Steel is a key building block of the modern world, going into everything from vehicles to buildings to household appliances. Steel demand is set to be robust, with a boom in mega projects (like data centers), each worth at least $1 billion. There have now been $1.4 trillion worth of mega projects announced since 2021, all of which will make heavy use of steel. But steel stocks are cyclical, so make sure you stick with companies that can best weather the full steel cycle. Here’s what you need to know.

The old way and the new way

There are two broad ways to make steel, blast furnaces and electric arc mini-mills. Blast furnaces have been around for a very long time. They use metallurgical coal and iron ore to create primary steel. These mills are vital to the world’s steel production, but blast furnaces are very expensive to operate. When steel demand is strong, blast furnaces tend to make a lot of money because they operate at high utilization rates. When steel demand is weak, they often lose money — sometimes quite a bit of money — because they aren’t selling enough steel to cover their operating costs.

The newer method of making steel, electric arc mini-mills, uses scrap metal and electricity. These mills are far easier to ramp up and down with demand, so they can operate profitably even as steel markets pull back. Electric arc mini-mills alone aren’t enough to supply the world with the steel it needs, but the more-modern technology has a clear edge on the profitability front.

Steel stocks to avoid, unless you want to play the cycle

Cleveland-Cliffs (NYSE: CLF), once a supplier of iron ore to the North American steel industry, bought its way into the steel sector by acquiring several large regional steel makers. Its portfolio of mills is dominated by blast furnaces. Iconic United States Steel (NYSE: X) was founded when the only technology available was blast furnaces. Today, it’s branching out to include electric arc mini-mills as it looks to provide a broader product line to customers. That’s better, but still not great.

Both these companies are likely to see huge earnings advances in good times, but the bad times in the steel industry will likely be quite painful, financially speaking, thanks to the steel-making technology they use.

U.S. Steel is also in the middle of a cross-border acquisition drama. There are both financial and political angles to the company’s plan to be bought out by a Japanese competitor. Most investors would likely be better off avoiding what could be a very dramatic and headline-grabbing stock.

Two stocks to buy for the long term in the steel sector

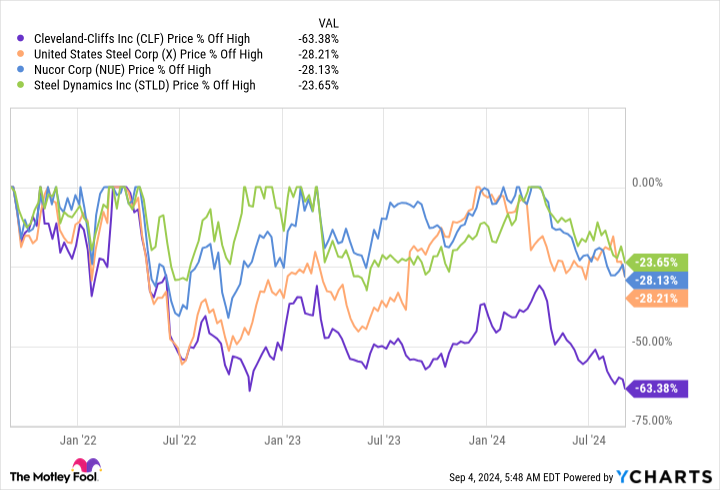

That brings us to Nucor (NYSE: NUE) and Steel Dynamics (NASDAQ: STLD), both of which use more modern electric arc mini-mills. From this perspective, their businesses are likely to be more consistent through the cyclical steel industry’s ups and downs. They won’t likely be as profitable as U.S. Steel or Cleveland-Cliffs in good years, but they won’t be as unprofitable during bad years, either. In fact, Nucor and Steel Dynamics have a pretty impressive history of remaining profitable through the entire steel cycle, with only rare exceptions.

Nucor is the older, larger, and more diversified of the two companies. It’s more of a slow-moving giant. Steel Dynamics is the upstart, with a faster growth rate (for the steel industry) and an expanding reach, both geographically and with regard to product offerings. Conservative investors will probably prefer Nucor, while more growth-minded types will likely find Steel Dynamics appealing.

Although one could use any number of metrics to highlight these companies’ consistency, one of the easiest is dividends. Nucor is a Dividend King with a huge 51 consecutive annual dividend increases under its belt. That’s pretty incredible given the steel sector’s cyclical nature, speaking directly to its ability to reward investors while managing through good and bad times. Steel Dynamics is a much younger company, founded by former Nucor employees, with a streak of 13 consecutive annual dividend increases.

There’s opportunity in steel, but choose wisely

Given the large-scale construction boom in North America that’s starting to ramp up, investors might be thinking about jumping into the steel sector. To be fair, there are countercurrents here, notably from an increasing flow of low-priced imports that are depressing prices. But that isn’t exactly a new phenomenon, so don’t let it dissuade you from looking at the steel sector.

If you do want to put some money into steel stocks, the best options for long-term investors are likely to be Nucor and Steel Dynamics. Their businesses are advantaged relative to peers, and they have a proven track record of rewarding investors through the entire steel cycle.

The best part? Both Nucor and Steel Dynamics are between 20% and 30% below their recent highs. Now appears to be an attractive time to consider these leading steel makers for your portfolio.

Should you invest $1,000 in United States Steel right now?

Before you buy stock in United States Steel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and United States Steel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Reuben Gregg Brewer has positions in Nucor. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2 Top Steel Stocks to Buy in September was originally published by The Motley Fool