Bargains can be harder to come by when the stock market is up big on the year. But there are plenty of opportunities if you know where to look.

Toyota Motor (NYSE: TM), Delta Air Lines (NYSE: DAL), and Brookfield Infrastructure (NYSE: BIP)(NYSE: BIPC) may not be the fastest-growing, flashiest names. But all three companies reward investors with growing payouts and have inexpensive valuations.

Here’s why all three dividend stocks are worth buying in September.

Toyota is at the top of its game, yet the stock is down big

Daniel Foelber (Toyota): After surging to an all-time high of over $255 a share earlier this year, Toyota is now down around 30% from that high and has erased essentially all of its 2024 gains.

Automakers like Toyota benefit from lower interest rates, which reduce borrowing costs for buyers and help drive sales. Inflation and higher interest rates have been a challenge for the industry. But overall, Toyota’s sales have held up fairly well.

For the fiscal year ending in March, Toyota manufactured a record number of cars and its June quarter had strong earnings.

Toyota has taken a unique approach to the threat of electrification by focusing on innovations that don’t abandon its heritage or internal combustion engine (ICE) prowess. Its new combustion engine lineup features low- or no-carbon engines that can run on gasoline and alternative fuels.

Toyota has long been a pioneer in hybrids. Its hybrid business continues to grow nicely and offers a middle ground between pure ICE vehicles and electric vehicles.

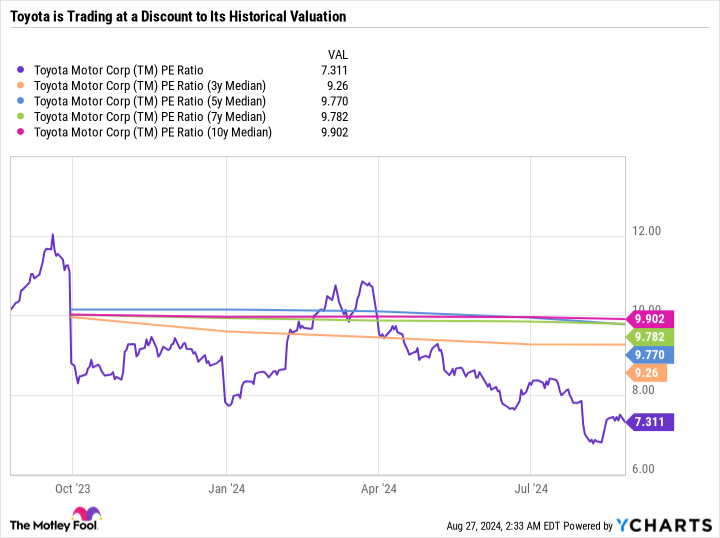

As for its valuation, Toyota has a price-to-earnings (P/E) ratio of just 7.3.

As inexpensive as that may seem, it’s actually lower than its historical median P/E over various periods over the last 10 years. But it’s worth mentioning that automakers tend to have low valuations due to their capital-intensive nature, dependence on debt, global competition, and the industry’s cyclical nature.

Toyota is committed to growing its dividend. However, its priority is the growth of the core business. Toyota makes semiannual dividend payments in March and in September, with the March payout usually being higher than the September payout — likely because it is closer to the end of the company’s fiscal year. Due to the variances in the payout, it’s tricky to know precisely what Toyota’s yield will be in a given year, but I would say investors can expect around a 2% to 2.5% annual yield based on the current stock price.

All told, Toyota is a great choice for value investors looking for a proven legacy automaker that approaches sustainability by utilizing existing infrastructure while also considering the demand for lower-carbon fuels and climate goals.

The market is being too negative over Delta Air Lines

Lee Samaha (Delta Air Lines): The stock trades at less than 7 times its estimated earnings in 2024 and only 7.5 times the midpoint of management’s full-year 2024 free-cash-flow guidance. Whichever way you look at it, Delta’s valuation is extremely attractive.

However, there’s usually a reason for the lowly valuations. In this case, the market is probably stressed about the current overcapacity in the airline market and the potential for a disappointing second half for Delta.

In addition, Delta suffered an estimated $500 million loss of revenue due to a technology outage and is believed to be seeking compensation from Microsoft and CrowdStrike over the issue.

Any deterioration in the earnings outlook is not good news for Delta, considering it has a market cap of just $26.4 billion and debt and finance lease obligations standing at $18 billion at the end of the second quarter.

That said, the market may be too pessimistic. While losing revenue at any time is disappointing, the $500 million represents less than 1% of its expected revenue this year.

Moreover, both Delta Air Lines and United Airlines believe that the industry is already reacting to overcapacity by rationalizing routes, leading to capacity growth moderation. If Delta’s and United’s management are right, then pricing should firm up, and Delta can meet its full-year guidance. As noted above, the stock looks like a great value based on the expected numbers.

Brookfield Infrastructure Partners LP is a powerful way to pump passive income into your portfolio

Scott Levine (Brookfield Infrastructure Partners LP): Hiking its distribution higher for the past 14 years, Brookfield Infrastructure Partners LP has demonstrated a steadfast commitment to rewarding shareholders. It seems highly unlikely, moreover, that the global operator of infrastructure assets is going to end its streak anytime soon. In fact, management aspires to raise its payout between 5% to 9% annually. And if all of this doesn’t excite investors looking to generate stronger passive income flows, consider this: Shares of Brookfield Infrastructure — currently offering a 4.9% forward dividend yield — are not richly valued.

Operating a variety of infrastructure assets, from midstream to electric utilities, Brookfield Infrastructure Partners LP has a considerable presence worldwide, and it seems poised to grow further in the near future. In its second-quarter 2024 letter to shareholders, management noted that its backlog of capital projects stands at $7.7 billion, a high-water mark for the company and a solid indication that the company is well positioned to continue raising its dividend.

The company’s high dividend yield may give conservative investors pause as it’s not uncommon that high yields are actually perilous dividend traps. This, however, is not the case with Brookfield Infrastructure Partners LP. For one, the company has an investment grade balance sheet rated BBB+ by Fitch Ratings. Also, management has espoused a circumspect approach to raising the distribution, targeting a funds from operation payout ratio of 60% to 70%.

Currently, shares of Brookfield Infrastructure Partners LP are changing hands at 3.2 times operating cash flow, a discount to their five-year cash-flow multiple of 4.5. Between the stock’s inexpensive valuation, management’s goal of boosting its payout higher each year, and the company’s solid financial footing, loading up on Brookfield Infrastructure Partners LP stock is a compelling option right now.

Should you invest $1,000 in Toyota Motor right now?

Before you buy stock in Toyota Motor, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Toyota Motor wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike and Microsoft. The Motley Fool recommends Brookfield Infrastructure Partners and Delta Air Lines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 Bargain-Basement Value Stocks With Growing Dividends to Buy in September was originally published by The Motley Fool