Over the last 7 days, the Australian market has dropped 1.7%, but it is up 8.8% over the past year with earnings expected to grow by 12% per annum in the coming years. In this context, dividend stocks with strong yields can provide a reliable income stream and potential for growth, making them an attractive option for investors seeking stability and returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In Australia

|

Name |

Dividend Yield |

Dividend Rating |

|

Perenti (ASX:PRN) |

7.92% |

★★★★★☆ |

|

Collins Foods (ASX:CKF) |

3.66% |

★★★★★☆ |

|

Nick Scali (ASX:NCK) |

4.44% |

★★★★★☆ |

|

Fiducian Group (ASX:FID) |

4.92% |

★★★★★☆ |

|

MFF Capital Investments (ASX:MFF) |

3.67% |

★★★★★☆ |

|

Super Retail Group (ASX:SUL) |

6.56% |

★★★★★☆ |

|

National Storage REIT (ASX:NSR) |

4.51% |

★★★★★☆ |

|

Premier Investments (ASX:PMV) |

3.88% |

★★★★★☆ |

|

Ricegrowers (ASX:SGLLV) |

6.29% |

★★★★☆☆ |

|

Grange Resources (ASX:GRR) |

8.00% |

★★★★☆☆ |

Click here to see the full list of 34 stocks from our Top ASX Dividend Stocks screener.

Here’s a peek at a few of the choices from the screener.

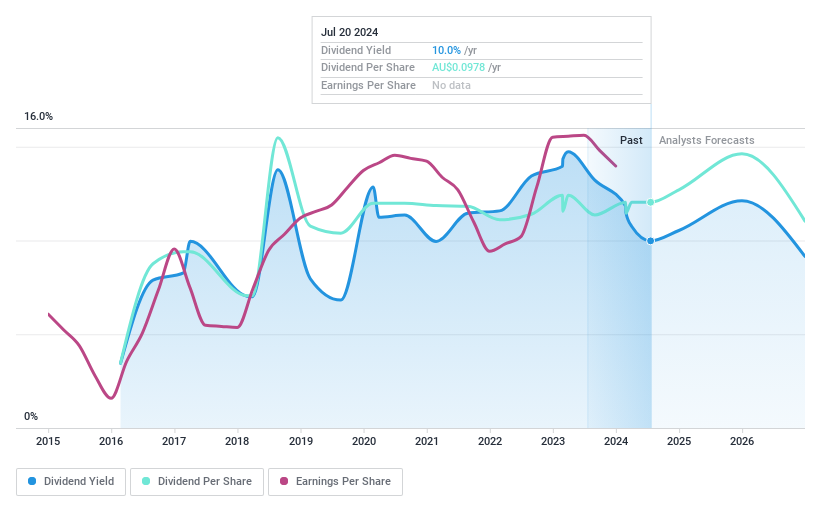

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kina Securities Limited (ASX:KSL) operates in Papua New Guinea, offering commercial banking, financial services, fund administration, investment management, and share brokerage services with a market cap of A$403.69 million.

Operations: Kina Securities Limited generates revenue from its Banking & Finance segment (PGK 391.80 million) and Wealth Management segment (PGK 39.65 million).

Dividend Yield: 9.6%

Kina Securities announced a A$0.04 per share dividend for the six months ended June 30, 2024, with a payment date of October 4, 2024. Despite an increase in net interest income to PGK111.71 million from PGK98.23 million, net income declined slightly to PGK42.24 million from PGK46.37 million year-over-year. The company’s dividends are covered by earnings (75.5% payout ratio), but its dividend history is volatile and it has a high level of bad loans (7.9%).

