Chevron (NYSE: CVX) is offering investors a solid 4.4%-or-so dividend yield in the energy patch. That compares favorably to the average energy stock’s 3.1% yield and even more favorably to the broader market’s 1.2%. But a generous dividend payment is just one reason to like Chevron if you are looking for a high-yield energy stock to add to your portfolio.

Here are three more reasons to like this energy giant.

1. Chevron has a diversified business

Chevron is what’s known as an integrated energy giant. The giant part is simple to understand; the company’s market capitalization is around $260 billion. It isn’t the largest integrated energy company, but it competes easily with all of the big players in the energy sector. The integrated aspect means that Chevron has operations across the energy spectrum, including the upstream, midstream, and downstream segments.

Each of these broad segments operates a little differently, with some tending to do well while others do less well, or even poorly. Chevron’s upstream (oil and natural gas production) business is the driving force behind revenue and earnings, but the midstream (pipeline) and downstream (chemicals and refining) operations help to soften the peaks and valleys. In this way, Chevron is actually a fairly conservative option within the energy sector.

2. Chevron has a long history of dividend success

The consistency Chevron offers investors is highlighted by its dividend. Not the yield, but the actual yearly payments. The company has increased the annual dividend for a huge 37 consecutive years. That’s an incredible streak when you consider the swings in energy prices over that span. In fact, during the coronavirus pandemic, oil prices fell below zero at one point! Chevron’s dividend didn’t skip a beat.

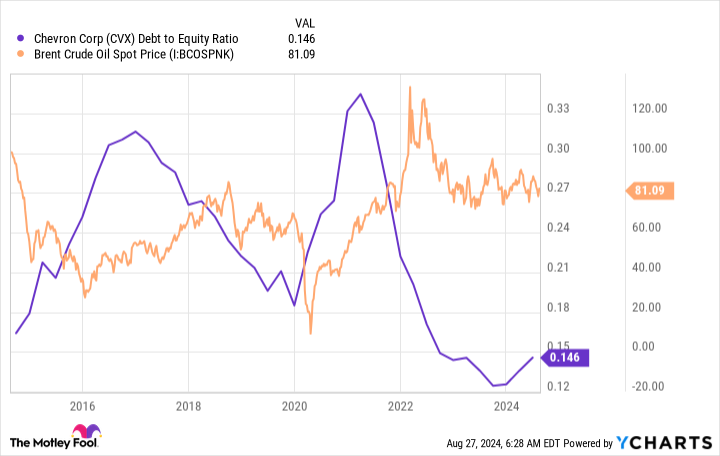

The diversified business helped on that front, but the bigger assist comes from Chevron’s balance sheet. Chevron tends to keep its leverage low, with a current debt-to-equity ratio of around 0.15. That would be good for any company, but it notably gives Chevron the wherewithal to add leverage during oil downturns so it can keep supporting its business and dividends. When energy prices recover, as they always have historically, it reduces leverage so it’s ready for the next energy trough. As long as management remains focused on financial strength, the dividend looks like it should be secure through the energy cycle.

3. Chevron’s business isn’t going away anytime soon

The one big negative with Chevron for many investors will be its focus on carbon fuels. While it has dabbled in the clean energy space, it has really chosen to stay an oil and natural gas company. But don’t think that’s a bad thing. Yes, clean energy is a growing sector. But oil and natural gas are going to remain important for decades to come. In fact, Chevron peer ExxonMobil still expects carbon fuels to represent around half of the world’s energy demand in 2050.

This means that companies like Chevron will still be needed. But there’s a small wrinkle here, because oil and natural gas are depleting assets, so more drilling will have to be done or there will be a supply/demand mismatch that could lead to high energy prices. In other words, not only will the oil Chevron has today be needed, but there’s still plenty of opportunity for investment in the energy patch.

In fact, if the world wants to keep up with energy demand, more (perhaps much more) investment will be a necessity. Financially strong Chevron will be there to benefit.

Chevron is a through-the-cycle pick

To be fair, the best time to buy Chevron stock is probably during oil downturns, when investors are throwing the baby out with the bathwater. However, if you are looking for a reliable high-yield oil stock, Chevron is still pretty attractive right now, noting its relatively high yield.

For many, the best way to look at Chevron might be to buy it and just keep buying it. That’s particularly true during industry downturns, which is a time to add more shares while others are fearful — after all, the energy giant appears to have a bright future and has clearly proven its staying power through the entire energy cycle.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

3 Reasons to Buy High-Yield Chevron Stock Like There’s No Tomorrow was originally published by The Motley Fool