Companies with high dividend yields can seem attractive, but there is far more to income stocks than above-average yields. Any corporation’s payouts are in danger without a robust business backing it up. That’s why choosing the right dividend stock requires looking beyond the yield and into the company’s fundamentals.

Let’s illustrate that with two examples: Pfizer (NYSE: PFE), and Medical Properties Trust (NYSE: MPW). While both have attractive yields, the former is a worthy investment, but the latter, not so much. Here’s why.

The high-yield stock to buy: Pfizer

The drugmaker’s stock isn’t popular on the market right now, with shares significantly lagging the market over the past two years. In the meantime, the stock’s dividend yield rose, and as of this writing, it stands at 5.7%. Despite Pfizer’s issues, the company can maintain its dividend program.

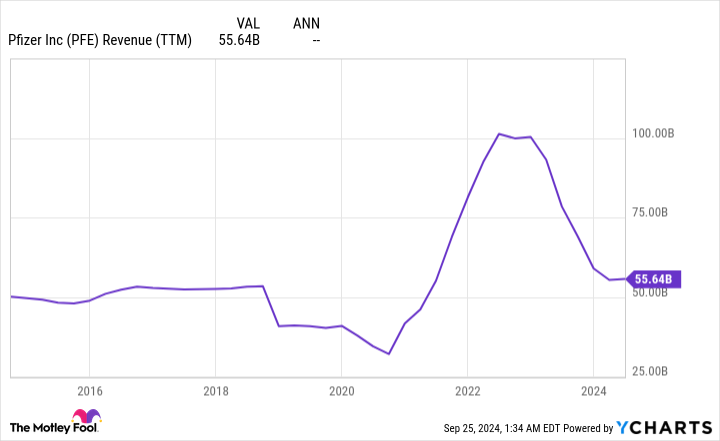

To be fair, Pfizer’s financial results are relatively poor compared to what it delivered in 2021 and 2022 — two years during which its sales skyrocketed thanks to its work in the coronavirus area. Yet, its top line inflected well above pre-pandemic levels, a very encouraging sign that points to secular growth in the business.

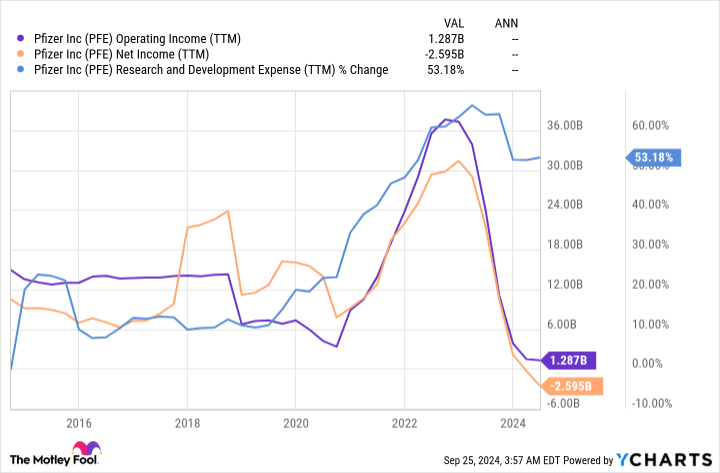

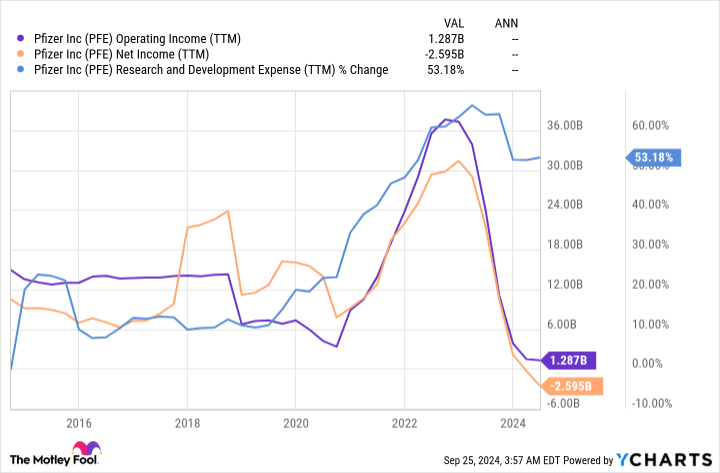

Pfizer’s COVID-19 drugs will eventually stop affecting its results as much. Moreover, there’s no letup in the company’s research & development expenses (which are far higher than pre-pandemic levels) that saw operating and net income drop below pre-COVID levels.

And so there is a strong possibility that a whole lot of products are in the pipeline, which should help the company return to profitable growth. Currently, Pfizer’s pipeline has over 100 programs. But two areas where the company is focusing its research efforts, and worth a special mention, are in the weight loss space and oncology.

The lucrative GLP-1 weight loss field is growing rapidly. Pfizer’s candidate, oral danuglipron, recently performed well in a phase 2 study.