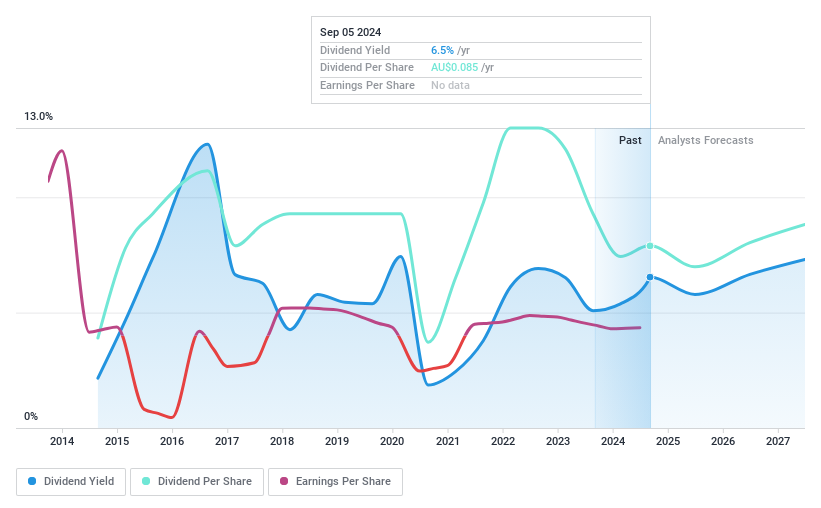

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nine Entertainment Co. Holdings Limited operates in the broadcasting and program production sectors, covering free-to-air television, video on demand, and metropolitan radio networks in Australia, with a market cap of A$2.06 billion.

Operations: Nine Entertainment Co. Holdings Limited’s revenue segments include Stan (A$447.73 million), Publishing (A$558.63 million), Broadcasting (A$1.23 billion), and Domain Group (A$395.73 million).

Dividend Yield: 6.5%

Nine Entertainment Holdings’ dividend yield of 6.54% is among the top 25% in Australia, but its high payout ratio (123.8%) raises concerns about sustainability. Recent earnings decline to A$110.9 million from A$181.81 million highlights financial strain, and the proposed dividend decrease to 4.5 cents per share further underscores volatility in payouts. Despite a forecasted earnings growth of 19.45%, NEC’s dividends have been unreliable over the past decade with significant fluctuations.

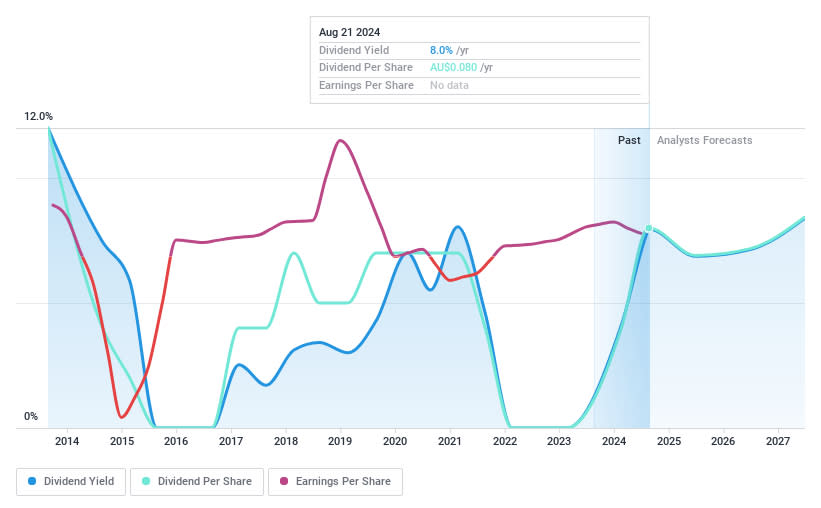

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Perenti Limited is a global mining services company with a market cap of A$961.99 million.

Operations: Perenti Limited generates revenue from three primary segments: Drilling Services (A$598.10 million), Contract Mining Services (A$2.54 billion), and Mining Services and Idoba (A$239.06 million).

Dividend Yield: 7.9%

Perenti’s dividend yield of 7.92% places it in the top 25% of Australian payers, but its unstable track record over the past decade raises concerns. The company’s dividends are supported by earnings (payout ratio: 55.3%) and cash flows (cash payout ratio: 49.9%). Recent guidance forecasts revenue between A$3.4 billion and A$3.6 billion for FY2025, while recent executive changes may impact future stability and strategic direction.

Summing It All Up

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:KSL ASX:NEC and ASX:PRN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com