Last week, Nvidia (NASDAQ: NVDA) reported solid financial results for the second quarter, but the stock has now tumbled 20% from its high. The drawdown was fueled by concerns about the sustainability of the artificial intelligence (AI) boom and the delayed launch of Blackwell, Nvidia’s next generation of data center chips.

That represents a dramatic change in market sentiment for the semiconductor company. Only three months ago, Nvidia announced a 10-for-1 stock split alongside phenomenal first-quarter financial results, and that news caused shares to surge 20% during the following week.

But Nvidia is still on pace to be a $10 trillion company by 2030, according to Beth Kendig, lead technology analyst at the I/O Fund. She remains upbeat about Blackwell and expects an upward revision in the consensus earnings estimate for the next fiscal year. “Early next year will be fireworks again for Nvidia, and we will be on track for that $10 trillion,” she told Yahoo Finance.

Former hedge fund manager and current Mad Money host Jim Cramer came to the same conclusion several years earlier. In 2021, he told CNBC’s Halftime Report that Nvidia could eventually be a $10 trillion company, and his conviction has not wavered. “I stand by my view that you should own Nvidia stock and not trade it,” Cramer recently told viewers.

Nvidia is currently worth $2.6 trillion, so the $10 trillion target set by Kendig and Cramer implies 285% upside for shareholders. Here’s what investors should know.

Nvidia has a durable competitive advantage in AI chips

Nvidia is best known for its graphics processing units (GPUs), chips that complete complex calculations orders of magnitude faster than central processing units (CPUs). The company accounted for 98% of data center GPU shipments last year, and its GPUs accounted for over 80% of AI processors, according to analysts. Nvidia is also the market leader in AI networking equipment, according to Morningstar.

However, Nvidia is truly formidable because it pairs cutting-edge hardware with proprietary CUDA software. The CUDA platform includes over 400 software libraries (building blocks) that streamline GPU application development across a broad range of disciplines. Nvidia launched CUDA in 2006, and the ecosystem is still expanding. For instance, the company added new libraries for data processing, generative AI, and physics simulations in August.

Morgan Stanley analysts wrote in a recent note, “We have seen many threats to Nvidia come and go since 2018 — something like a dozen start-ups, several efforts from merchant competitors such as Intel and AMD, and several custom designs. Most of these have come up short. Competing with Nvidia, a company that spends over $10 billion per year in R&D, is a difficult feat.”

Blackwell GPUs could be the most important product in Nvidia’s history

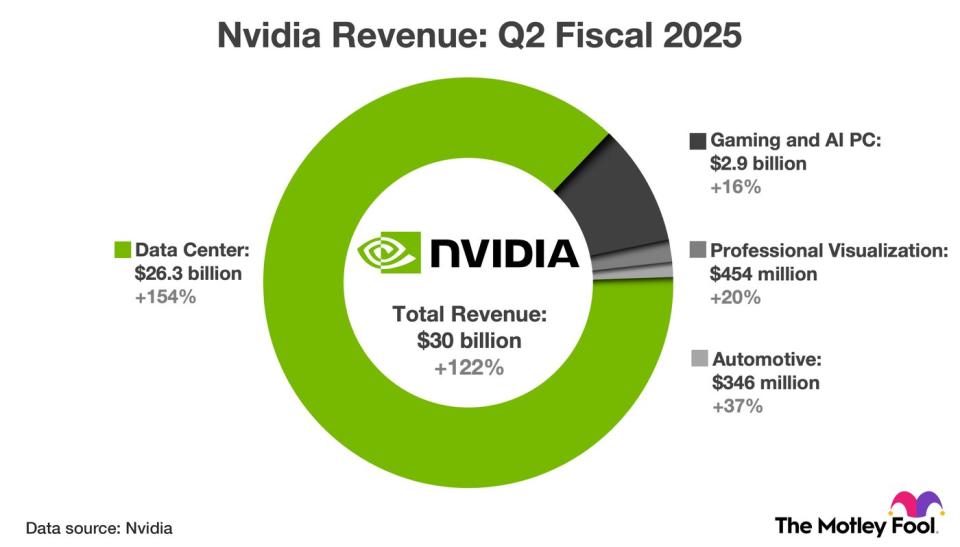

Last week, Nvidia reported excellent financial results for the second quarter of fiscal 2025 (ended July 2024). Revenue increased 122% to $30 billion as demand for AI hardware and software drove strong sales growth in the data center segment. Meanwhile, non-GAAP (generally accepted accounting principles) net income surged 152% to $0.68 per diluted share.

The chart below provides segment-specific revenue figures for the second quarter.

Shown above is second-quarter revenue growth across Nvidia’s four primary business segments. OEM & Other revenue has been excluded because it accounted for less than 1% of total revenue.

In August, The Information published a report alleging that Blackwell GPU shipments would be delayed due to design flaws discovered unusually late in production. Nvidia CFO Colette Kress provided context on the recent earnings call: “We executed a change to the Blackwell GPU mass to improve production yields. Blackwell production ramp is scheduled to begin in the fourth quarter.”

That means Blackwell will hit the market about three months later than originally quoted by management. But CEO Jensen Huang still believes the platform will be a game changer for the industry. In fact, he recently told analysts, “The Blackwell architecture platform will likely be the most successful product in our history.”

Nvidia stock trades at a reasonable valuation

Wall Street analysts expect Nvidia’s adjusted earnings to increase at 49% annually through fiscal 2026 (ends January 2026). That consensus estimate makes its current valuation of 48 times adjusted earnings look reasonable.

As for the $10 trillion target Beth Kendig and Jim Cramer set, I think Nvidia could hit the milestone by 2030. For instance, if we assume the price-to-earnings ratio falls to 25 by the end of the decade, Nvidia would achieve a $10 trillion valuation if earnings increased at 36% annually.

That is well within the realm of possibility. In fact, spending across AI hardware, software, and services is expected to increase by 36% annually through 2030, according to Grand View Research. However, investors should not take that outcome for granted. A lot could go wrong in the next six and a half years.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

1 Stock-Split Artificial Intelligence (AI) Stock to Buy Before It Soars 285%, According to Certain Wall Street Experts was originally published by The Motley Fool