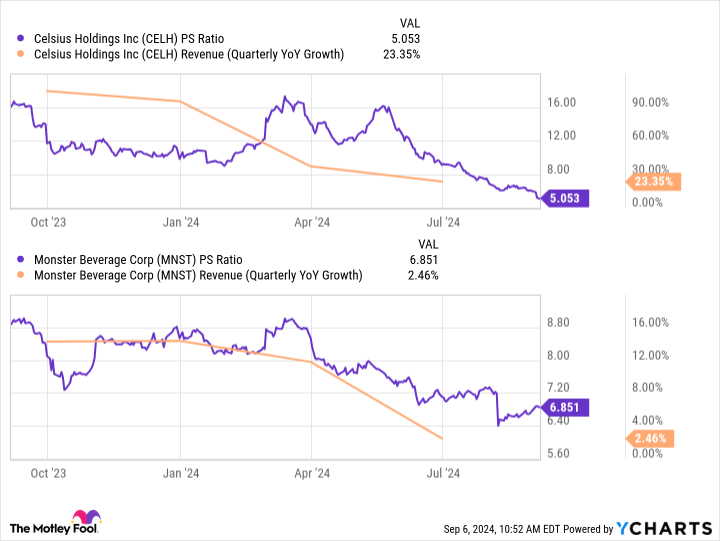

PepsiCo has become Celsius’ primary distribution partner, opening up access to more points of sale and helping Celsius launch in new markets. Year-over-year sales growth peaked at more than 175%. But with high growth comes high expectations. Celsius’ price-to-sales (P/S) ratio jumped to 17, more than double that of its chief competitor, Monster Beverage.

As you can see above, growth rates have slowed dramatically. Not only is triple-digit growth a tough follow-up act, but PepsiCo’s initial surge to fill inventories pulled some growth forward. In its Q2 earnings call, management noted that PepsiCo’s inventory movements created a headwind of $20 million to $30 million during the quarter. Celsius is a much larger company today with $1.5 billion in annual sales; it’s unlikely that revenue will grow by triple digits again.

In other words, the market has reset its expectations (valuation) for Celsius to a new reality of slower growth.

Looking forward

Celsius isn’t done growing just because the business isn’t growing at 100% anymore. The company’s $402 million in Q2 sales was still a 23% increase over the prior year. If you add in the $20 million to $30 million headwind due to PepsiCo’s inventory, growth would have been at least 5 percentage points higher. There are two take-home points for investors here.

First, Celsius is still gaining market share from its competition. The company’s North American sales grew 23% year over year in Q2. The energy drink market isn’t growing that fast; according to Mordor Intelligence, the energy drink market in North America will grow at a low-single-digit rate through 2030. Mathematically, Celsius’ growth is coming from somewhere. Monster Beverage is a top competitor and only grew North American sales by 3% year over year in Q2. Celsius is likely outperforming other brands.

Second, Celsius’ international growth story is very early. Success isn’t a given, but PepsiCo’s distribution support will significantly help. International sales grew 30% year over year in Q2 but represented just 5% of total sales, so it doesn’t move the needle. This year, Celsius launched in six new countries; the international growth story could become more important over time.

There is no reason Celsius can’t maintain double-digit sales growth for a while yet.

Assessing the stock’s long-term potential

Investors could be poised for strong investment returns if that’s the case.

Despite growing sales much faster than Monster, the stock is cheaper than Monster:

Celsius is profitable under generally accepted accounting principles (GAAP) with similar profit margins to Monster, so it’s hard to argue that Celsius’ revenue isn’t as “high-quality” as Monster’s and would thus deserve a lower valuation. Instead, Celsius’ stock seems oversold and mispriced relative to its peers. The stock doesn’t need a higher P/S ratio if sales keep growing at a double-digit pace; the growth alone would drive the share price higher over time.

Investors shouldn’t let the adverse price action write the narrative about Celsius stock. The company is doing well, and the stock’s valuation more than compensates for slower long-term growth. The stock wasn’t a great buy at its highs, but it’s a compelling investment idea today.

Should you invest $1,000 in Celsius right now?

Before you buy stock in Celsius, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Celsius wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Celsius and Monster Beverage. The Motley Fool has a disclosure policy.

1 Growth Stock Down 66% to Buy Right Now was originally published by The Motley Fool