Then, there are the company’s efforts in oncology. Pfizer acquired Seagen, an oncology specialist, for $43 billion. CEO Albert Bourla said of the acquisition: “We are not buying the golden eggs. We are acquiring the goose that is laying the golden eggs.” Seagen had several approved cancer drugs and a deep pipeline, but it was a much smaller company than Pfizer, with less funding and smaller footprints in the industry. Now that they are a single entity, Pfizer should become a much more prominent player in oncology.

So, despite a poorer showing over the last year or so, the company’s underlying business boasts excellent prospects. Pfizer’s dividend should be safe. It has increased its payouts by 17% in the past five years. Pfizer is a reliable, high-yield dividend stock to buy and hold.

The high-yield stock to avoid: Medical Properties Trust

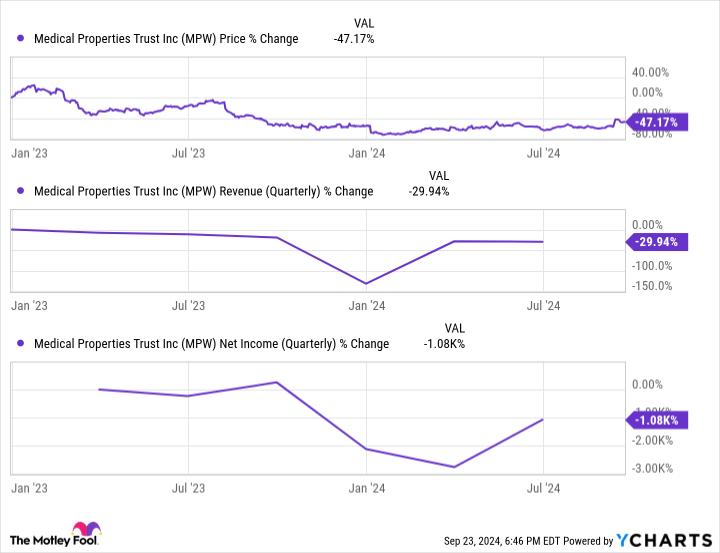

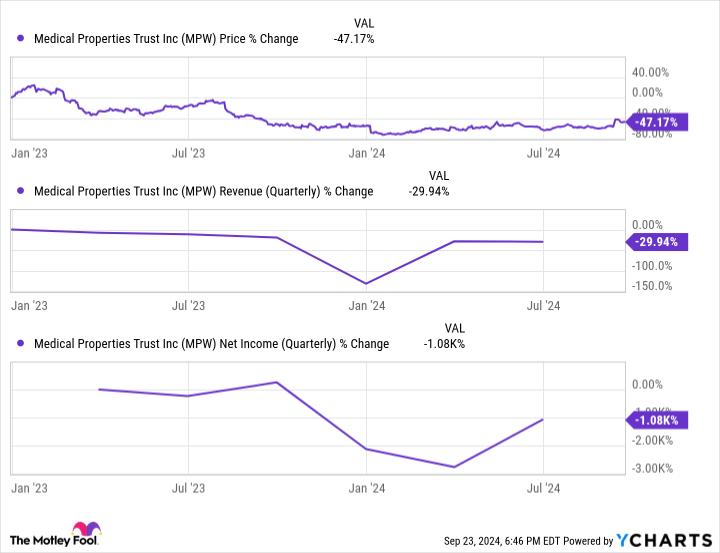

Medical Properties Trust (MPT), a healthcare-focused real estate investment trust (REIT), has been bruised and battered since early 2023. The company’s revenue, earnings, and share price have all moved in the wrong direction.

Unlike in Pfizer’s case, this isn’t because MPT was falling from incredible heights. Here’s the reason. Steward Healthcare, one of its important tenants, had trouble keeping up with rent payments. Steward officially filed for bankruptcy in May.

As a result of this issue, MPT had no choice but to slash its dividends. It has done it twice since mid-2023. MPT’s yield remains impressive at 5.56%. Still, dividend seekers loathe payout cuts, so MPT might not be the best option right now.

Some will object that the company looks on the verge of putting its Steward-related problems in the rearview mirror. True enough. MPT recently reached agreements to put new tenants in 15 of the 23 hospitals previously operated by Steward Healthcare. The average term of the lease is about 18 years.

But as per the agreement, these new tenants won’t start paying rent until the first quarter of 2025, and even then, they will only pay half of the contractual agreement by the end of next year. They will gradually ramp things up until they reach the total amount in fourth-quarter 2026.

This is a win for MPT: It gets rid of its troubled tenant and replaces it with four new ones (more diversification), which (unless financial problems also arise with them) will pay regular and predictable amounts until at least 2042 on average. However, MPT still has work to do in fixing its business. It has yet to find solutions for some of Steward’s former facilities, including some hospitals under construction.

Even if it had, given the issues it has faced lately, I’d recommend staying away from the stock, at least for now. Yes, MPT is improving its business, but it’s best to watch how things unfold from the sidelines until it can prove that it is officially back by delivering consistently good results.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

1 Ultra-High-Yield Healthcare Stock to Buy Hand Over Fist and 1 to Avoid was originally published by The Motley Fool