Nvidia (NASDAQ: NVDA) stock has delivered stunning returns once again in 2024 following a blistering performance last year, but a closer look at the company’s price chart will tell us that it has lost momentum over the past three months.

Nvidia stock has remained flat during this period because of doubts surrounding the company’s artificial intelligence (AI)-related prospects and its ability to continue delivering eye-popping growth. Investors may be wondering if they should be buying more shares of this semiconductor giant or start booking profits. However, it won’t be surprising to see Nvidia stock regaining its mojo and delivering another stellar year in 2025.

In this article, we will check out a couple of reasons why buying Nvidia stock before 2025 is a no-brainer.

Nvidia is expected to ship more AI chips next year

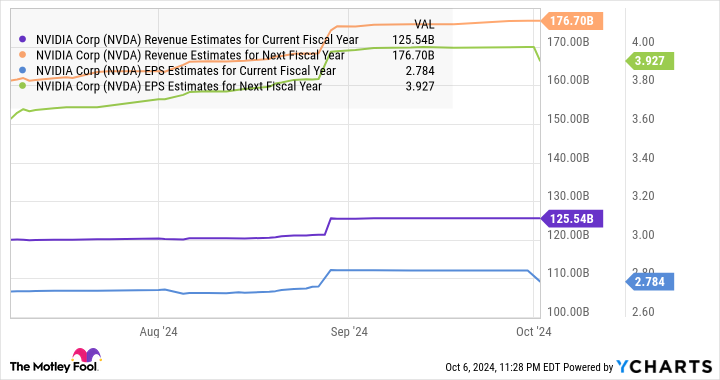

Analysts are expecting Nvidia to witness a substantial increase in shipments of its AI graphics processing units (GPUs) in 2025. Market research firm TrendForce believes that Nvidia could witness a 55% increase in shipments of its AI GPUs next year, driven by the arrival of the company’s next-generation Blackwell processors.

TrendForce estimates that Blackwell will account for 80% of Nvidia’s AI GPU shipments next year. This also means that the shipments of Nvidia’s older generation Hopper chips will continue to remain solid as well in 2025. The good part is that TrendForce isn’t the only one expecting a jump in Nvidia’s AI GPU sales next year.

Japanese investment bank Mizuho has raised its estimate for Nvidia’s 2025 AI GPU shipments by 8% to 10% as compared to its prior estimate issued in July this year. Mizuho credits this upward revision to an improvement in the company’s supply chain. More specifically, Nvidia’s foundry partner Taiwan Semiconductor Manufacturing (popularly known as TSMC) is reportedly going to double its advanced packaging capacity, which will allow the former to manufacture more AI GPUs.

Moreover, TSMC plans to continue increasing its advanced packaging capacity beyond next year as well. The foundry giant believes that it will be able to clock an annual growth rate of at least 60% in its chip-on-wafer-on-substrate (CoWoS) packaging capacity through 2026. This should place Nvidia in a nice position to capitalize on the fast-growing demand for AI chips.

Allied Market Research estimates that sales of AI chips could increase at an annual rate of 38% through 2032, generating $384 billion in annual revenue. Nvidia is the dominant player in the AI chip market with a market share that’s estimated between 70% and 95%, though a closer look at its AI revenue as compared to that of its rivals will indicate that its share is likely at the higher end of that range.

More importantly, TSMC’s improving production profile should ensure that Nvidia maintains its dominance in the AI chip market. So, higher sales of AI GPUs should translate into solid growth for Nvidia in the next fiscal year, while its pricing power in this market would lead to healthy growth in its bottom line as well.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

The valuation shouldn’t be a concern considering its potential growth

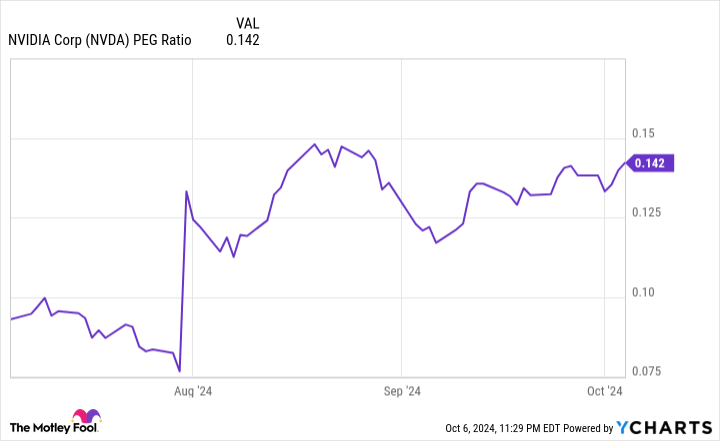

Some might point out that Nvidia is richly valued right now with a trailing price-to-earnings ratio (P/E) of 58, which is higher than the Nasdaq-100 index’s average earnings multiple of 32. But at the same time, Nvidia has been able to justify its valuation with outstanding growth. In fact, Nvidia’s earnings multiple is currently lower than its five-year average P/E of 72.

Also, Nvidia’s price/earnings-to-growth ratio (PEG ratio) of just 0.14 means that the stock is very much undervalued considering the growth that it is forecasted to deliver.

NVDA PEG Ratio data by YCharts

The PEG ratio is a valuation metric that takes into account the potential earnings growth that a company could deliver. A reading of less than 1 means that the said stock is undervalued. That’s why now would be a good time for investors to load up on Nvidia stock before the potential jump in sales of the company’s AI chips in 2025 sends it soaring.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $814,364!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

2 Massive Reasons to Buy Nvidia Stock Before 2025 was originally published by The Motley Fool