Dividend-paying stocks have long been a cornerstone of many passive income strategies. However, some dividend stocks are decidedly superior candidates for a passive income portfolio.

For instance, research shows that companies with payout ratios below 75% are less likely to cut or suspend their dividends, making them more dependable income sources. Stocks with even lower payout ratios — below 50% — may offer an extra layer of security and room for future dividend growth.

Two stocks in the aerospace and defense industry stand out in this regard. Northrop Grumman (NYSE: NOC) and Howmet Aerospace (NYSE: HWM) both sport conservative payout ratios, with Howmet’s well below the 50% mark and Northrop’s hovering near that critical threshold. This financial prudence suggests a solid foundation for ongoing dividend payments and the potential for substantial increases in the years ahead.

Here’s why passive income investors may want to consider buying and holding these two dividend stocks.

Northrop Grumman: A passive income powerhouse

Northrop Grumman, founded in 1939, is one of the world’s largest defense contractors and a notable passive income generator. The company’s diverse portfolio encompasses aircraft, defense, mission, and space systems. With annual revenues on track to break $40 billion this year, Northrop Grumman continues to demonstrate strong growth in the aerospace and defense industry.

Northrop Grumman’s stock stands out for its solid passive income potential. It currently offers a yield of 1.58%, with a five-year annualized dividend growth rate of 7.27%. The company also maintains a conservative payout ratio of 49.8%, suggesting room for future increases in passive income through dividend growth.

The company’s long-term growth potential is underpinned by its involvement in key military development programs, such as the Ground Based Strategic Deterrent program and the ongoing development of the cutting-edge B-21 bomber.

Northrop Grumman’s revenue relies heavily on government defense spending, which introduces an element of political risk. However, this risk is mitigated by the historical upward trend in global defense budgets.

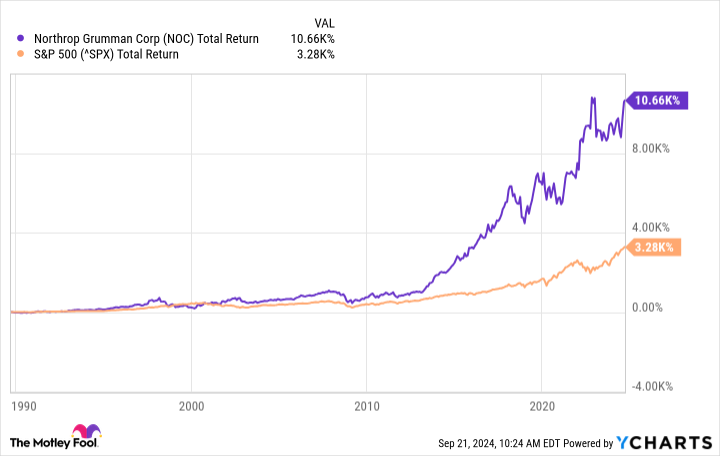

The company has consistently capitalized on this trend, delivering market-beating returns over time. With worldwide defense spending continuing to rise, Northrop Grumman appears well positioned to maintain its strong performance.

Northrop Grumman’s combination of a growing dividend, involvement in long-term defense projects, and exposure to emerging aerospace technologies makes it an attractive option for passive-income seekers. The company offers investors the potential for both steady passive income and long-term growth.

Howmet Aerospace: A renewed focus on dividend growth

Howmet Aerospace is a leading provider of advanced engineered solutions for the aerospace and transportation industries. The company operates through four segments: Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels.

Howmet Aerospace’s recent 60% dividend hike, combined with its established market position, makes it an intriguing passive income play. The company currently offers a modest 0.33% yield with a highly conservative 8.44% payout ratio, suggesting ample room for future increases in its quarterly cash distribution.

Howmet Aerospace’s business model is driven by demand for its engine products and fastening systems from plane makers catering to the surge in air travel demand. This strong market position has allowed the company to raise its full-year forecasts and increase its quarterly dividend in recent years.

It’s worth noting that Howmet Aerospace has cut its dividend in the not-so-distant past, suspending it to preserve cash during the pandemic. However, the company’s recent dividend hike and improved outlook signal a potential return to robust dividend growth.

Two top passive income candidates

Northrop Grumman and Howmet Aerospace screen as attractive candidates for a passive income portfolio. These two defense stocks offer an intriguing blend of current yield, dividend growth potential, and sustainability — three key traits shared by the best passive income stocks.

Should you invest $1,000 in Northrop Grumman right now?

Before you buy stock in Northrop Grumman, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Northrop Grumman wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

George Budwell has positions in Howmet Aerospace and Northrop Grumman. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2 Top Passive Income Stocks With Payout Ratios Below 50% was originally published by The Motley Fool