With the Federal Reserve finally cutting interest rates, it’s the perfect time to add some dividend stocks to your portfolio that have the potential to generate big returns in the coming years.

A dividend yield, however, should never be the only criterion for choosing which dividend stocks to buy. Stocks supporting high yields with steady and growing dividends have the highest potential to rise in the long run and generate big returns for their investors. With that in mind, here are three rock-solid, high-yield dividend stocks you can buy now and hold for a decade.

A bankable big yield for the next decade

The first high-yield dividend stock I find promising is Energy Transfer (NYSE: ET), which yields a hefty 7.9%. Midstream oil and gas companies offer some of the most bankable dividends in the entire energy sector thanks to their contract-based business models. One could argue there are better-known stocks with stronger dividend histories than Energy Transfer to buy.

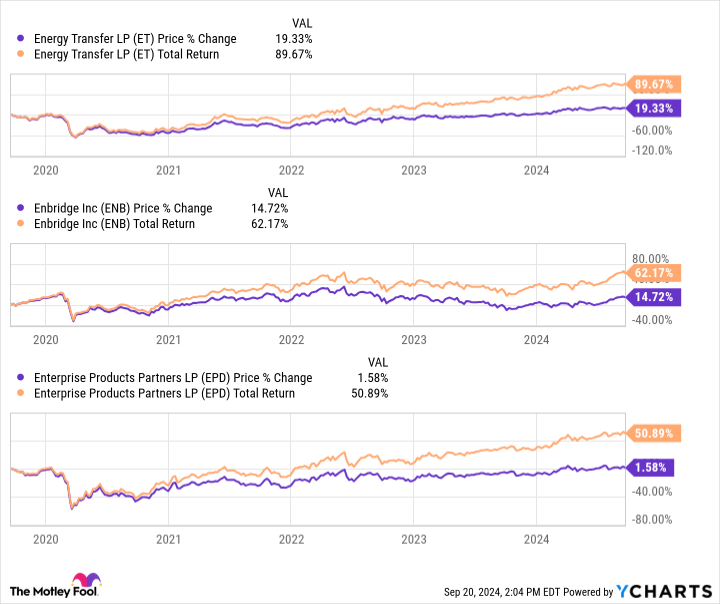

Energy Transfer stock, however, has generated far bigger returns than its larger counterparts, Enterprise Products Partners and Enbridge, in recent years and could continue to outperform, given its growth and dividend goals.

Energy Transfer gets almost 90% of its income from fee-based contracts, which means only about 10% of its earnings are exposed to the volatility in oil and gas prices. A large portion of those stable earnings and cash flows goes to its shareholders. To put some numbers to that, Energy Transfer aims to pay out a little over 50% of its distributable cash flows (DCF) in dividends, invest up to 40% of DCF in growth, and use the remaining cash to pay debt and repurchase shares in the long term.

Energy Transfer is about to acquire WTG Midstream Holdings in a $3.3 billion deal that will expand its footprint in the Permian Basin. The acquisition and organic growth should give Energy Transfer enough clout to increase its annual dividend per share by 3% to 5% in the near term. That dividend growth, combined with a high yield, could generate solid returns for investors who buy Energy Transfer stock now and hold for a decade.

A high-yield stock in a fast-growing industry

After global renewable energy capacity grew by 50% in 2023, the International Energy Agency (IEA) predicts the renewable energy industry will grow at its fastest pace ever over the next five years. Buying a renewable energy stock now and holding it for the next decade is, therefore, a no-brainer investment move. While many stocks look enticing, one underrated high-yield renewable energy stock I’d recommend today is Clearway Energy (NYSE: CWEN)(NYSE: CWEN.A).

The IEA expects solar and wind deployments in the U.S. to double through 2028. With a capacity of 9 gigawatts across 26 states, Clearway Energy is one of the largest renewable energy producers in the U.S., specializing in wind, solar, and energy storage.

Clearway Energy cut its dividend in 2019, but it wasn’t the company’s fault. A large customer, PG&E, filed for bankruptcy, hitting Clearway Energy’s cash flows. The renewable energy giant quickly won back investor confidence when it raised its dividend again in 2020, and it has continued to increase its dividend every year since.

Thanks to its relationship with Clearway Energy Group (CEG), a company jointly owned by Global Infrastructure Partners and TotalEnergies, Clearway Energy has access to CEG’s extensive pipeline of renewable energy projects it can acquire under drop-down transactions to grow its business.

For now, Clearway Energy is confident about increasing its annual dividend per share by 5%-8% through 2026. Even better, the company is already working on its next cash-flow and dividend growth goals for 2027, making its 6.2%-yielding stock an attractive buy and hold for the next decade.

This high-yield stock could be a multibagger

Infrastructure is the backbone of an economy, and one of the best ways to invest in it is to buy shares of a well-established diversified company that owns various infrastructure assets and operates them to the best of its capability. No company comes close to Brookfield Infrastructure (NYSE: BIPC)(NYSE: BIP), making it a no-brainer stock to buy and hold for the next decade.

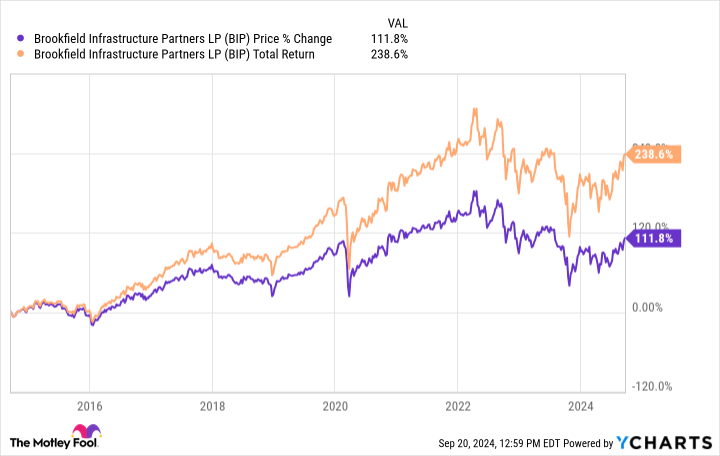

It’s also a dividend growth stock, with units of its partnership yielding 4.8%, while the corporate shares yield 3.8%. You’d be surprised that Brookfield Infrastructure Partners stock has more than tripled investors’ money in the past decade, thanks to dividend growth. Shares of the corporation were listed in 2020 and have more than doubled investors’ money since with reinvested dividends.

What has worked for Brookfield Infrastructure so far should continue to work in the future. Specifically, Brookfield Infrastructure owns assets across utilities, transportation, midstream energy, and data infrastructure in the Americas, Europe, and Asia-Pacific regions. Thanks to the essential nature of these assets, 90% of the company’s cash flows are contracted and, therefore, highly predictable and stable.

A large portion of those cash flows is returned to shareholders as dividends. Since 2009, Brookfield Infrastructure has grown its funds from operations by a compound annual growth rate (CAGR) of 15% and its dividend by 9% CAGR.

Brookfield Infrastructure is an intriguing play on some of the biggest global trends, like digitalization and decarbonization. Growth opportunities are aplenty, and the company is confident in growing its annual dividend by 5%-9% in the long term. That pace of dividend growth should support the stock’s yield, making way for potential multibagger returns over the next decade.

Should you invest $1,000 in Brookfield Infrastructure Partners right now?

Before you buy stock in Brookfield Infrastructure Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Brookfield Infrastructure Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Brookfield Infrastructure Partners and Enterprise Products Partners. The Motley Fool has a disclosure policy.

3 High-Yield Dividend Stocks You Can Buy and Hold for a Decade was originally published by The Motley Fool