Income investors looking for solid dividends of companies poised to rebound shouldn’t overlook the following two stocks. Both stocks are dealing with headwinds and slowing growth, but offer solid and steady dividends while you wait for headwinds to subside. Here’s a closer look at Genuine Parts (NYSE: GPC) and J.M. Smucker (NYSE: SJM).

Unflattering guidance

Established nearly 100 years ago, Genuine Parts is a leading global service company that specializes in the distribution of automotive and industrial replacement parts with a vast network of over 10,700 locations across 17 countries.

If you’re looking for an income stock that’s currently out of favor with the market, look no further than Genuine Parts. Over the past six months, the stock and the S&P 500 have moved in opposite directions, with the former posting a 9% decline and the latter a 9% gain.

Part of its lagging stock price has to do with recent financial guidance updates, which weren’t flattering. Full-year total sales growth went from a range of 3% to 5% down to a range of 1% to 3%. Adjusted earnings per share (EPS) dropped from a range of $9.80 to $9.95 down to a range of $9.30 to $9.50.

But with Genuine Parts, investors get an incredibly stable business, despite its current slowdown. In fact, between 2013 and 2023 the 10-year compound annual growth rate (CAGR) for revenue was a healthy 7%, and the 10-year CAGR of adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) was an impressive 8%.

The good news for investors is that while the prices for new cars remain high, it pushes demand for replacement parts higher as more consumers repair instead of purchase new. Also impressive is the company’s track record of dividends, with 2024 representing the company’s 68th consecutive year of dividend increases. It boasts a current dividend yield of 2.8%, which is a yield worth taking notice of while waiting for headwinds to subside for the company.

Innovation on deck

J.M. Smucker is a leading retailer of food for both people and pets, and it offers well-known brands such as Folgers, Dunkin’, Café Bustelo, Jif, Smucker’s, Hostess, and Meow Mix, among many others. The company also boasts 95% of U.S. retail channel sales from categories it holds the No. 1 or No. 2 brand position and its products are found in over 90% of U.S. homes.

J.M. Smucker finds itself in a similar position as Genuine Parts: Slower-than-desired growth paired with reduced guidance led to the company’s stock trailing the S&P 500 over the past six months. You might not notice the growth struggle if only glancing at the fiscal 2025 first-quarter results. That’s because net sales increased by $319.9 million, or 18%. However, when you back out the company’s recent acquisition of Hostess Brands and currency exchange, net sales increased a much more modest 1%.

J.M. Smucker also updated its full-year guidance, lowering net sales growth down to a range of 8.5% to 9.5%, from it previous guidance of 9.5% to 10.5%. It also expects lower adjusted earnings per share and free cash flow. The company is hoping its push for innovation will help reverse its slow growth. J.M. Smucker is working to increase market share of Café Bustelo across the U.S. market, introducing new Jif To Go nut spreads, new marketing and merchandising for Crustables, and the first Hostess product that can be microwaved, with its Meltamors.

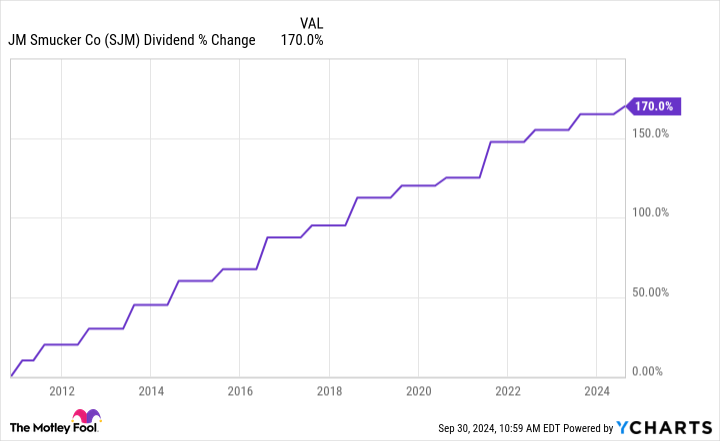

Ultimately, you can see the consistent growth in JM Smuckers’ dividend over time, and it offers a current dividend yield of 3.5% while investors wait for innovation and acquisition synergies to improve the company’s financials.

Buy now

Both of these companies are dealing with retail headwinds that are hindering growth, and that’s why savvy long-term shareholders should largely ignore the cyclicality of the retail industry. Both of these companies have a pathway to growing sales through innovation, and both should get on track over the next year. In the meantime you have two companies with proven track records of delivering value to shareholders through stable dividends.

Should you invest $1,000 in J.M. Smucker right now?

Before you buy stock in J.M. Smucker, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and J.M. Smucker wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends J.M. Smucker. The Motley Fool has a disclosure policy.

2 Down-on-Their-Luck Dividend Stocks Poised to Rebound was originally published by The Motley Fool